Newly released US Justice Department emails suggest Jeffrey Epstein, the late financier and convicted sex offender, gained exposure to early cryptocurrency venture investments through intermediaries, including a reported stake in Coinbase.

Epstein may have invested $3.25 million into cryptocurrency exchange Coinbase back in 2014, according to files released by the US Department of Justice (DOJ).

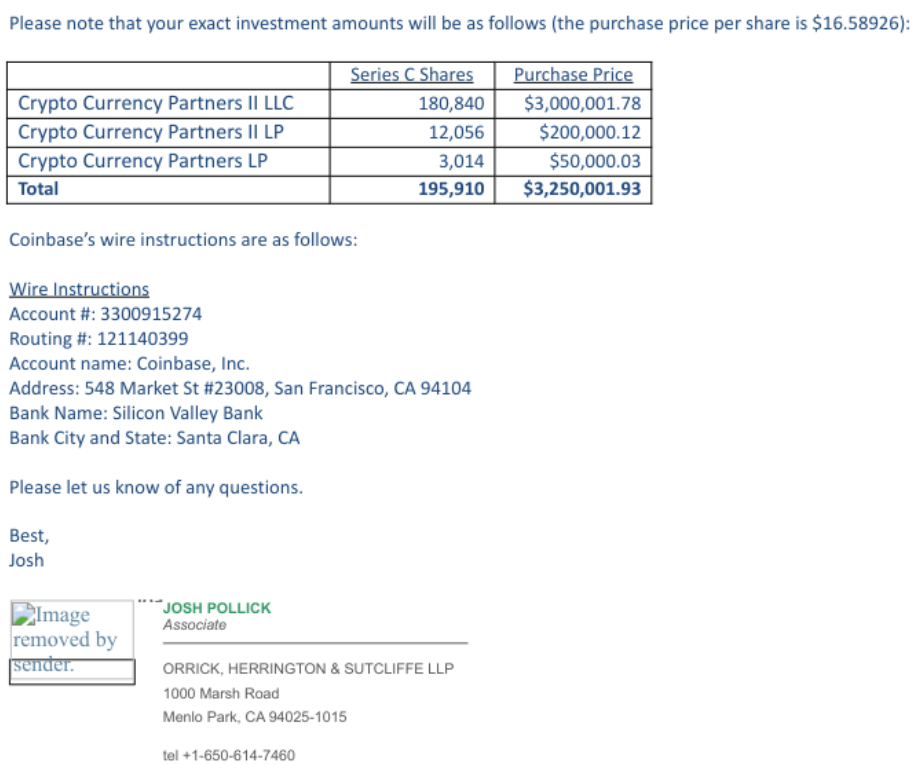

The emails suggest an entity linked to Epstein acquired 195,910 Series C shares for a total of $3.25 million when Coinbase was valued at $400 million.

The documents do not indicate that Coinbase executives had direct dealings with Epstein or were aware of the ultimate beneficial owner of the investment at the time.

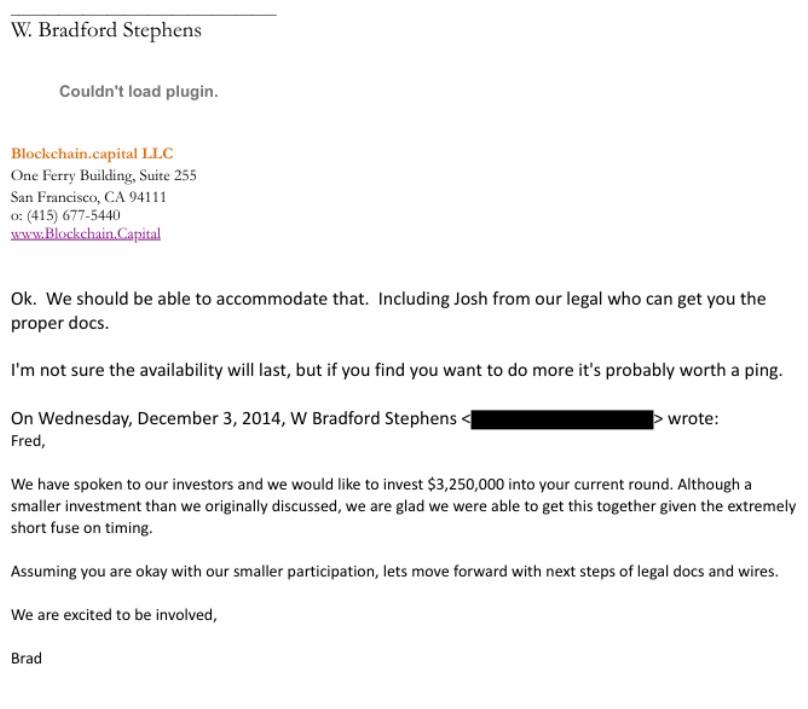

“When we figure out which LLC will be making the $3m investment, we will have them change the name of the investing entity. Wire instructions are also included,” wrote Bradford Stephens, the founder and managing partner of Blockchain Capital, in an email on Dec. 4, 2014, to Darren Indyke, one of Epstein’s known associates.

