U.S. equities traded mixed midday Thursday, with the Dow Jones Industrial Average edging higher while the S&P 500 and Nasdaq Composite remained under pressure as investors recalibrated rate expectations and rotated out of high-growth technology shares.

Wall Street Splits as Dow Grinds Higher While Tech Drags Nasdaq Lower

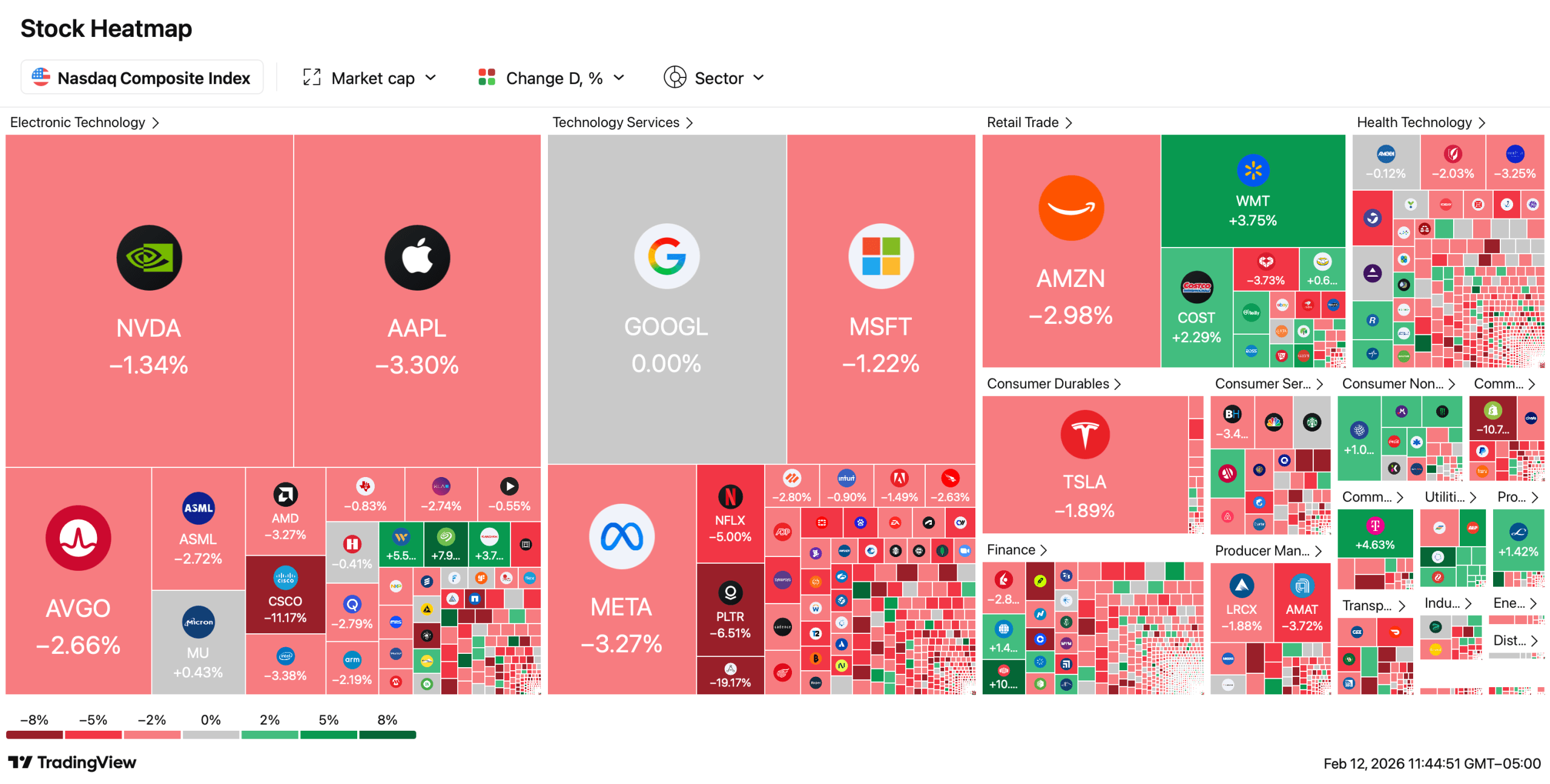

As of late morning Feb. 12, the Dow hovered near 50,145, up roughly 23 points, or 0.05%, while the S&P 500 slipped about 28 points, or 0.41%, to around 6,913. The Nasdaq Composite fell 216 points, or 0.94%, to approximately 22,850. The NYSE Composite outperformed, gaining about 18 points to 23,498.

The divergence follows a stronger-than-expected January jobs report that showed 130,000 nonfarm payrolls added, well above forecasts near 55,000. Unemployment ticked down to 4.3%, reinforcing the view that the labor market remains firm.

That resilience, however, has complicated hopes for imminent Federal Reserve rate cuts. Treasury yields pushed into the 4.15% to 4.18% range on the 10-year note, pressuring rate-sensitive technology stocks and lifting financials and industrial names tied more closely to economic momentum.

The rotation theme was visible across sectors. Energy and industrial shares showed relative strength, while parts of software and semiconductor segments struggled amid ongoing concerns about artificial intelligence (AI)-driven disruption and stretched valuations.

