U.S. Judge Rules in Favor of Voyager Advisors, Restricts SEC's Actions in Bankruptcy Token Case

The Securities and Exchange Commission (SEC) is closely monitoring the restructuring plan of Voyager Digital Ltd., a trading platform that filed for bankruptcy on July 5th, 2022, with the aim of returning value to its 100,000 customers.

The SEC raised objections to the company's planned plan on February 22 due to concerns that key components of the restructuring plan could violate securities regulations, including the $1.02 billion sale of the company's assets to Binance.US.

Bankruptcy Judge Michael Wiles clarified on March 6th that the SEC cannot fine executives involved in Voyager Digital if the company issues bankruptcy tokens to repay affected customers.

However, the SEC will still be regulating and monitoring the transactions related to the redistribution of funds to ensure compliance with relevant laws and regulations.

In a supplemental objection statement, the SEC also objected to legal protection that would prevent any U.S. agency, including the SEC, from bringing claims against anyone involved in the restructuring transactions.

This means that executives and restructuring advisers involved in Voyager's bankruptcy would be protected from lawsuits if they implement the court-approved bankruptcy plan. Nonetheless, they remain subject to other legal consequences if they violate any laws or regulations.

The SEC expressed concern over certain provisions in Voyager Digital's bankruptcy plan that it deemed "extraordinary" and "highly improper." However, Voyager's lawyer argued that granting the SEC such authority would create fear among those involved in the transaction. After much debate, Voyager's lawyers agreed to narrow the scope of legal releases, demonstrating a commitment to ethical business practices.

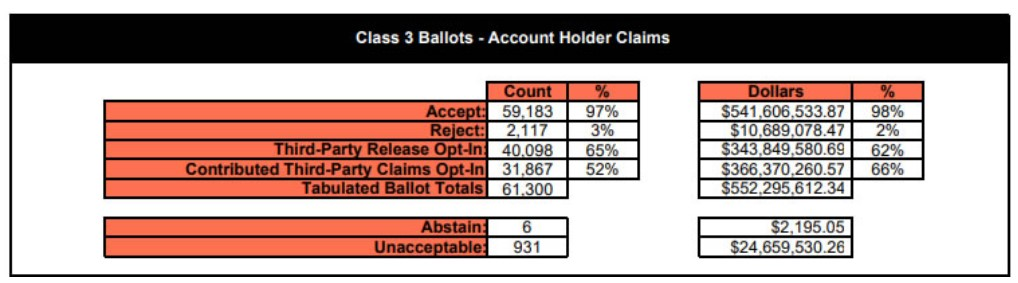

Despite the SEC's objections, a court filing on February 28th revealed that 97% of Voyager account holders who participated in a poll were in favour of the currentBinance.USrestructuring plan. The court is still considering the matter.

In conclusion, it is crucial for companies to adhere to proper legal procedures when dealing with bankruptcy and repayment plans to protect all parties involved and ensure accountability.

The SEC's monitoring of Voyager Digital's restructuring plan highlights the importance of compliance with securities laws and regulations, and the need for cooperation between regulators and companies to achieve ethical and lawful outcomes.

Also read - Nautilus Facility Launches 8,000 TeraWulf Rigs for Nuclear-Powered Mining