President Donald Trump said Thursday he will announce his pick to replace Federal Reserve Chair Jerome Powell on Friday morning, ending months of speculation over who will lead the world’s most powerful central bank.

Frontrunner Kevin Warsh’s anti-QE stance could reshape the liquidity environment that has buoyed risk assets, including cryptocurrencies, since 2008.

Trump Teases Friday Announcement

“I’ll be announcing the Fed chair tomorrow morning,” Trump said at the Kennedy Center on Thursday evening. He hinted that the pick “won’t be too surprising” and will be “someone known to everyone in the financial world.” The President added that “a lot of people think this is somebody that could’ve been there a few years ago.”

🚨 BREAKING: TRUMP: "I'll be announcing the Fed Chair tomorrow morning." pic.twitter.com/GrvIm3zAc8

— Breaking911 (@Breaking911) January 30, 2026

Warsh Surges in Prediction Markets

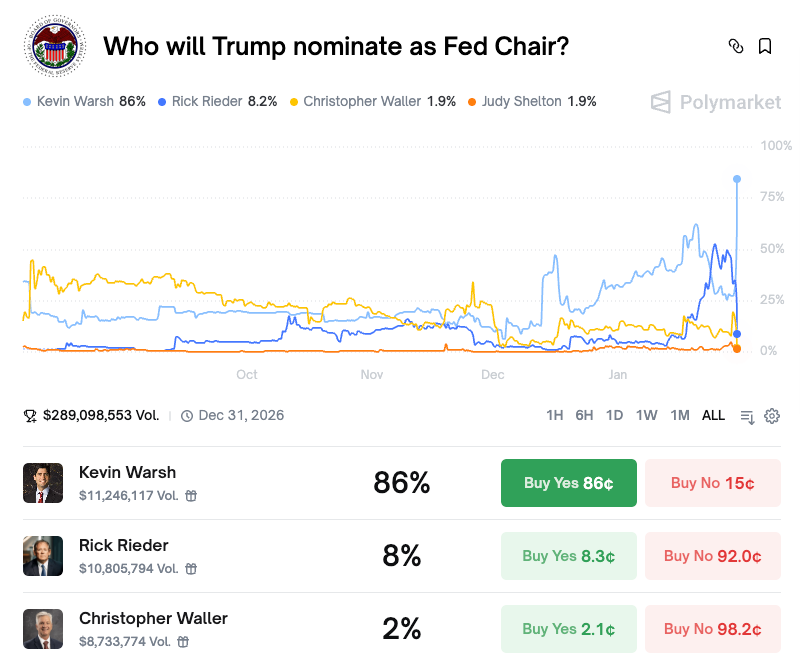

Former Fed Governor Kevin Warsh emerged as the clear frontrunner following a White House visit on Thursday. Prediction markets shifted dramatically. Polymarket showed Warsh at 87% probability on $289 million in trading volume. Kalshi reflected similar odds at 86% on $74 million volume.

The surge was swift. BlackRock Chief Investment Officer Rick Rieder had been the odds-on favorite as recently as Wednesday before Warsh overtook him. Economist Justin Wolfers noted on X that the White House sighting alone was “enough evidence for prediction markets” to reprice Warsh’s odds.

Other candidates on Trump’s shortlist include Fed Governor Christopher Waller, who dissented from this week’s decision to hold rates steady, and National Economic Council Director Kevin Hassett, though Trump has indicated he prefers to keep Hassett in his current role.

Warsh’s Policy Stance: Rate Cuts Without QE

Warsh served as a Fed governor from 2006 to 2011 and has called for a structural overhaul of the central bank. Macro analyst Alex Krüger summarized Warsh’s positions on X: he believes AI-driven productivity gains are disinflationary, justifying aggressive rate cuts, while arguing the Fed’s balance sheet has subsidized Wall Street and should shrink significantly.

