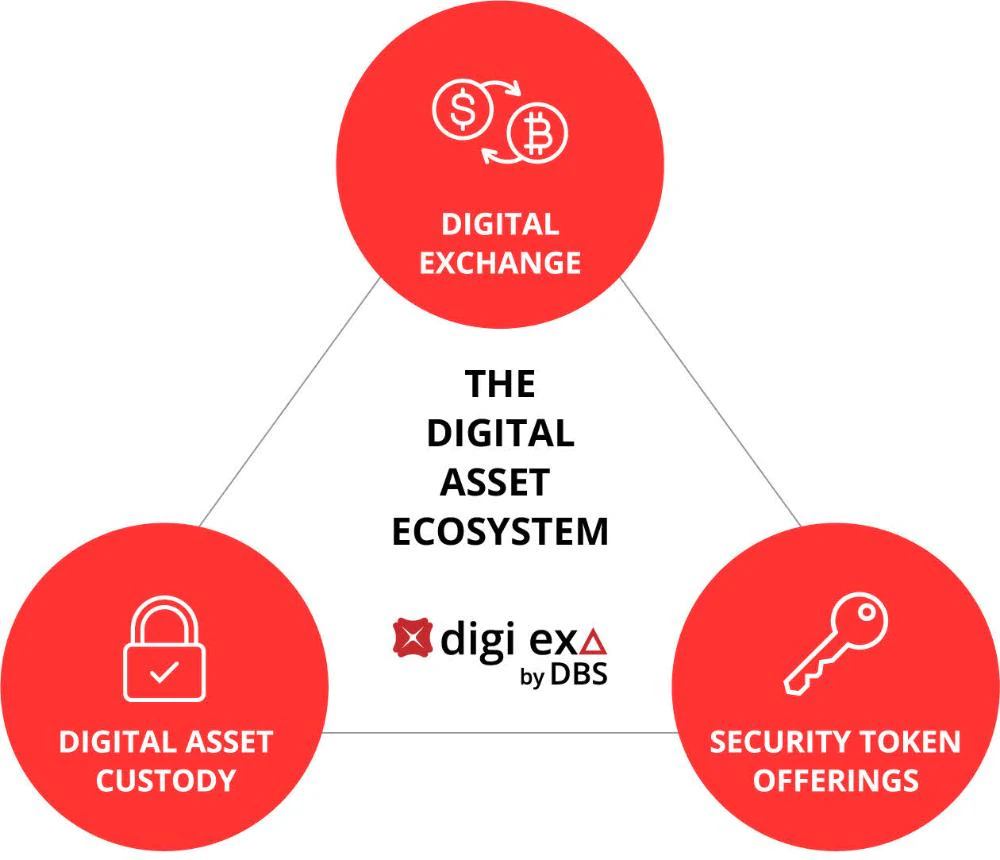

A Singapore-based multinational bank with over $400 billion of assets, DBS announced an institutional-grade digital asset exchange, custody, and platform for security token offerings (STOs).

Billion Dollar Bank DBS Launches Crypto Exchange

At the time of writing, DBS has taken down the page with the announcement, which may be attributed to ongoing social media excitement.

This is a big deal https://t.co/cdDdDhdD7S

— Barry Silbert (@BarrySilbert) October 27, 2020

According to the announcement, the new exchange is regulated by the Monetary Authority of Singapore (MAS). Only financial institutions and professional market makers like DBS Vickers Securities will be allowed to use the platform. They will act as intermediaries for individual clients.

The exchange has a 0.1% fee, but institutions can add additional fees for individuals.

Regarding the security token offerings, DBS claims that small and medium-sized enterprises, along with corporations, can potentially reach a wider investor audience through digital fundraising.

Notably, only qualified investors will be approved to participate once the service is live.

The initial crypto lineup includes Bitcoin, Bitcoin Cash, Ether, and XRP. Trading pairs are against fiat currencies, such as USD, SGD, and JPY.

Margin trading isn’t offered at this stage. However, institutions will need to pledge fiat or digital currencies to be able to trade. Trading limits will depend on the size of a pledge.

DBS highlighted that it offers a convenient fiat on-ramp, eliminating the need for stablecoins like USDT. It’s a sensible claim, considering that regulators worldwide are weighing central bank digital currencies (CBDCs) and pushing against stablecoins.

A downside of the bank-backed exchange is that it has a trading schedule and may be inconvenient for those who are used to 24/7 crypto trading.

Overall, the DBS announcement falls in line with the ongoing trend of crypto acceptance among institutions. With giants like PayPal integrating digital currencies into their services, the bull-run indeed appears to be in the first inning.

cryptobriefing.com

cryptobriefing.com