America’s largest crypto exchange Coinbase has been subpoenaed in the latest crypto crackdown in the United States. In action against Bybit, the Commodity Futures Trading Commission is seeking information to bolster its case.

Coinbase users have started receiving emails regarding ongoing legal action by the CFTC against another exchange.

Coinbase Subpoenaed

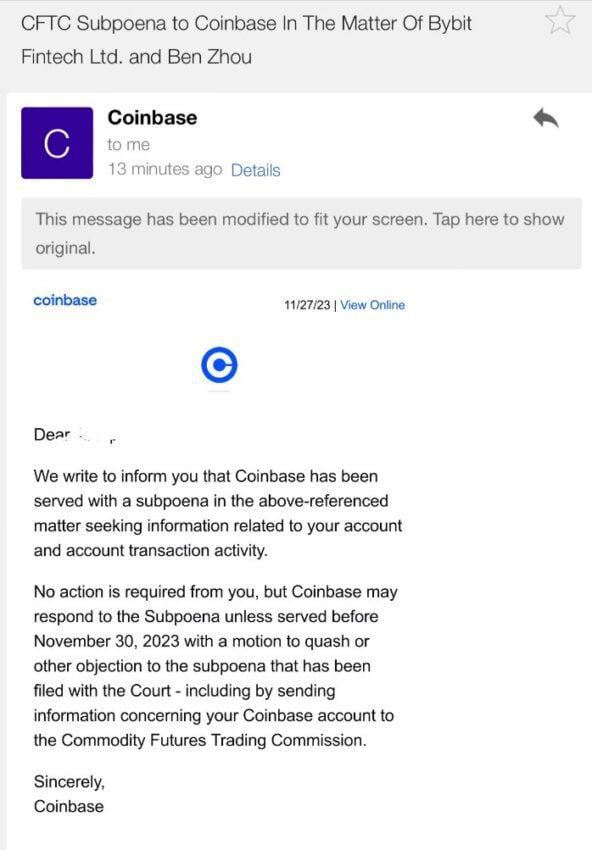

Several users of the America’s leading crypto exchange reported receiving emails from the firm on Nov. 27. The message read:

“We write to inform you that Coinbase has been served with a subpoena in the above-referenced matter seeking information related to your account and account transaction activity.”

The matter referenced was the title of the email, “CFTC Subpoena to Coinbase in the matter of Bybit Fintech Ltd. and Ben Zhou [Bybit CEO].”

Analyst Tom Crown said, “Looks like if you sent or received transactions from Bybit to Coinbase you received this email.”

Concerned users have also taken to Reddit to get more information, many claiming not to have used Dubai-based Bybit in several years. One respondent explained:

“CFTC is seeking information on subscriber behavior, generally to prove something about Bybit. It’s completely up to you to file a motion to quash in the next couple of days. If you don’t, your information will be turned over to CFTC.”

Read more: Coinbase Review 2023: The Best Crypto Exchange for Beginners?

The email said that no action was required from recipients, however, “Coinbase may respond to the subpoena unless served before November 30, 2023, with a motion to quash or other objection … including sending information concerning your Coinbase account to the CFTC.”

Alice.nya commented, “This is a clever way of determining that Bybit had US users (previous attempts were less sophisticated), which can then lead to CFTC action similar to what Binance and BitMEX went through.”

On Nov. 10, the FTX bankruptcy estate filed a lawsuit against Bybit, its investment arm, Mirana, and various executives. Its aim was to recover funds and crypto assets that Bybit withdrew from FTX just before its collapse.

Turning The Page

In an unrelated interview with CNBC this week, Coinbase CEO Brian Armstrong said the crypto industry can turn the page after the historic Binance settlement.

“The enforcement action against Binance, that’s allowing us to kind of turn the page on that and hopefully close that chapter of history,”

“I think that regulatory clarity is going to help bring in more investment, especially from institutions,” he added.

Additionally, company shares (COIN) have jumped 20% since the news of the Binance settlement broke last week.

The firm is embroiled in its own regulatory battle in the US where it has repeatedly called for clarity on crypto assets.

beincrypto.com

beincrypto.com