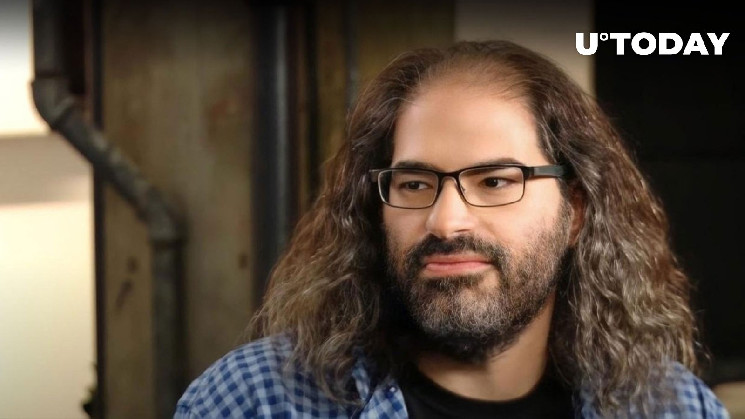

Chief technology officer at Ripple, David Schwartz, known on Twitter as @JoelKatz, has commented on a recent move by the U.S. SEC against major U.S.-based crypto exchange Bittrex.

In the legal complaint published by the regulator, the SEC refers to several cryptocurrencies listed on Bittrex as securities: $DASH, $ALGO, OMG, IHT, NGC and TKN. Schwartz cited the SEC's document, saying that according to it, investors into these tokens "have a reasonable expectation of a profit" and jokingly qualified this as "investment advice."

SEC claims buyers of $DASH, $ALGO, OMG, TKN, NGC and IHT have a reasonable expectation of a profit!

— David "JoelKatz" Schwartz (@JoelKatz) April 17, 2023

Bittrex withdraws from U.S.

As reported by U.Today, Bittrex exchange is winding down all its operations in the USA due to constant scrutiny from local regulators. The management team of the exchange tweeted that the reason is continued uncertainty spread by regulators. It also stated that U.S. regulators are not interested in offering reasonable rules that would help adapt innovative technologies and thus enhance the prosperity of the U.S. economy.

The exchange will finish working with U.S. customers by the end of April. At the moment, users have a chance to withdraw their funds and move them to cold wallets or to other exchanges.

Richie Lai, CEO of Bittrex, who also co-founded it, stated that the tough decision made by the company saddened him. Now, the former U.S. Bittrex team will focus on helping Bittrex Global to succeed in other parts of the world.

SEC sues Bittrex on April 17

On Monday, April 17, the U.S. regulator put forward charges against Bittrex and its former chief William Shihara of running an unregistered digital exchange, according to the press release.

The document claims that at least over the past eight years, since 2014, Bittrex has been offering its customers the chance to invest and trade tokens, which the regulator believes to be unregistered securities.

Aside from that, the SEC believes that Shihara and the platform had arrangements with issuers of tokens to place them on Bittrex and, for that purpose, they would remove from social media and other channels open to the general public specific "problematic statements." Shihara reckoned that the latter might drive the SEC to initiate an investigation into those digital currencies to check if they were unregistered securities.

Such "problematic statements" would be, for example, statements related to "price predictions," "expectations of profit" and other terms related to investment. The aforementioned tokens were included, per the SEC.

The head of the SEC's Division of Enforcement Gurbir S. Grewal stated that Bittrex prioritized profits over investor protection.

u.today

u.today