Terraform Labs, the blockchain company behind the well-known Terra ecosystem, has recently filed for bankruptcy in the United States, approximately a month subsequent to a court ruling that found the company in violation of U.S. laws.

As indicated in legal filings dated January 21, Terraform Labs, headquartered in Singapore, disclosed liabilities ranging from $100 million to $500 million.

Noteworthy among the creditors with the most significant unsecured claims are Alexander Svanevik, the CEO of Nansen at Standard Crypto, and Rasmus Savander, a commercial lead at TokenTerminal.

The filing is anticipated to enable the company to implement its business strategy amidst ongoing legal challenges, including legal proceedings in both Singapore and the United States, notably involving the U.S. Securities and Exchange Commission (SEC), as stated in Terraform Labs’ announcement reported by Reuters.

Following this development, the value of LUNA experienced a decline of more than 5%, settling at $0.62 according to CoinGecko data.

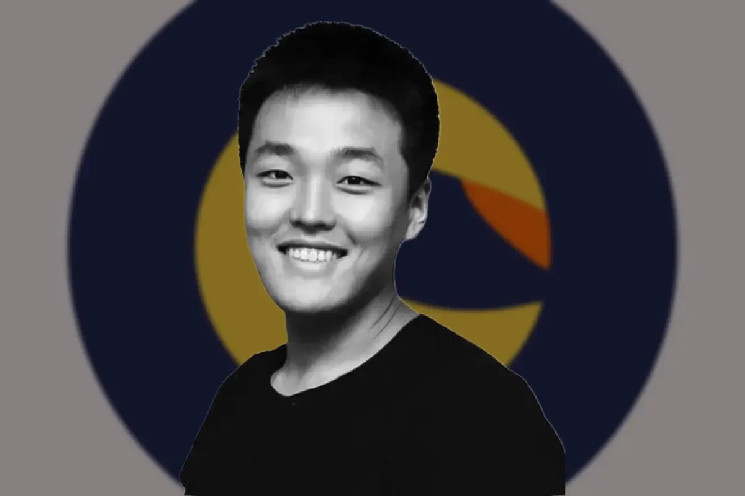

In late December 2023, a U.S. federal judge ruled in favor of the SEC in a case against Terraform Labs and its former leader, Do Kwon, who has been in custody in Montenegro since March 2023 due to his conviction for attempting to use a forged passport to flee to Dubai on a private jet.

READ MORE: Fed Holds Steady Amid Rate Cut Speculation

The U.S. court’s decision centered on Terraform Labs and Do Kwon’s sale of two unregistered securities, specifically referencing LUNA, UST, and MIR tokens.

Terraform Labs played a pivotal role in the Terra ecosystem by contributing to the development and support of various projects and protocols within the ecosystem.

Notably, one of Terra’s key products was its algorithmic stablecoin, TerraUSD (UST), which, despite its intention to maintain a peg to the U.S. dollar through algorithmic mechanisms linked to LUNA, faced challenges and ultimately did not succeed.