You might also like

Investors’ Bitcoin Positions To Depend On Their Time Horizons

Aptos (APT) – Is FOMO Or FUD Better?

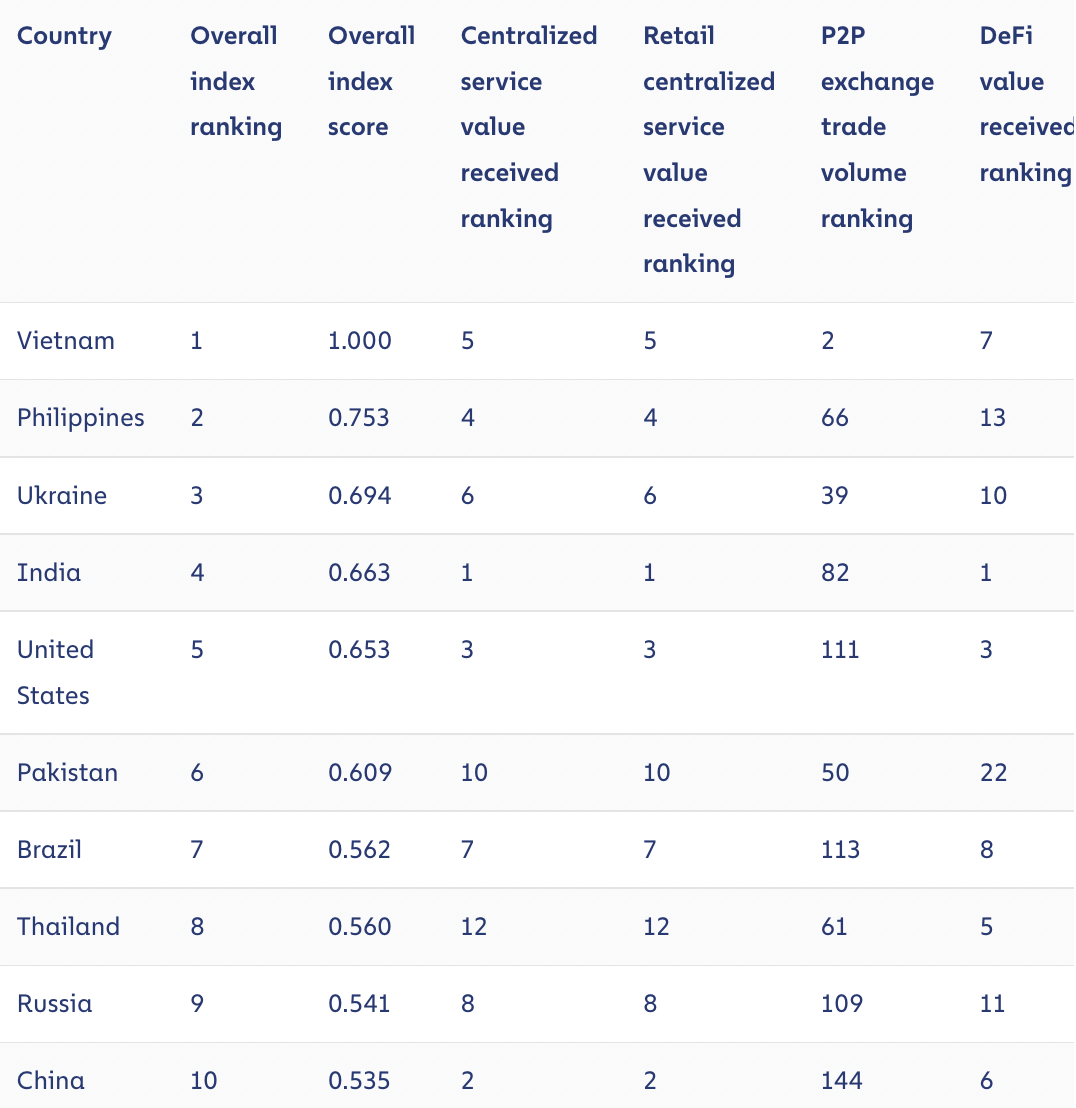

Emerging markets typically dominate the global adoption list. Still, three stand out when it comes to the top 10: Vietnam gaining the top spot, the United States climbing to fifth place, and China entering the list, according to the most recent report by Chainalysis.

According to ‘The 2022 Geography of Cryptocurrency Report,’ the top five countries on the global crypto adoption index are Vietnam, the Philippines, Ukraine, India, and the United States. Pakistan, Brazil, Thailand, Russia, and China round out the top 10 based on the total index ranking.

Vietnam is ranked first for the second consecutive year regarding bitcoin adoption. According to the sub-rankings, the country has high purchasing power and population-adjusted adoption of centralised, DeFi, and P2P crypto tools.

Source: Chainalysis 2022 Geography of Cryptocurrency Report

Source: Chainalysis 2022 Geography of Cryptocurrency Report

According to a survey conducted in 2020, 21% of Vietnamese consumers acknowledged using or owning cryptocurrencies.

