Crypto industry executives are confident that stablecoin regulations will finally be rolled out in the United States this year. Moreover, the regulatory outlook in the country may have shifted to a less adversarial stance following the approval of spot crypto exchange-traded funds last week.

On January 15, Circle chief executive Jeremy Allaire said there was a “very good chance” that stablecoin regulations would be passed in the US in 2024.

Long Awaited Stablecoin Regulations

Speaking to CNBC at the World Economic Forum in Davos, Allaire said that global regulation efforts were expanding, and the US is likely to follow.

“I think what you’re seeing is a desire from the administration, a desire from the Treasury, from the [Federal Reserve], by both chambers of Congress, and certainly on a bipartisan basis.”

Other countries are regulating digital dollar stablecoins before the US, he added. Allaure concluded:

“And so I think there is a very strong desire to act and assert US leadership and get the right consumer protections involved.”

Read more: A Guide to the Best Stablecoins in 2024

The Clarity for Payment Stablecoins Act was passed by the House Financial Services Committee in 2023, but it has yet to be approved by the House of Representatives.

The act aims to bring stablecoins under the same regulatory frameworks as traditional finance.

Circle’s chief strategy officer, Dante Disparte, said,

“I remain optimistic that payments stablecoin policy is a possibility early in the new year.”

Circle has been losing market share for its USDC stablecoin over the past year, declining by 42%.

Meanwhile, industry leader Tether keeps growing, with its supply hitting a record 95 billion USDT on January 16. This gives the firm a market-dominating 73% share, while Circle’s has dwindled to 19%.

Circle has been aggressively expanding overseas in light of the US crypto crackdown in 2023.

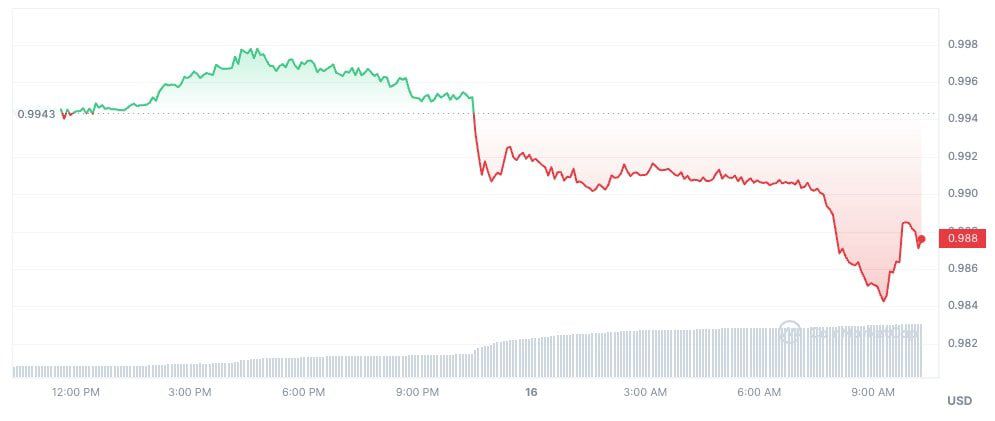

$TUSD Drops Peg

In related news, TrueUSD has dropped its one-dollar peg. The Justin Sun-linked stablecoin depegged on January 15 in a fall to $0.984, according to Coingecko.

An anomalous amount of $TUSD selling on Binance totaling around $333 million has contributed to the depeg. Additionally, Binance has switched to the First Digital USD (FDUSD) for its latest Launchpad offering, MANTLE.

$TUSD is the fifth largest stablecoin, with a circulation of $1.9 billion and a market share of 1.4%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

beincrypto.com

beincrypto.com