The cryptocurrency market is not the only financial asset that has suffered losses and recorded a consistent decline as the year winds to an end. In fact, every major asset class for investment has recorded negative returns or an unchanged performance year. This is the conclusion of a CNBC report summarizing the performance of markets in 2018.

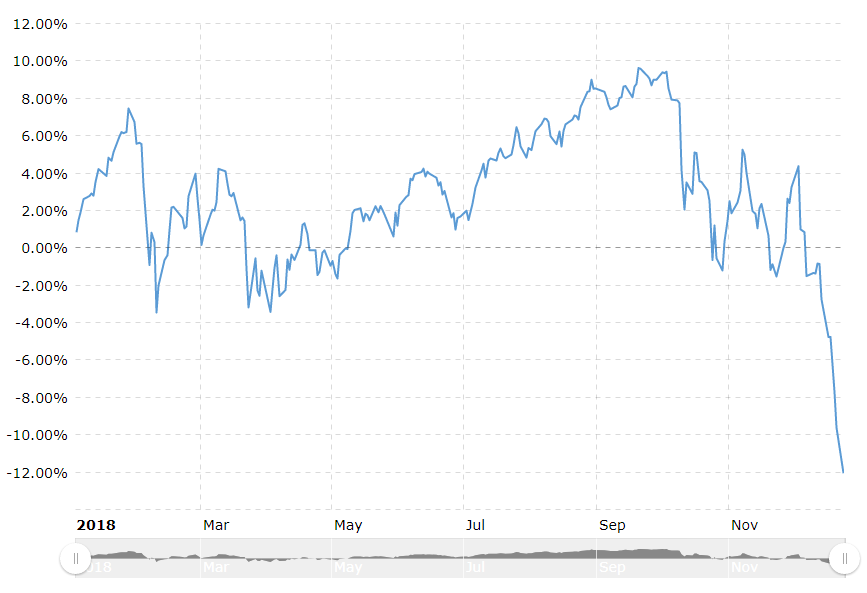

According to the report, the activity dominating the close of the trading year is a series of shorts on stocks, corporate bonds, commodities, government debt, and practically every other asset class available in markets around the world. This comes a few weeks after Morgan Creek founder Anthony Pompliano pointed out that that the S&P 500 lost $755 billion in a little over 4 hours of trading as the general market rout shows no sign of stopping anytime soon.

The S&P 500 lost almost $755 BILLION today.

That is more money lost in a single day for public equity investors than all crypto investors combined this year.

The math don’t lie! 🤷🏽♂️

— Pomp 🌪 (@APompliano) December 4, 2018

Misery Across Board

Cryptocurrencies have experienced a mostly negative year, recording a decline in trading volumes, as well as price crashes led by bitcoin which is down roughly 80 percent from its all time high of December 2017. In total, between January and December, about $700 billion of market capitalization has been wiped off cryptocurrencies as investors brace for a so-called crypto winter in the absence of any optimistic predictions coming to fruition.