Related: Trump's Fed nomination a ‘mixed’ signal for Bitcoin, US liquidity: Analyst

The latest batch of Epstein-related documents shows that the late sex trafficker had growing ties to the early development of the crypto industry and that he invested in numerous top crypto-native firms.

Epstein-linked entities also participated in the $18-million oversubscribed seed round of blockchain technology company Blockstream.

The investment was made through three separate limited liability companies (LLCs), including Crypto Currency Partners II LLC, Crypto Currency Partners II LLP, and Crypto Currency Partners LP.

Related: BitMine nears $7B in unrealized losses as Ether downturn pressures treasury firms

Epstein sold half his Coinbase investment in 2018 for $15 million: Emails

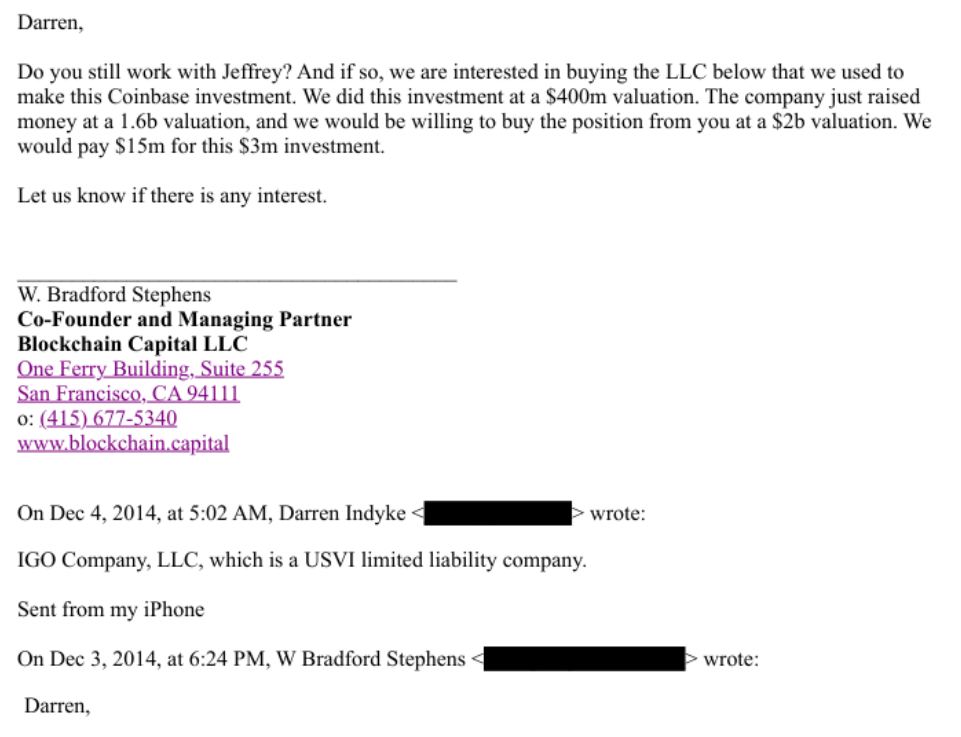

Four years after the investment deal, Epstein was approached by Stephens in 2018, who sought to buy his Coinbase investment.

According to the documents, Stephens offered to buy 50% of Epstein’s investment based on a $2 billion valuation, paying $15 million for roughly half of the position originally acquired for about $3 million.

“We are interested in buying the LLC below that we used to make this Coinbase investment,” wrote Stephens in an email on Jan. 20, 2018, adding:

“We did this investment at a $400m valuation. The company just raised money at a 1.6b valuation, and we would be willing to buy the position from you at a $2b valuation. We would pay $15m for this $3m investment.”

A month later, in a Feb. 22 email, Brock Pierce, the co-founder of Blockchain Capital, claimed that Stephens had “wired $15m for half of your Coinbase position yesterday. So you still have $15m of equity and now $=5m of cash back if so.”

Pierce was the second figure to help facilitate Epstein’s investment in the exchange. The DOJ releases include numerous references to Pierce in connection with cryptocurrency investment discussions tied to Epstein-linked entities.

Cointelegraph has approached Coinbase for comment on Epstein’s potential investment in the exchange.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

cointelegraph.com

cointelegraph.com