This mix of dovish rate policy and hawkish balance sheet stance sets Warsh apart. Deutsche Bank’s Matthew Luzzetti wrote in December that Warsh’s preference for “lower policy rates, possibly counterbalanced by a smaller balance sheet” would require regulatory changes to work.

RSM Chief Economist Joseph Brusuelas was more critical. He wrote on X that Warsh’s “first instinct is hawkish” and that he “got the policy response wrong” after the Global Financial Crisis.

Crypto Implications

Warsh’s opposition to QE could pressure cryptocurrencies, which have historically risen alongside Fed balance-sheet expansion. The balance sheet now stands at roughly $6.5 trillion, down from $8.9 trillion in 2022.

His stance on digital assets is nuanced. Warsh invested in the stablecoin project Basis in 2018 and in the asset manager Bitwise in 2021, where he remains an advisor.

Yet in a 2022 WSJ op-ed, he dismissed private cryptocurrencies as “masquerading as money,” writing that “cryptocurrency is a misnomer—it isn’t money, it is software.” He also backed a US central bank digital currency, a stance at odds with Trump’s pro-Bitcoin rhetoric.

Senate Confirmation Uncertain

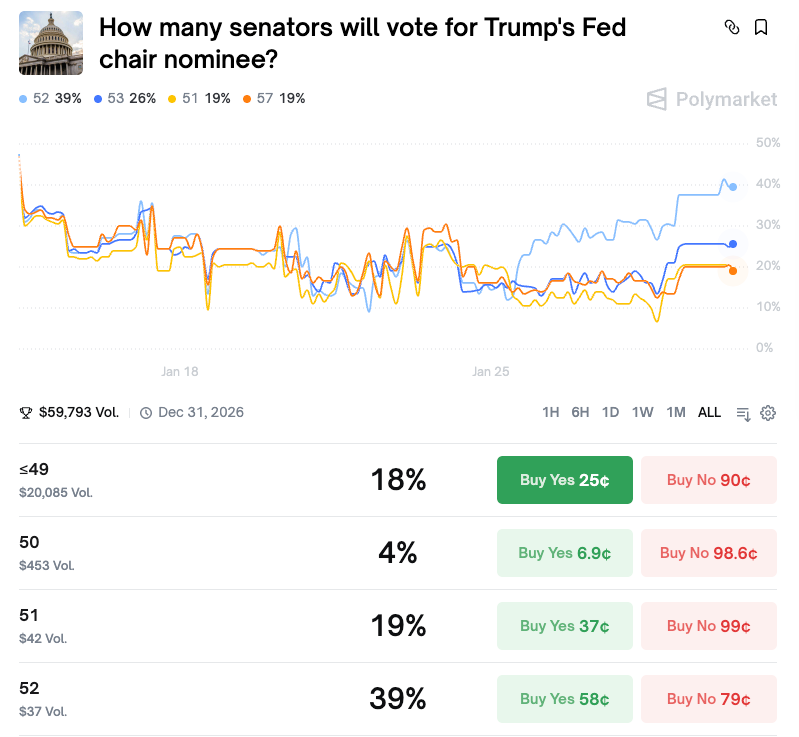

While Warsh’s nomination appears likely, confirmation is less certain. Polymarket shows a 39% chance of passing with exactly 52 votes—the most likely scenario—while an 18% probability of outright rejection reflects uncertainty over Senator Tillis’s threatened blockade.

Republican Senator Thom Tillis, a member of the Banking Committee, has vowed to block any Fed nominee until the DOJ concludes its probe into Powell. The investigation centers on the renovation costs at Fed headquarters and Powell’s testimony, which he called a “pretext” to pressure him.

Powell’s term as Chair ends May 15, though his governor term runs until January 2028. Trump nearly picked Warsh in 2018 but chose Powell instead—a decision he has publicly regretted.

The Fed held rates at 3.50%-3.75% Wednesday after three cuts in 2025. Trump wants rates “two points and even three points lower.”

beincrypto.com

beincrypto.com