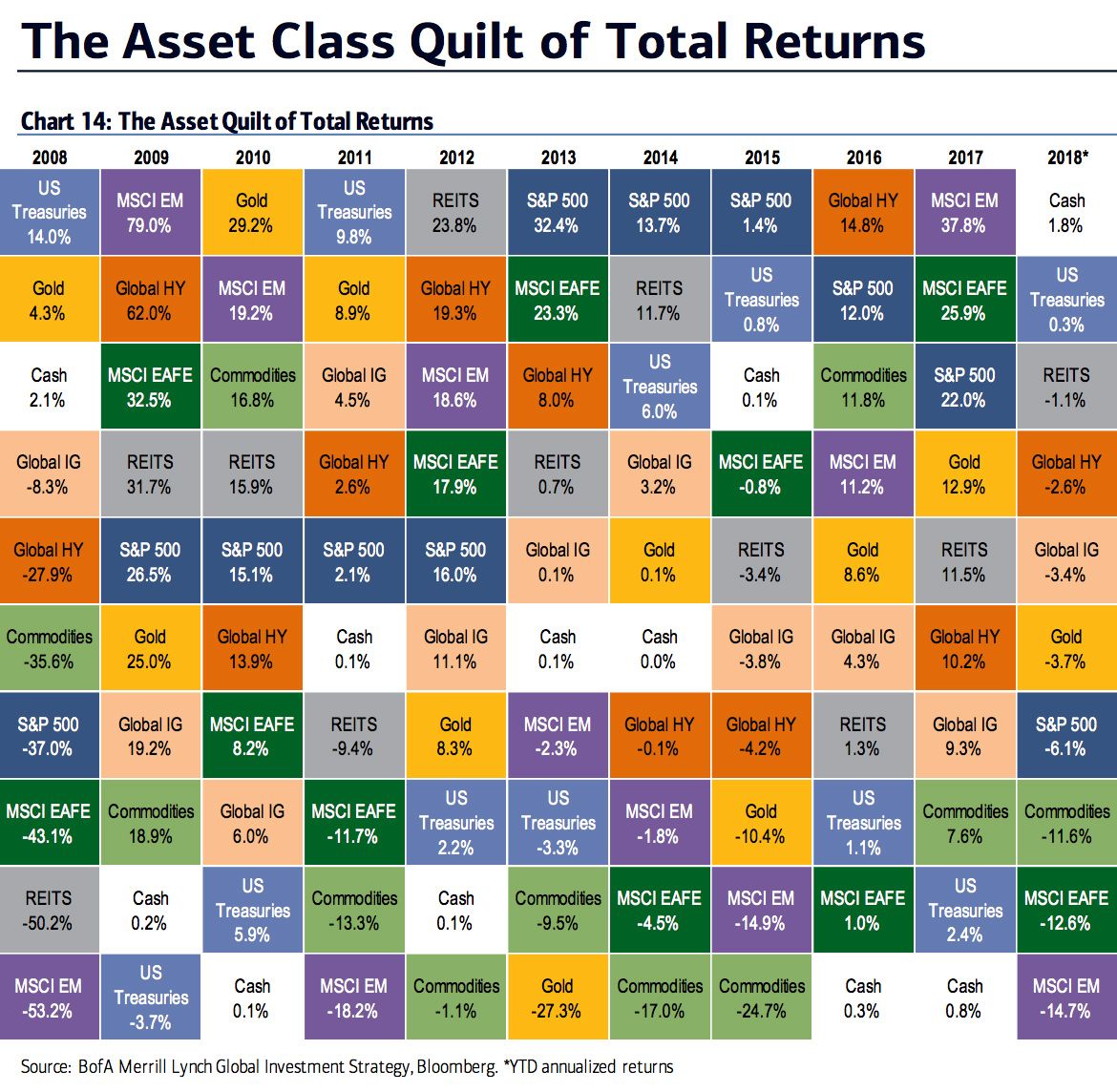

This pain however, is merely a relatively small part of the pain experienced by investors across practically every market in the U.S.A. In October, CNN reported that the Bank of America warned that 14 of 19 bear market signals had been triggered and the turbulence could last. While some investors believed that the prolonged equities bull run which began in March 2009 would still prolong, many accepted that the longest bull run in American history was over.

