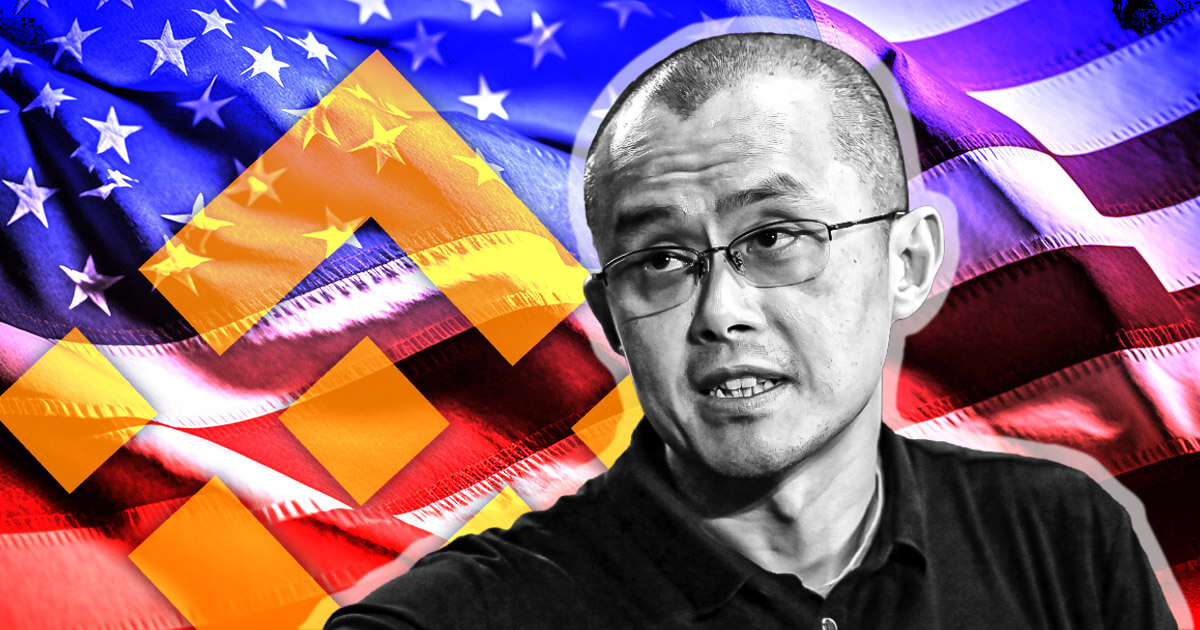

Changpeng Zhao, the former CEO of Binance, is currently barred from returning to his home in the United Arab Emirates (UAE), as per the ruling of a federal judge in Seattle.

U.S. District Judge Richard Jones has temporarily suspended a decision that would have allowed Zhao to leave the U.S. before his sentencing, scheduled for February 2024. The court adhered to U.S. prosecutors’ request to reconsider an earlier decision that would have permitted Zhao to return to the UAE.

“Substantial risk”

The prosecutors warned of a “substantial risk” that Zhao, who recently pleaded guilty to anti-money laundering and U.S. sanctions violations, might not return to the U.S. due to his significant assets, his ties to the UAE, and potential extradition difficulties.

Zhao’s guilty plea was part of a broad agreement with the government. He also agreed to pay a $50 million fine, separate from Binance’s $4.3 billion settlement with the Department of Justice.

Zhao’s recent plea agreement required him to step down from his leadership position at Binance. In a public statement, Zhao acknowledged his mistakes and expressed his commitment to taking responsibility for his actions. Despite his resignation, he indicated his intention to remain involved with Binance and to become a private, passive investor in areas including blockchain technology. However, it is possible that Zhao might be barred from involvement in the company.

On the sentencing front, Zhao’s legal team has suggested the possibility of no jail time for their client, arguing that Zhao could be “eligible to serve half of any term of imprisonment in a non-jail setting,” such as home detention or community confinement. However, U.S. prosecutors have indicated they may seek as much as 10 years’ prison time.

The final decision on Zhao’s ability to travel will be made by Judge Jones, who will decide whether Zhao should be restricted from traveling back to the UAE. As the situation unfolds, the crypto industry and its enthusiasts will likely be watching closely, given the broader implications this case could have on regulatory scrutiny and compliance in the cryptocurrency space.

cryptoslate.com

cryptoslate.com