A group of senators led by Elizabeth Warren (D-MA) are aiming for the strictest US crypto restrictions ever. That also includes making some crypto transactions over $10,000 legally reportable.

The junior senator from Massachusetts has long been an adversary of crypto, and this is the left-wing politician’s latest attempt to cut the link between crime and digital currencies. However, her efforts are backed by a coalition of politicians from across the political spectrum.

A Bipartisan Effort in the Senate

To do so, Warren, along with Senators Roger Marshall (R-KS), Joe Manchin (D-WV), and Lindsey Graham (R-SC), has reintroduced the Digital Asset Anti-Money Laundering Act. If passed, the bill will require industry players engaging in transactions exceeding $10,000 in digital assets through offshore accounts to file a Report of Foreign Bank and Financial Accounts (FBAR) with the Internal Revenue Service (IRS).

Marshall and Warren are reintroducing the bill, while Manchin and Graham are cosponsors.

The bill will also designate a host of crypto industry players—including wallet providers and validators—as financial institutions. As well as new reporting requirements for transactions over $10,000, these parties will have to report any activity that looks like money laundering or tax evasion.

The proposed legislation was first introduced in December 2022. Similar anti-money laundering laws and regulations around non-digital assets are already on the books.

Learn more about crypto ATMs and the best options available: 7 Best Bitcoin ATMs With Low Fees and High Privacy

The law will also add greater responsibilities to owners and administrators of crypto ATMs. If it passes, the Financial Crimes Enforcement Network (FinCEN) will have to ensure that they regularly submit and update the physical addresses of the machines, and verify customer and counterparty identity. A nasty shock for those who use crypto ATMs to launder money, which many machines are accused of facilitating.

The new law will also expand responsibilities to digital asset businesses, requires verifying identities and records for self-custody wallets, and strengthen compliance processes.

Put simply, the bill will deal the cypherpunk dream of digital freedom and sovereignty a terminal blow. In a statement, Warren tarred crypto with a broad brush and praised her bill’s corrective potential.

“Crypto has become the payment method of choice for rogue nations, drug lords, ransomware gangs, and fraudsters to launder billions of dollars in stolen funds, evade sanctions, fund illegal weapons programs, and profit off of devastating cyberattacks. This bipartisan bill is the toughest proposal on the table to crack down on crypto crime and give regulators the tools they need to stop the flow of crypto to bad actors,” Warren said.

Crypto Crime Is Actually Down This Year

Warren is a longstanding critic of digital assets, taking aim at everything from NFTs to stablecoins. On August 2, Warren and three colleagues wrote a letter to the IRS urging stricter tax rules for “crypto brokers.”

Not content with harrying the IRS, the senators also sent the letter to the United States Treasury.

Although, the document’s use of the term crypto broker was contested by colleagues and the industry. The definition appears to include automated software systems such as validators, nodes, wallet providers, and miners and stakers.

As a progressive politician, Warren has often framed her regulatory vendetta as a battle for fairness for working people. However, on this occasion, her stated target is a non-partisan one: crime.

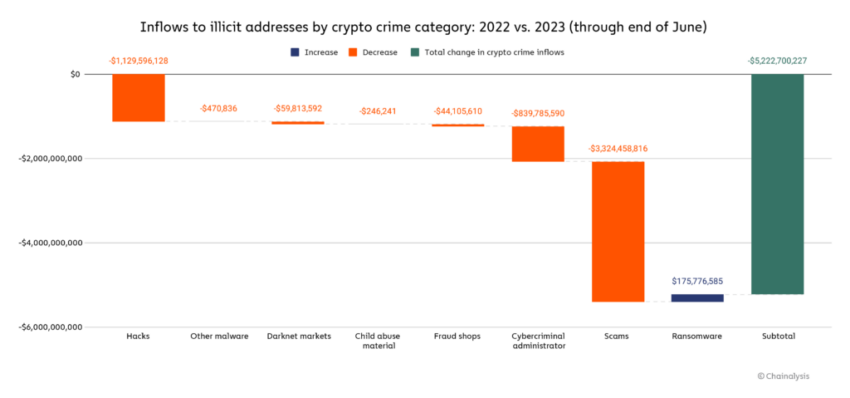

Despite this focus, data from Chainalysis shows that crypto-related crime is down 63% since the start of 2023. However, this is unlikely to stop the senator’s anti-crypto crusade any time soon.

beincrypto.com

beincrypto.com