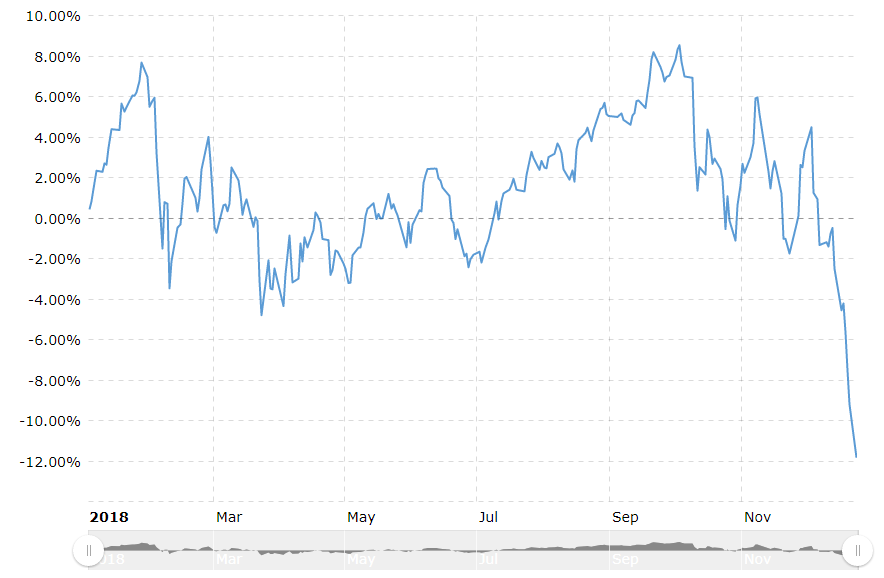

The latter group turned out to be right, with Market Watch reporting recently that the S&P 500 fell 2.1 percent to 2,417, and the Dow Jones Industrial Average falling 1.6 percent to 22,444. The Nasdaq Composite on its part slipped 3 percent to 6,333 points.

Speaking to CNBC, Head of U.S. Rate Strategy at BMO, Ian Lyngen predicted that the downward movement will continue into 2019. In his words:

All assets have underperformed in 2018 simply because the Fed accelerated the process of tightening monetary policy with a two-pronged approach of both hiking rates and reducing the balance sheet […] “We continue to expect the Fed will hike next year until they break something. The reversal in equities is not the magnitude that has historically led the Fed reverse their policy, so there’s still room to go.

Last Monday, U.S. Treasury Secretary Steve Mnuchin spoke to the CEOs of JP Morgan Chase, Bank of America, Goldman Sachs, Morgan Stanley, Wells Fargo and Citigroup to discuss ways of calming the equity market rout and confirm presence of sufficient liquidity to aid recovery efforts through commercial and retail lending.

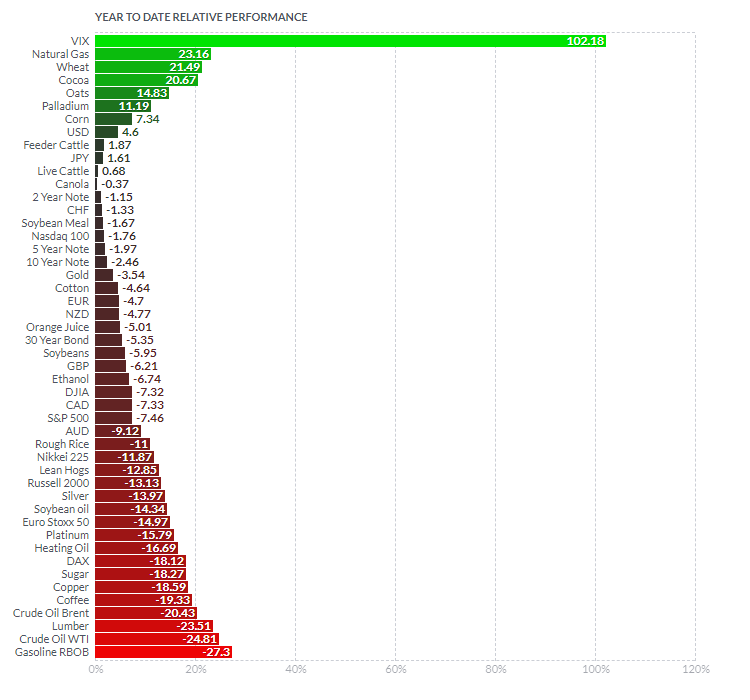

In 2018 There Were Few Winning Options

The only notable winning options in 2018 were commodities like natural gas, wheat, cocoa, oats, palladium and corn. Where will 2019 bring us? Comment below.