MicroStrategy, a company listed on Nasdaq and a giant in software solutions, has invested $ 250 million in bitcoins.

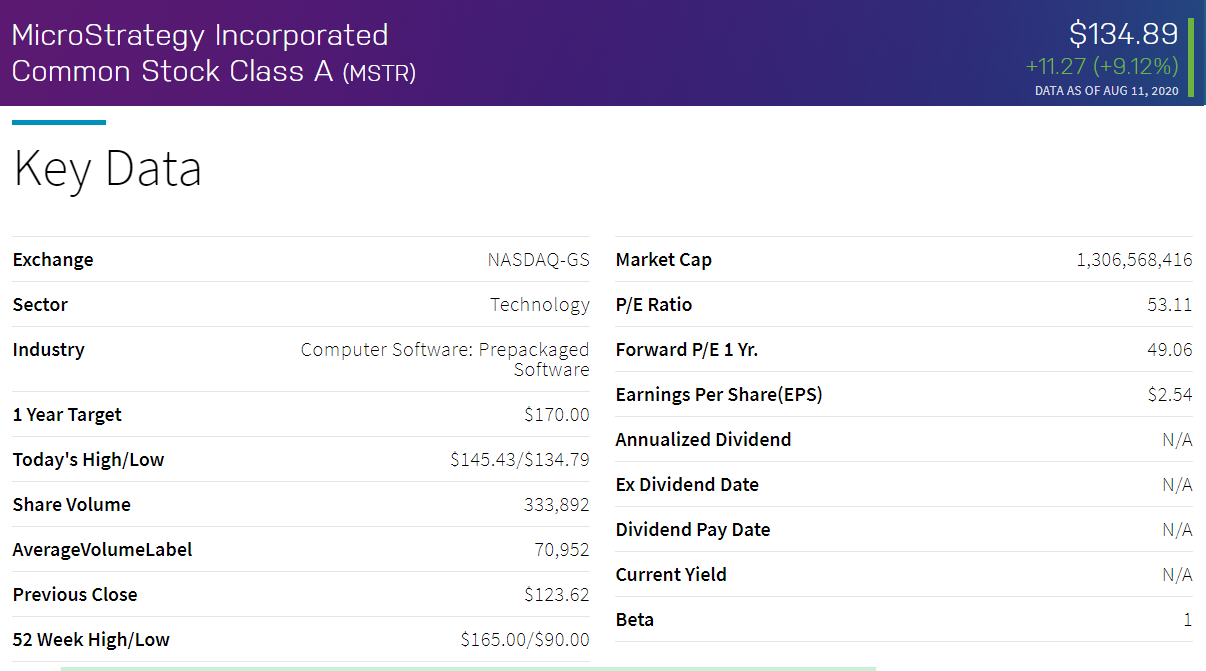

The largest independent publicly-traded business intelligence company, whose capitalization, according to Nasdaq, exceeded $ 1.3 billion, recognized bitcoin as a legitimate investment asset. In the published Press Release, the company informs that the purchase of bitcoin was carried out in accordance with the new strategy and after it publishing its financial results for the second quarter of 2020.

Michael J. Saylor, CEO, MicroStrategy Incorporated said:

Our investment in Bitcoin is part of our new capital allocation strategy, which seeks to maximize long-term value for our shareholders,

“ This investment reflects our belief that Bitcoin, as the world’s most widely-adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash.

Since its inception over a decade ago, Bitcoin has emerged as a significant addition to the global financial system, with characteristics that are useful to both individuals and institutions. MicroStrategy has recognized Bitcoin as a legitimate investment asset that can be superior to cash and accordingly has made Bitcoin the principal holding in its treasury reserve strategy.

The company was convinced mainly by the characteristic features of bitcoin such as global acceptance, brand recognition, ecosystem vitality, network dominance, architectural resilience, technical utilities and the community itself. Michael also thinks that bitcoin is digital gold because it is harder, stronger, faster, and smarter than any money and the company expects a significant increase in its value.

Microstrategy has a history of more than 30 years in anticipating technological trends and provides modern analytics on an open, comprehensive enterprise platform used by many of the world’s most admired brands in the Fortune Global 500.

Read also: Goldman Sachs wants to create its own Token and Digitize Wall Street

ccnews24.net

ccnews24.net