Individual stock moves amplified the divide. Applovin dropped sharply despite posting earnings above expectations, as investors questioned longer-term AI impacts. Cisco Systems also declined after reporting revenue growth tied to AI demand but flagging cost pressures. On the upside, Novocure jumped following FDA approval for a cancer treatment device, and Vertiv and Globalfoundries advanced on earnings and forward guidance.

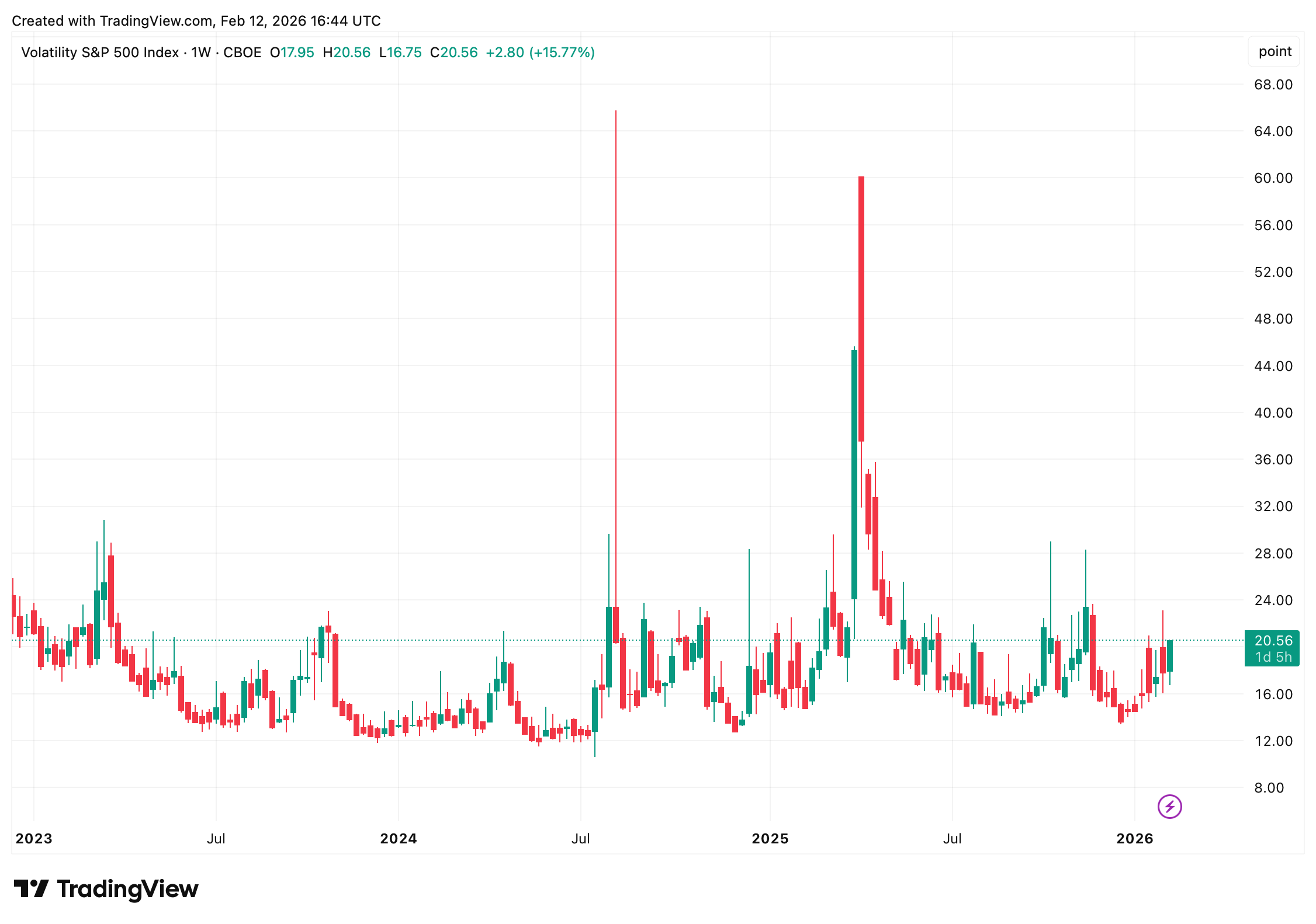

Volatility remained contained. The Cboe Volatility Index, or VIX, dipped to around 17.5, signaling only modest concern even as the Nasdaq lagged. The broader S&P 500 remains up modestly year to date, though leadership has narrowed and then broadened again as capital rotates beyond mega-cap technology.

Attention now turns squarely to Friday’s Consumer Price Index (CPI) report. Economists expect annual inflation to be near 2.5%. A softer print could revive rate-cut speculation and provide relief for growth stocks. A hotter reading may reinforce a “higher-for-longer” stance, potentially extending the current rotation into cyclicals and value-oriented sectors.

For now, Wall Street’s midday tone reflects a market neither panicked nor euphoric — just repositioning in real time as fresh data reshapes expectations.

FAQ ❓

- Why is the Dow rising while the Nasdaq is falling?Investors are rotating into cyclical and industrial stocks while trimming exposure to rate-sensitive technology names.

- How did the jobs report impact markets?Stronger payroll growth reduced expectations for near-term Federal Reserve rate cuts, pushing yields higher.

- What role is AI playing in today’s trading?AI-related valuation concerns are weighing on parts of the software and semiconductor sectors.

- Why is Friday’s CPI report important? Inflation data could shift rate expectations and drive the next move in equities.

news.bitcoin.com

news.bitcoin.com