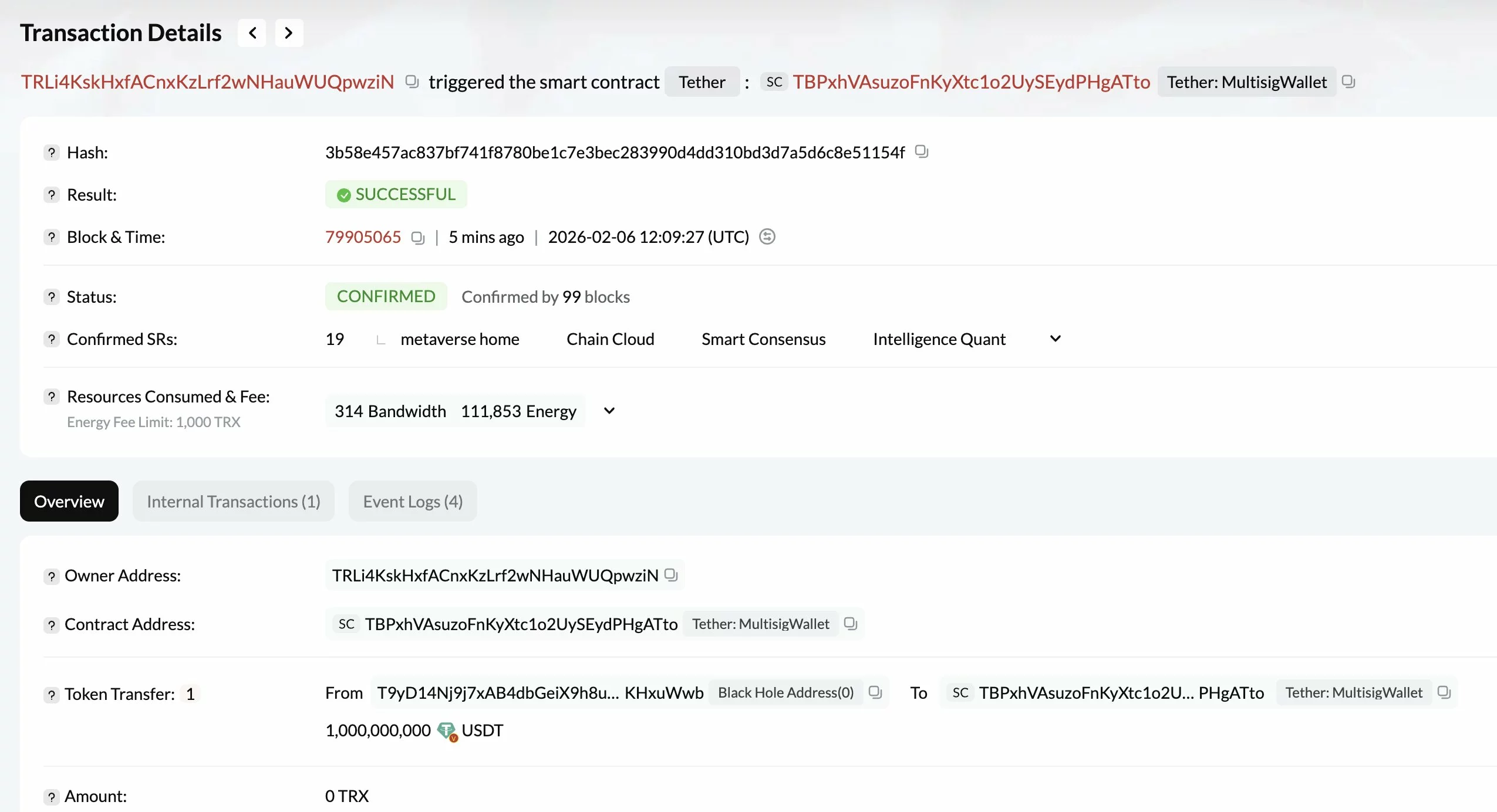

Stablecoin issuer Tether has minted another $1 billion worth of $USDT, adding to a sharp rise in stablecoin issuance over the past week, according to on-chain analytics firm Lookonchain.

- Tether minted $1B $USDT, adding to roughly $4.75B in stablecoins issued by Tether and Circle over the past week, according to Lookonchain.

- Analysts caution the surge is a liquidity signal, not a buy signal, noting that rising stablecoin supply has also coincided with choppy or falling Bitcoin prices.

- Markets are watching deployment, redemptions, and velocity, alongside macro factors like ETF flows and derivatives funding, for confirmation of bullish momentum.

The latest mint brings total stablecoin issuance by Tether and Circle to roughly $4.75 billion in the past seven days, highlighting a rapid expansion in crypto market liquidity even as broader markets remain under pressure.

Lookonchain noted that the most recent $USDT mint occurred on the Tron network, as Bitcoin ($BTC) continued to trade around the $66,000 level.

Liquidity signal, not a buy signal

Crypto analyst Milk Road cautioned that while large stablecoin mints are often framed as “dry powder” for a market rebound, the signal is more nuanced.

Tether just minted $1B $USDT on Tron while $BTC bleeds below $74K.

— Milk Road (@MilkRoad) February 4, 2026

Here's what it actually means:

$3B in combined stablecoin mints over three days looks like dry powder accumulating…

Big players positioning to buy the dip is the easy narrative…

But the bigger story is… https://t.co/yTH0A8c01n pic.twitter.com/wXp4ORzdlu

According to Milk Road, roughly $3 billion in stablecoin issuance over just three days points to liquidity building within the market’s infrastructure rather than an immediate directional bet on prices.

Historically, rising stablecoin supply has preceded bull runs, but similar conditions have also occurred during choppy or declining Bitcoin markets.

“Stablecoin supply growth alone isn’t a directional indicator,” Milk Road said, describing it instead as a liquidity and readiness signal.

What markets are watching

Analysts say the key indicators to monitor are whether stablecoin issuance is accompanied by low redemptions, improving velocity, and deployment onto exchanges, alongside supportive macro conditions such as ETF inflows and favorable derivatives funding rates.

Absent those signals, rising stablecoin supply may simply reflect market participants positioning capital, rather than actively deploying it.

As Milk Road put it, the market may be “loading ammunition, not pulling the trigger.”