Congressman Maxine Waters wrote a letter to Meta Platforms (formerly Facebook), asking for clarity on recent filings describing crypto-related projects. Meta has submitted applications to the US Patent and Trademark Office (USPTO) to develop crypto infrastructure and offer trading services amid a potential crypto shakeup at the US Securities and Exchange Commission (SEC).

The congresswoman demands answers from Meta on whether the company intends to pursue Web3, digital assets, or digital wallet projects. She also wants to understand Meta’s ambitions to create mining, storage, transmission, and settlement technologies associated with crypto.

Meta and Its Failed Crypto Project in Focus

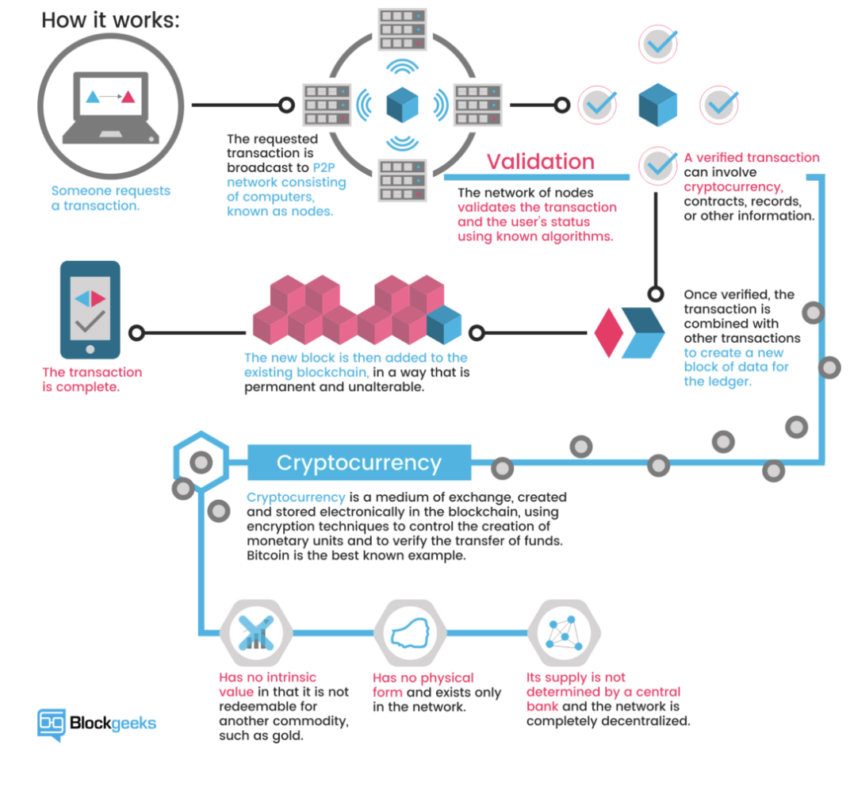

Meta filed applications with the USPTO on Monday to integrate crypto with social media services and develop blockchain-related technologies. Concerning the latter, the company is looking to secure service mark applications for crypto payment verification services and blockchain as a service. It also wants to offer “e-wallet services.”

Read more: How To Accept Crypto Payments: A Brief Guide

Waters seeks clarity on Meta’s crypto plans after employees confirmed last October that the company had no ongoing crypto-related projects. She referred to Meta’s failed Diem project as the reason for her concern.

“Members of the Committee have previously expressed their concerns regarding Facebook’s potential creation of a cryptocurrency…However, the trademark applications described above seem to indicate that Meta has not ceased its activity in digital assets since the shutdown of [stablecoin project] Diem.”

Read more: Top 12 Crypto Companies to Watch in 2024

The President’s Working Group for Financial Markets and two other government offices warned that the Diem project would place too much power in the hands of a commercial organization. Later, the CEO of Diem, Stuart Levey, said,

“It became clear from our dialogue with federal regulators that the project could not move ahead.”

SEC Gets Rebuked for Crypto Approach

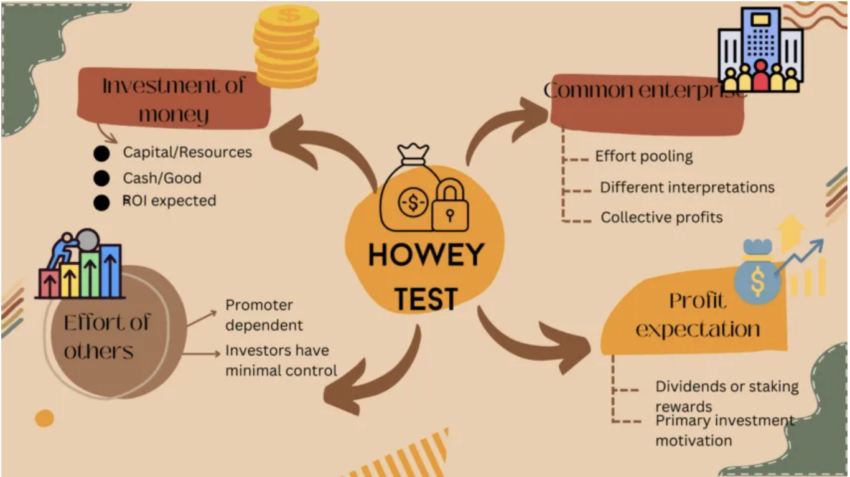

In the meantime, the US Government Accountability Office (GAO) has found minimal concerns with how the US Securities and Exchange Commission (SEC) handles crypto assets. It appeared to disagree with SEC Chairman Gary Gensler’s opinion that most cryptocurrencies are securities.

Despite having a claimed staff headcount of 116, the SEC may lack crypto skills because it can’t compete with private sector salaries. The GAO recommended that the SEC’s fintech outreach group develop measurable goals aligned with its 2022-2026 roadmap.

Binance went to court on Monday in a bid to dismiss the SEC’s lawsuit against it. Much of the SEC’s argument is built on whether Binance offers assets that fall under the SEC’s purview. A lawyer for Binance said the SEC had yet to provide a clear path to registration despite asking companies to register.

The Binance judge has chosen to take the issue under advisement. The judge in the SEC’s case against cryptocurrency exchange Coinbase said the SEC’s argument seemed to bring all digital assets under the agency‘s purview.

“It seems like you are trying to say that all digital assets, at the end of the day, have the earmark of securities. If you are not, where is the boundary of what you are saying?”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

beincrypto.com

beincrypto.com