Tether’s latest attestation shows the world’s largest stablecoin issuer held more assets than liabilities at the end of 2025, according to an independent assurance report released Jan. 30.

Tether Confirms Reserve Coverage in ISAE 3000R Assurance Report

The report, prepared by BDO Advisory Services under the ISAE 3000R standard, covers Tether International, S.A. de C.V.’s financial figures and reserves as of Dec. 31, 2025, and provides a point-in-time snapshot rather than a full audit.

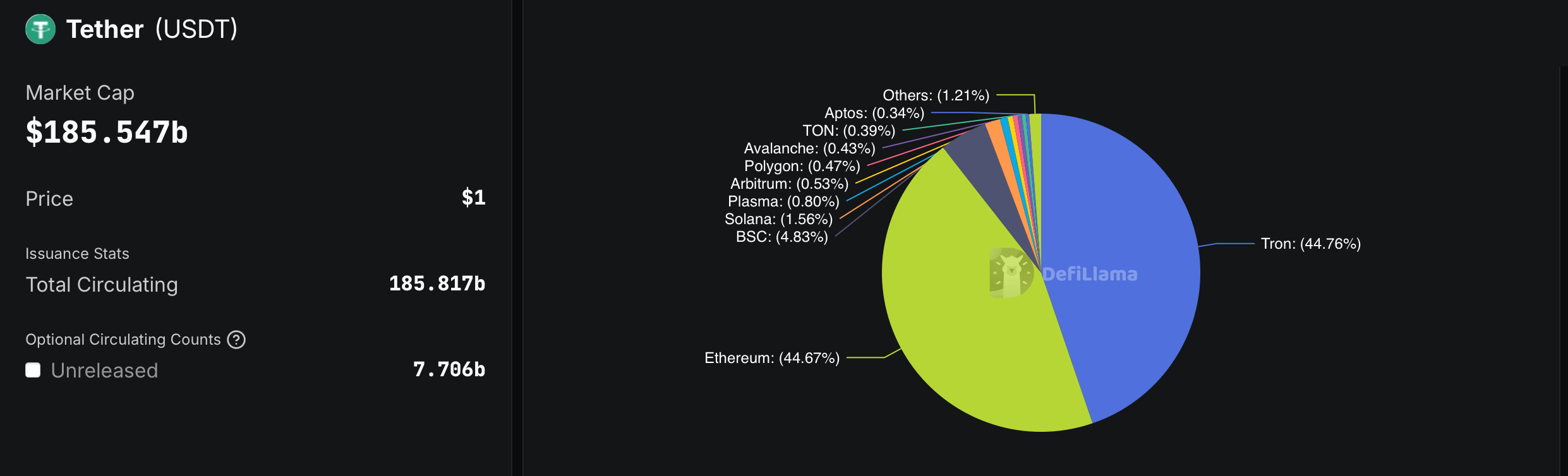

BDO ranks among the world’s largest accounting and advisory networks, delivering assurance and advisory services to a wide spectrum of corporate and institutional clients. The firm concluded that the figures were fairly presented, in all material respects, based on Tether’s stated accounting policies. As of year-end, Tether reported total assets of $192.9 billion against total liabilities of $186.5 billion, resulting in excess reserves of approximately $6.34 billion.

Most liabilities—about $186.45 billion—were tied to issued digital tokens redeemable on demand. The attestation shows that cash, cash equivalents, and other short-term deposits made up the largest share of reserves. U.S. Treasury bills with maturities under 90 days accounted for roughly $122.3 billion, while overnight and term reverse repurchase agreements totaled about $24.8 billion combined.

Cash and bank deposits represented a comparatively small portion at roughly $34 million. Beyond government-backed instruments, the reserves also included $17.45 billion in precious metals, primarily physical gold bars, and $8.43 billion in bitcoin held onchain at a reference price of $87,647.54 per bitcoin at the reporting timestamp.

Corporate bonds and other investments together accounted for less than $3 billion, while secured loans totaled about $17.04 billion. The report states that all secured loans were overcollateralized by liquid assets and subject to margin calls and liquidation mechanisms. Management reported no expected credit losses at the reporting date, noting that valuations assume normal market conditions rather than stressed scenarios.

Tether’s equity declined year over year, falling from $7.09 billion at the end of 2024 to $6.34 billion in 2025. The change reflected more than $10.1 billion in financial results offset by dividend distributions totaling roughly $10.86 billion during the period.

The attestation also highlights unresolved legal matters. As of Dec. 31, 2025, Tether International was a defendant in two civil cases in New York courts, including a class action tied to the bitcoin price decline in 2017–2018 and a separate case related to stablecoin freezes. No provisions were recorded for these cases, as outcomes could not be reliably estimated.

Also read: Universal Launches UAE Central Bank‑Registered USD Stablecoin

Separately, Tether published an accompanying financial update stating that net profits exceeded $10 billion in 2025 and that its overall exposure to U.S. Treasuries, including indirect exposure through repurchase agreements, surpassed $141 billion. That disclosure also noted that proprietary investments funded from excess capital are excluded from token reserves.

BDO emphasized that the assurance applies only to balances at Dec. 31, 2025, and does not extend to periods before or after that date, nor to the notes accompanying the financial figures.

“ USDT expanded because global demand for dollars is increasingly moving outside traditional banking rails, particularly in regions where financial systems are slow, fragmented, or inaccessible,” Tether CEO Paolo Ardoino said in the update accompanying the crypto firm’s attestation.

FAQ 💵

-

What did Tether’s latest attestation cover?

It reviewed Tether International’s reserves and liabilities as of Dec. 31, 2025, under ISAE 3000R standards. -

Did Tether’s reserves exceed its liabilities?

Yes, assets exceeded liabilities by about $6.34 billion at year-end 2025. -

What assets back Tether tokens?

Reserves include U.S. Treasury bills, reverse repos, gold, bitcoin, secured loans, and other investments. -

Is this a full audit?

No, the report is a reasonable assurance engagement, not a full financial audit.

news.bitcoin.com

news.bitcoin.com