Table of Contents

No, he did not. Various posts on X claim BlackRock CEO Larry Fink warned that the US dollar would turn into "Monopoly money" and eventually be "abandoned." Multiple accounts have repeated it as fact. But the quote does not belong to Fink. It belongs to a Reddit user, and the trail is easy to follow if you actually read the source material.

Where Did the Quote Really Come From?

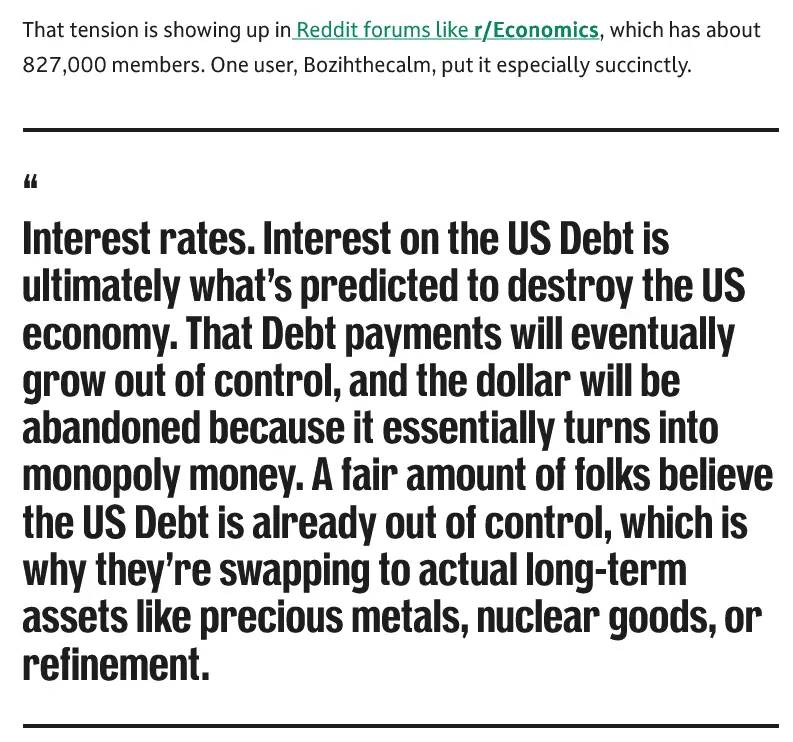

TheStreet published an article on January 18 covering the US national debt crossing $38 trillion. In it, they quoted a Reddit user named Bozihthecalm from the r/Economics subreddit, who wrote: "Debt payments will eventually grow out of control, and the dollar will be abandoned because it essentially turns into monopoly money."

TheStreet presented it clearly as online commentary, not as a statement from any executive. But somewhere between Reddit, TheStreet, and X, the attribution shifted. Accounts started pairing the quote with images of Fink and Bitcoin logos, framing it as if the head of the world's largest asset manager had personally issued a warning about the dollar's collapse.

He did not.

What Did Fink Actually Say?

Fink's real comments came during a January 15 CNBC "Squawk on the Street" interview, where he discussed BlackRock's Q4 2025 earnings and the broader economy. He was direct about the debt problem but far from apocalyptic.

"We haven't had fiscal discipline... Over $38 trillion, right? You're growing it. It grew last year and it's going to grow this year," Fink said. He noted that markets keep obsessing over the Federal Reserve while ignoring the growing fiscal risk, adding that debt headlines have "landed with a dull thud" despite their importance.

He warned that high deficits are keeping interest rates elevated because "we don't have enough ability to finance it." But he also struck an optimistic note, arguing that sustained 3% GDP growth over the next 10 to 15 years could actually shrink the debt-to-GDP ratio even with large deficits.

No "Monopoly money." No "abandonment." Just a call for fiscal discipline paired with cautious optimism about growth.

Is the Debt Concern Real Though?

Absolutely. The underlying numbers are serious enough without needing a fabricated quote to sell them.

As of January 7, the US national debt stood at $38.43 trillion. By February 4, it had climbed to $38.56 trillion. Interest payments on public debt hit $276 billion in Q1 of fiscal 2026, up 13% year over year, according to the CBO. The average interest rate on total marketable debt sits at 3.35% as of January 2026, and net interest spending surpassed $1 trillion for the full fiscal year 2025 for the first time in history.

The Committee for a Responsible Federal Budget calls trillion-dollar interest payments "the new normal." That is not a Reddit user speculating. That is the baseline.

Why Does This Keep Happening in Crypto?

Because sensational headlines drive engagement, which in turn drives price action. Pair a powerful name like Larry Fink with a dramatic claim about the dollar dying, throw in a Bitcoin logo, and the post writes itself.

Fink has genuinely become one of crypto's biggest institutional allies. He went from Bitcoin skeptic to launching the iShares Bitcoin Trust ETF (IBIT), which raised over $50 billion in assets in its first year. In his 2025 annual letter, he acknowledged that Bitcoin could challenge the dollar's reserve status if deficits continue unchecked. The bullish case does not need a fake quote to stand on its own.

But credibility matters. When the crypto space passes off a Reddit comment as a CEO's warning, it feeds the very narrative critics use to dismiss the industry. Verify before you amplify.

Sources:

- TheStreet — Original article quoting Reddit user Bozihthecalm on r/Economics, with context on Fink's CNBC interview

- JEC Monthly Debt Update — US national debt data as of January 7, 2026

- Committee for a Responsible Federal Budget — Analysis of net interest payments surpassing $1 trillion in FY2025

- Peterson Foundation — Interest cost tracker showing Q1 FY2026 spending data

- CryptoSlate — Coverage of Fink's 2025 annual letter on Bitcoin and dollar risk

bsc.news

bsc.news