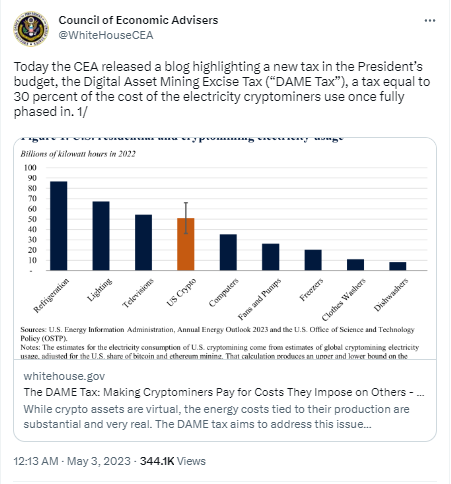

The government of Joe Biden has revived its support for imposing a 30% digital asset mining energy (DAME) tax on cryptocurrency miners in an effort to improve the supposedly harmful impacts of the cryptocurrency mining industry on the environment.

It was first mentioned in President Joe Biden’s proposed budget for FY2024, which was released on March 9. The cryptocurrency mining tax suggests gradually imposing a 30% tax charge on the electricity used by bitcoin miners.

The White House Council of Economic Advisers (CEA) blog article from May 2 has been widely panned since it was released.The blog post claims that bitcoin mining has “negative spillovers” on ecosystems, human well-being, and power infrastructure. Findings suggest that low-income neighborhoods and communities of color face a disproportionate share of the costs associated with pollution from power generation, which in turn drives up the price of energy for everyone.

Using clean power (such as hydropower) for cryptocurrency mining is said to still have an adverse impact on the environment since it may cause other energy consumers to migrate to “dirtier” sources of electricity. This is because the rising cost of all sources of power is a direct result of the growing demand for electricity.

Could Taxation be the Answer to Fund Safety Programs?

Bitcoin’s price dropped below $20,000 after the Department of the Treasury said that an excise tax on power consumption by digital asset miners might diminish mining activity and its accompanying environmental consequences and other problems.The idea was brought back into the limelight when a statement was released by the White House Council of Economic Advisers (CEA) justifying the necessity for the new tax.

To paraphrase CEA, cryptocurrency miners are exempt from compensating for the hardships they cause. Local pollution increases, energy costs rise, and the global climate suffers as a result of rising greenhouse gas emissions; these are the costs.The CEA’s Twitter thread has been widely criticized when it was made public. The proposed tax has been criticized by some, who term it propaganda, while others argue that it will “simply push bitcoin mining to Russia & other countries.”

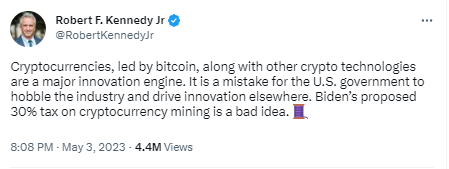

Robert F, backlashes the plan

Presidential hopeful Robert F. Kennedy Jr. termed President Biden’s plan to impose a 30% tax on cryptocurrency mining a “Bad Idea” in a blunt statement.Robert, who sees cryptocurrencies like Bitcoin and its underlying technology as a huge innovation engine, has argued that the United States government is making a mistake by encouraging similar developments in other countries.

Robert F. Kennedy said that although worries about energy usage may be exaggerated, Bitcoin mining uses almost as much energy as the video game industry, but “no one calls for a ban” on the latter.

Robert F. Kennedy Jr. believes that the story of Bitcoin’s energy and environmental effect is only a “selective pretext to suppress anything that threatens elite power structures.”

The presidential contender said that a diversified environment is a more robust ecosystem. The diversity of a currency ecosystem, rather than relying on a single centralized currency, would make the US economy more robust.In addition, Kennedy connected the dangers of a centralized system to the economy’s vulnerability and current crisis. Robert F. Kennedy made a profound remark in his tweet: “We need Cash and Crypto to ensure freedom.”

cryptonews.net

cryptonews.net