Ukrainian regulators are prepared to start taxing crypto gains at 18% from 2024, with lawmakers set to vote on proposals this fall.

Per Forbes Ukraine, the National Commission for Securities and the Stock Market is set to unveil a draft law, which will be set before lawmakers at the next parliamentary session.

The market regulator’s proposals include creating a flat-rate 18% tax on “income” from crypto “investments,” but military servicepeople will only need to pay 1.5%.

Commission member Yuriy Boyko said:

“We hope that the law will be adopted in September, and will come into force in 2024.”

The commission also proposes granting itself and the central bank regulatory powers over the sector.

The draft law would also require all Ukrainian crypto exchanges and brokerages to apply for commission-issued operating permits.

Kyiv has been attempting to modify its crypto regulations in line with the EU in recent weeks, and wants to introduce regulations in the spirit of the EU’s Markets in Crypto-Assets (MiCA) legislation.

Boyko said:

“The [draft law] makes it possible to work according to EU rules. If an exchange or a [crypto trader] wants to operate in the market, they must comply with these rules.”

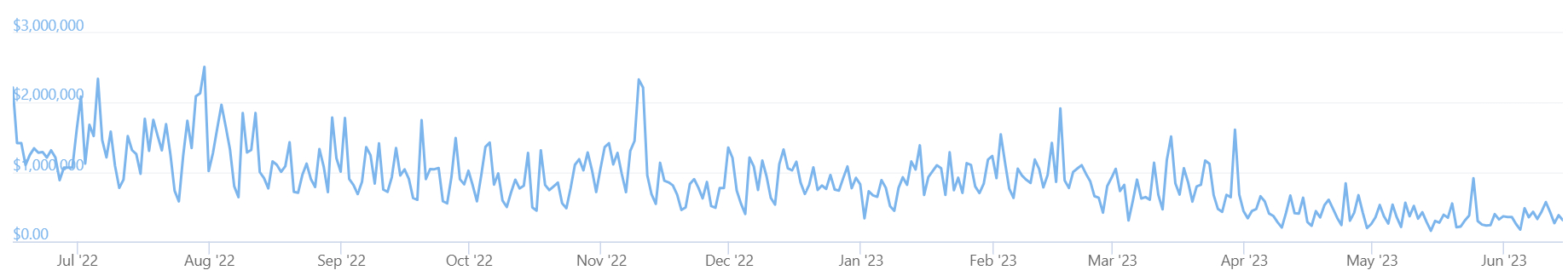

Crypto Community Displeased with Ukraine’s 18% Tax Plans?

The news was met with a mixed reaction from the nation’s crypto community.

Mykhailo Chobanyan, the founder of the Kuna crypto exchange, warned that Kyiv should not rush into action.

Chobanyan said that it was “necessary” to find out “why, how, and when regulation” is needed before legislating.

And the media outlet Forklog quoted a legal expert as opining that a tax rate of 18% could deter investors, and possibly “provoke an outflow of users and [crypto] companies from Ukraine.”

The central bank, meanwhile, has called for regulations that “balance the need to protect the interests of consumers” with “financial stability.”

The bank added that regulations should “take into account the peculiarities of the nation’s legal and financial system.”

Kyiv has also vowed to take steps to fight a perceived rise in “crypto-powered corruption.”

cryptonews.com

cryptonews.com