Moreover, local media reports indicate that crypto-based gaming is quite popular in Vietnam among gamers and developers.

The Philippines are also noteworthy since they made a giant leap from the 15th to the second.

“Both of these countries have similar growth drivers: play-to-earn (P2E) games and remittances,” said the report.

In the meantime, the United States climbed the ranks. This year, it ranks fifth, up from eighth in 2021 and sixth in 2020.

Interestingly, while it’s in the top three for other sub-indices, its population- and purchasing-power-adjusted P2P exchange adoption ranks 111th.

According to the report, this is not surprising, as the use of P2P exchanges tends to be strongest in countries with little purchasing power.

“Perhaps most interesting is the fact that the United States is by far the highest-ranked developed The 2022 Global Crypto Adoption Index 10 market country on our index, and one of only two to make the top 20 along with the UK.”

China ranked 13h in 2021 and jumped to the tenth slot this year, up from thirteenth in 2021. As indicated by sub-indices, China ranks second for buying power-adjusted transaction volume at the overall and retail levels.

According to the report, though the prohibition initially led to a significant decline in the crypto activity, China’s market has rebounded in recent months, indicating that the ban may be ineffective or laxly implemented.

Domination of emerging markets

According to Chainalysis, a specific pattern strengthened in 2021: “emerging markets dominate the index.” The research utilised a framework created by the World Bank, categorising countries according to their income levels and economic development as high-income, upper-middle-income, lower-middle-income, and low-income.

According to the report, the middle two categories dominate the top of our ranking. Out of the top 20 countries listed above:

- Vietnam, the Philippines, Ukraine, India, Pakistan, Nigeria, Morocco, Nepal, Kenya, and Indonesia have lower-middle-income countries;

- Brazil, Thailand, Russia, China, Turkey, Argentina, Colombia and Ecuador have upper-middle-income countries;

- The United States and the United Kingdom are high-income countries.

Users in lower- and upper-middle-income nations rely on cryptocurrencies to

- send remittances;

- maintain their savings during volatile periods of fiat currencies;

- fulfil additional financial requirements particular to their economies

The report’s conclusion was,

“These countries also tend to lean on Bitcoin and stablecoins more than other countries.”

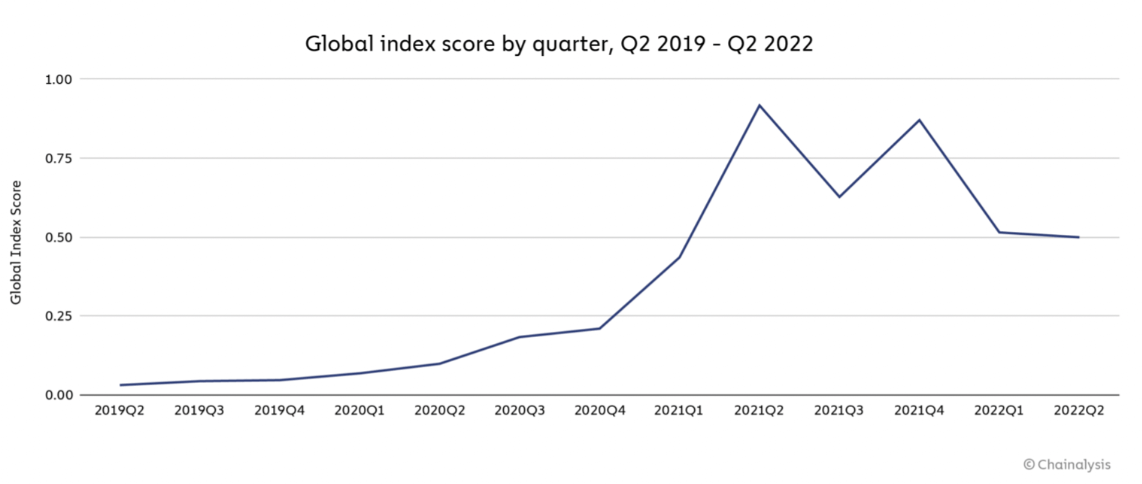

Adoption slowing and robust market fundamentals

In the past year, global crypto adoption has reached a plateau. According to Chainalysis, it has steadily increased from the middle of 2019, hit an all-time peak in the second quarter of 2021 and then fluctuated in waves, decreasing and recovering from quarter to quarter. In the last two quarters, as the bear market began, it has declined.

Still, it’s important to remember that worldwide adoption remains substantially above its 2019 pre-bull market levels, according to Chainalysis.

Source: Chainalysis 2022 Geography of Cryptocurrency Report

Source: Chainalysis 2022 Geography of Cryptocurrency Report

Notably, their losses are not locked in, although their portfolios have lost value – they have just not sold.

The report concluded, “the on-chain data suggests those holders are optimistic the market will bounce back, which keeps market fundamentals relatively healthy.”

coinculture.com

coinculture.com