Laser Digital, a full-service digital asset company backed by Japanese financial group Nomura, has reportedly filed for a US national bank trust charter, signaling that crypto-focused companies are seeking deeper integration into the US financial system amid a more permissive regulatory environment.

Citing sources familiar with the matter, the Financial Times reported Tuesday that Laser Digital had submitted its application to the Office of the Comptroller of the Currency (OCC). The charter would allow the company to operate at the federal level without applying for state-by-state custody licenses.

The company plans to offer spot trading for digital assets but does not intend to take customer deposits, the report said.

Approval of an OCC charter is a two-stage process, beginning with preliminary approval and followed by final authorization once the applicant demonstrates sufficient capital and operational credibility, a process that can take up to a year, the FT said.

Laser Digital was established in 2022 and is headquartered in Switzerland. The company has secured regulatory approvals in multiple jurisdictions, including Switzerland and Dubai.

Related: Nomura’s Laser Digital rolls out yield-bearing Bitcoin fund

A growing queue for US bank charters

Laser Digital would be far from alone in seeking a bank charter under the more industry-friendly regulatory environment associated with the administration of US President Donald Trump.

Before regulators began issuing approvals, several major crypto companies had publicly explored the option.

Last year, crypto exchange Coinbase told Cointelegraph it was considering a US federal bank charter, though it said no decision had been made at the time. Reports also suggested that crypto custodian BitGo and blockchain infrastructure provider Paxos were weighing similar moves.

Speculation also surrounded stablecoin issuer Circle, which later denied that it had formally applied for a charter.

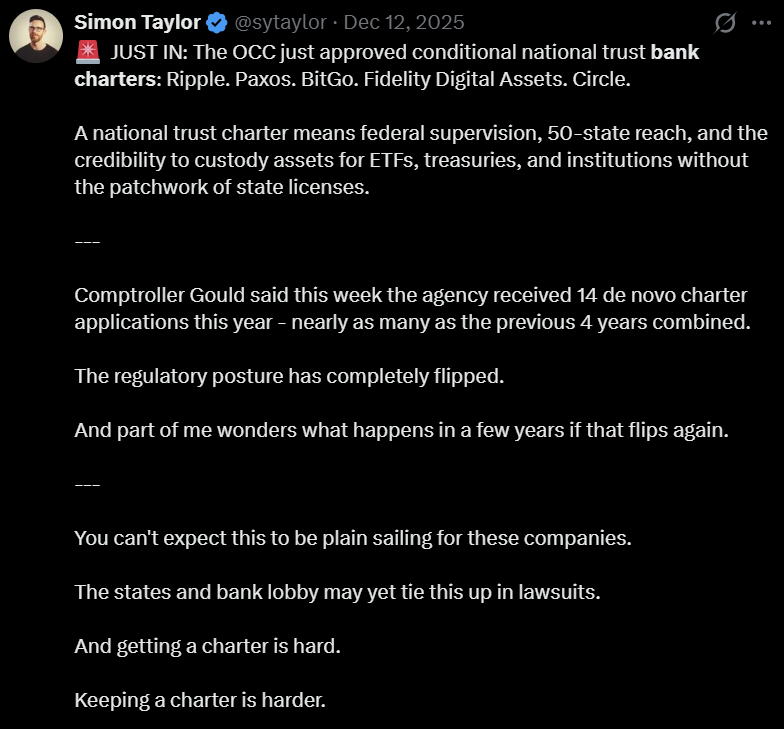

That exploratory phase has since given way to concrete regulatory action. In December, the OCC conditionally approved five national trust bank charters for digital asset companies: First National Digital Currency Bank, which is linked to Circle, Ripple National Trust Bank, BitGo Bank & Trust, Fidelity Digital Assets and Paxos Trust Company.

More recently, Trump-affiliated World Liberty Financial submitted its own application for a national bank charter, adding to the growing list of crypto and fintech companies seeking entry into the US banking system.

Not everyone is supportive of the trend. The American Bankers Association and other industry groups warned the Office of the Comptroller of the Currency last July of “significant policy and process concerns” if digital asset companies are granted bank licenses, arguing that such approvals could disrupt traditional banking safeguards.

Related: Stablecoin supply growth stalls as regulation, Treasury yields bite

cointelegraph.com

cointelegraph.com