Just over six months after Shopify partnered with Coinbase, payments using $USDC on Base via the integration remain only a small fraction of the e-commerce giant’s activity.

The integration, announced in June of last year and involving Shopify, Coinbase and Stripe, allows merchants at Shopify to accept $USDC payments settled on Base. The payments are settled via the Commerce Payments Protocol, an open source protocol developed by Shopify and Coinbase and launched at the time of the integration.

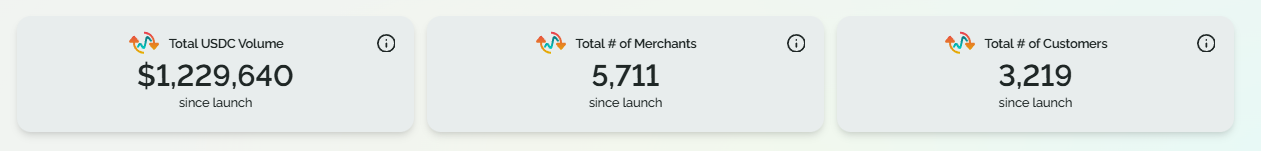

So far, however, adoption appears relatively low. According to data from blockchain analytics platform growthepie, since June, just $1.2 million in $USDC payments on Base has been processed from about 3,200 customers across 5,700 merchants via the Commerce Payments Protocol.

Growthepie also noted that these figures reflect activity across “multiple companies” that use the Commerce Payments Protocol, not only Shopify.

A Coinbase spokesperson confirmed to The Defiant that growthepie’s data “shows a piece of the puzzle,” adding that the Shopify rollout is ongoing and early signs are solid.

“Volume is trending up and we’re seeing merchants increasingly leaning into crypto, especially for cross-border payments,” the Coinbase spokesperson noted, adding that several other operators are in the pipeline.

When the partnership was first announced in June, Shopify described the move as an effort to “bring frictionless, secure stablecoin payments to merchants around the world.”

But the $USDC numbers remain just a tiny fraction of Shopify’s broader footprint. In 2024, the e-commerce giant reported more than 5.5 million merchants, 875 million customers, and roughly $300 billion in annual gross merchandise volume (GMV).

Growth Trajectory

Speaking with The Defiant, Lorenz Lehmann, research lead at growthepie, said the small absolute numbers should not be read as a failure.

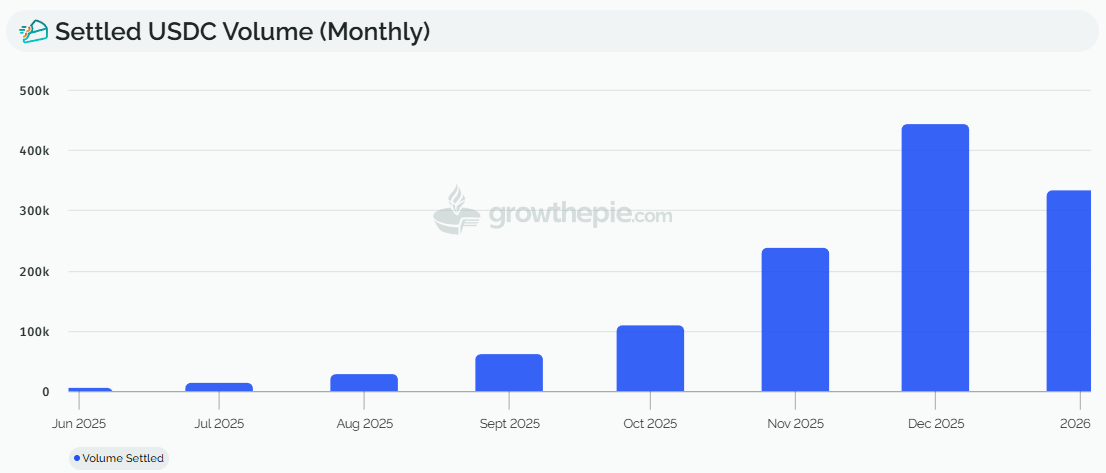

“While the absolute numbers ($1.2M) are small compared to Shopify’s global GMV, the growth trajectory is what matters in early-stage tech in our opinion,” Lehmann told The Defiant.

He noted that of the $1.2 million settled since Shopify went live with $USDC, roughly $750,000 occurred in the last two months alone, describing the progress as “the classic ‘slow then fast’ compounding growth curve common in crypto.” Lehmann elaborated:

“We view this as typical in a pilot-stage. In the early days of any new payment rail, you see high ‘novelty’ usage (people trying it once to see it work). The fact that volume is accelerating heavily in the last 60 days suggests we are moving past the ‘curiosity’ phase into more consistent utility.”

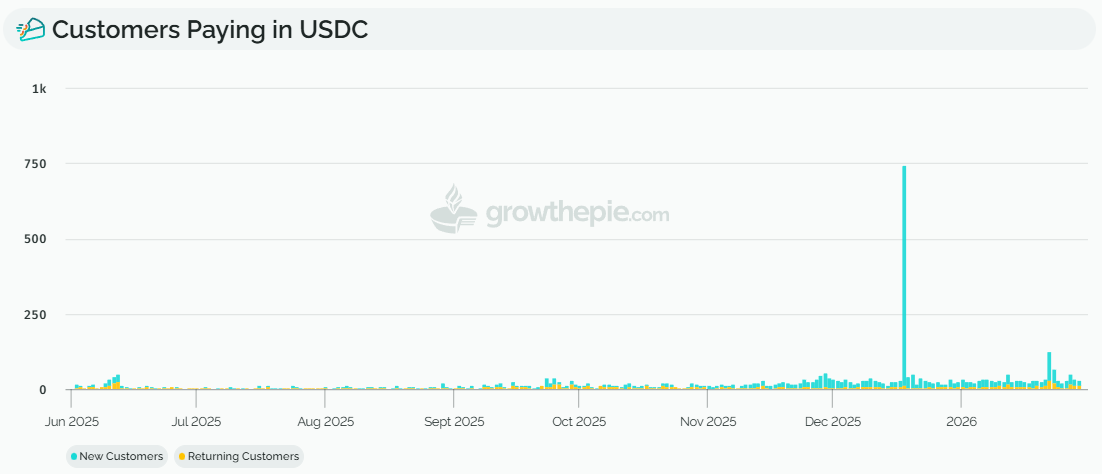

Still, growthepie’s dashboard shows limited repeat usage, with most wallets transacting only once. A “returning customer,” Lehmann explained, is defined as a wallet making a payment on a different day after its first transaction, with wallet addresses representing a lower bound for actual users.

As Lehmann noted, the "ghost town" risk is “real for any new tech,” but since the growth is accelerating, both merchant interest and customer habit-forming “are trending in the right direction.”

The Defiant reached out to Shopify for comments on the initiative but hasn’t received a response by press time.

A recent report by S&P Global Ratings found that just 5% of the total U.S. dollar-pegged stablecoin supply, which sits just above $300 billion, is currently used for payments in the private sector.