A report from the Biden administration has been published today that examines the risks involved with stablecoins and the financial system. The report’s recommendations align exactly with Gary Gensler’s months-long efforts to secure the SEC’s role in the stablecoin market.

Report Says Stablecoins Require Federal Oversight

In the second half of 2021, the US government has honed in on stablecoins. This digital asset class represents a vital bridge to crypto adoption as it addresses the problems of volatility and borderless payments. Stablecoins have the same utility as USD but are transacted on-chain, which makes monetary institutions very queasy.

In July, Treasury Secretary Yellen urged for stablecoins to be quickly regulated. Likewise, the Fed Chair, Jerome Powell, pointed to stablecoins as one more reason to develop the digital dollar. Four months later, the President’s Working Group on Financial Markets (PWG) delivered its stablecoins report on Monday.

In cooperation with the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC), the 23-page stablecoin report covers:

- How stablecoins are collateralized and redeemed.

- How they are managed and stored.

- Where they are used.

The report’s findings note that stablecoin confidence may be undermined during periods of stress. This can come from price drops in reserve assets used as collateral. Combined with the inherent cybersecurity risk, the report posits that these factors could cause a contagious “run”, thus posing a systemic risk to the wider economy.

As a remedy, the report suggests Stablecoin issuers should be treated as banks.

“Congress should require custodial wallet providers to be subject to appropriate federal oversight. Such oversight should include authority to restrict these service providers from lending customer stablecoins, and to require compliance with appropriate risk-management, liquidity, and capital requirements.”

This is a significant regulatory step, as those custodial wallet providers are no less than crypto exchanges and hybrid platforms, such as BlockFi or Gemini. Effectively, this would apply to all the crypto services that are challenging traditional banks.

Reactions to The Stablecoin Report: An Executive Power Grab?

As members of the Senate Banking Committee, Senators Pat Toomey, Cynthia Lummis and Sherrod Brown were the first to respond to the report. Sen. Toomey noted that the ball is now with Congress to decide whether federal agencies have any jurisdiction over stablecoins. Until that happens, the current administration should “resist the urge to stretch existing laws in an effort to expand its regulatory authority.”

Congressman Tom Emmer, serving on the Financial Services Subcommittee on Investor Protection, Entrepreneurship, and Capital Markets, arrived at the same conclusion.

With its stablecoin report, the PWG seems to try to force Congress to choose between handing over regulatory power to bureaucrats or risking the unchecked FSOC stamp out crypto innovation.

— Tom Emmer (@RepTomEmmer) November 1, 2021

In contrast, aligned with the Biden administration, Sen. Brown stated that new technologies must be brought under the same ruleset as existing traditional financial institutions. Gary Gensler, the Securities and Exchange Commission (SEC) Chair, emphasized the report’s conclusion that stablecoins diverge in their classification. Depending on how they are used, they could be securities, commodities and/or derivatives.

Gensler also acknowledges that it is now up to Congress to clarify matters further. Until that happens, he promised that:

“While Congress and the public evaluate this report, we at the SEC and our sibling agency, the Commodity Futures Trading Commission, will deploy the full protections of the federal securities laws and the Commodity Exchange Act to these products and arrangements, where applicable.”

The example of this deployment of full protections we have already seen when the SEC singled out and forced Coinbase to cancel its Lend Program. However, this is not surprising given that Gary Gensler was appointed to the SEC Chair position by President Biden. Therefore, recommendations from the PWG report could be interpreted as guidelines for extending the existing reach of the SEC’s regulatory power.

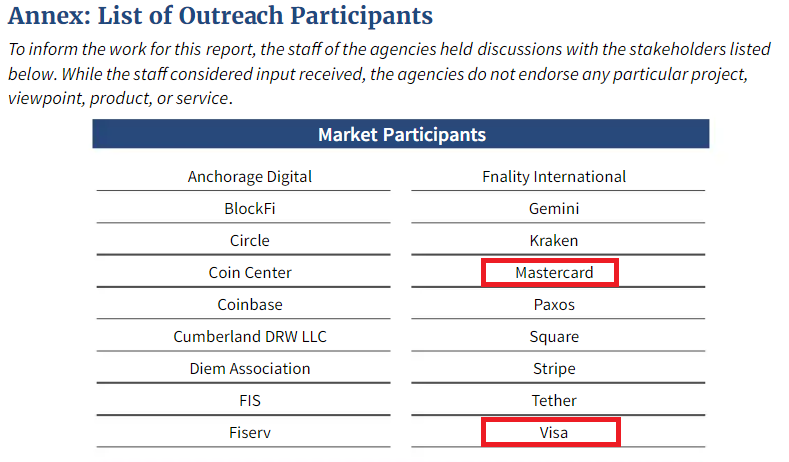

Moreover, before the report was released, there were rumors that Gary Gensler was pushing for the SEC’s regulatory power to cover cryptocurrencies and stablecoins. Interestingly, at the end of the report, there is a list of market participants, including Visa and Mastercard, both of which have no publicly released stablecoin operations.

We already know that Visa has developed its Universal Payment Channel (UPC) for cross-blockchain and CBDC transactions. Likewise, Mastercard partnered with Bakkt to bring crypto payment rails to merchants. Will the two largest payment processors get in the stablecoin game now that regulatory enforcement is approaching?

Congress Has Sat On Its Hands

The infrastructure bill’s crypto amendment has arguably highlighted the inaction on the part of Congress to get ahead of this issue. Treasury Secretary Yellen was the driving force behind the sneaked-in Warner-Portman-Sinema amendment, which aimed to make miners and wallet developers be receive the same legal restrictions as brokers.

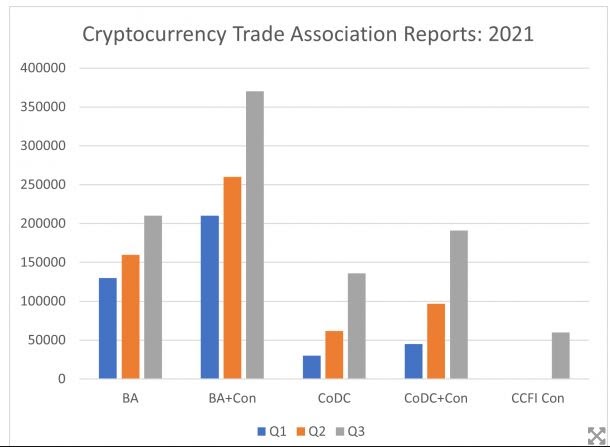

The silver lining is that the crypto lobby, in the form of the Congressional Blockchain Caucus, redoubled its efforts to ensure the crypto industry is not caught flat-footed again.

Source: Senate Lobbying Disclosures.

The Executive branch is now in a position to force Congress to act. This was noted by former Congressman Harold Ford Jr, who views the current legislative gray zone combined with regulatory overreach as stifling. Likewise, Spencer Bogart of Blockchain Capital foresees a brain drain for crypto firms if regulations remain as they are today.

tokenist.com

tokenist.com