The Marathon Patent Group, a publicly-traded bitcoin mining company, purchased $150 million in bitcoin during last week’s dip.

Marathon, which is listed on the NASDAQ stock exchange, purchased almost 5,000 bitcoin for $150 million. Financial services firm NYDIG facilitated the transaction.

The firm said that the purchase had a “quick turnaround.” NYDIG also performed the Mass Mutual $100 million bitcoin purchase in Dec 2020.

A Micro Strategy

Like MicroStrategy, which purchased $10 million more btc during last week’s dip, Marathon wants to add to its treasury. It sees holding btc as a long-term strategy similar to holding cash reserves but more forward-thinking.

Meanwhile, MicroStrategy CEO Michael Saylor colorfully made the case about why bitcoin can’t, and won’t, be heavily regulated. In a video, he explained his belief that once retail consumers and companies get hold of the cryptocurrency, it will be financially unsustainable not to accept it.

He explained that, at the end of the day, if you memorize your private key, nobody can open your vault, even with the government’s authority. (You can always say that you “forgot” your key if push comes to shove, he said).

Bitcoin on Nasdaq

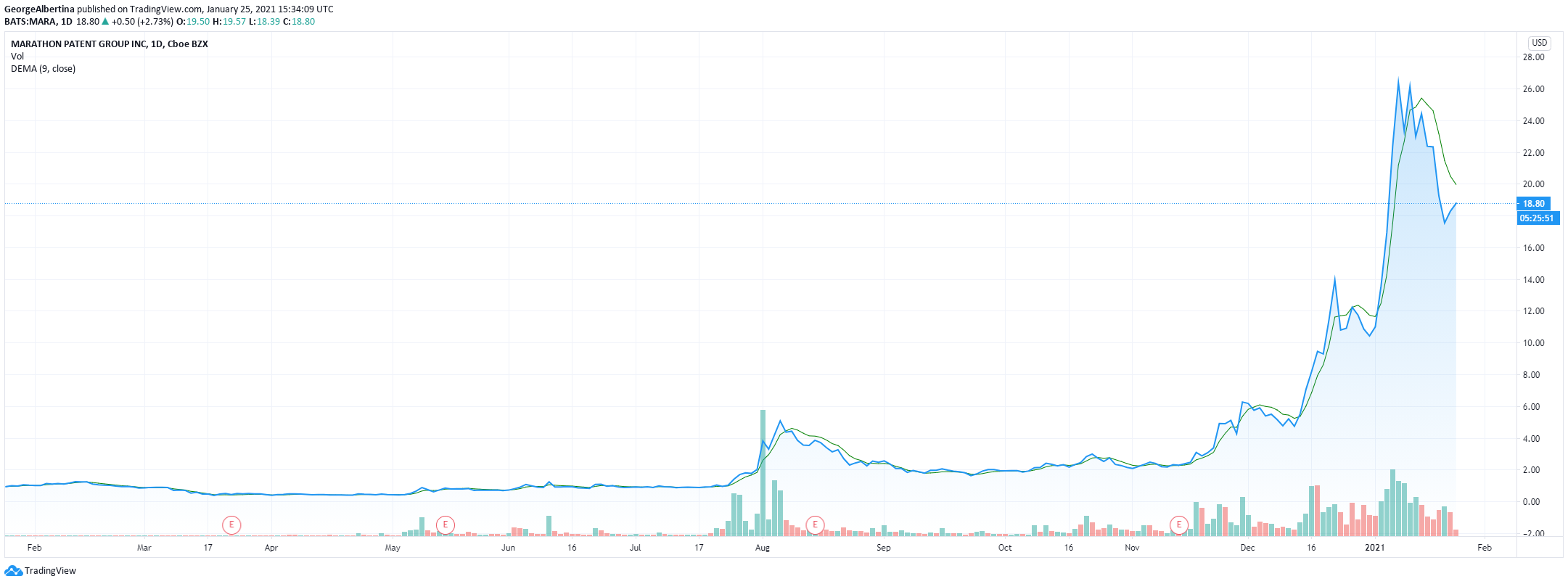

By holding bitcoin in the company’s treasury, Marathon is one of the only NASDAQ-listed companies that can provide exposure to digital currency. Last year, Marathon’s stock rallied almost 900%.

This is the first time the company, which mines bitcoin primarily, purchased reserves on the open market. This is a sign of “buying the dip” and seems to suggest that Marathon believes the price is going up.

CEO Merrick Okamoto said that the company had contracted 103,060 miners, which he expects to be fully deployed in early 2022. He said that at the current mining difficulty, the firm would produce 55 – 60 BTC ($1.8 – $2 million) a day.

New ASICs

On Dec 28, 2020, Marathon announced that it had purchased 70,000 S-19 ASIC miners from Bitmain. These specially designed ASICs mine bitcoin at high efficiency. The purchase cost $170 million.

According to Okamoto, this order was the largest Bitmain had ever received and would make it one of the world’s largest mining corporations. Based on this purchase, the company’s total hash rate could be 10.36 EH/s.

To further increase mining efficiency, the company partnered with Beowulf Energy to get cheap power to run the miners.

US of A Miners

This expansion is also important as there is growing concern about the number of bitcoin miners in China. China holds well over 50% of miners. And some are concerned about a government coordinated disruption of the network. There are also US initiatives to bring mining to North America.

Some companies have expanded enterprises in exchange for cheap power. US President Joe Biden’s cabinet and advisors, who have mixed records on cryptocurrency, could affect the success of such companies.

beincrypto.com

beincrypto.com