Table of Contents

Tether makes money by investing the reserves that back USDT. When users deposit dollars to mint stablecoins, Tether doesn't just sit on that cash. It puts those funds to work in U.S. Treasury bills, money market funds, and other low-risk assets. The interest? Tether keeps it.

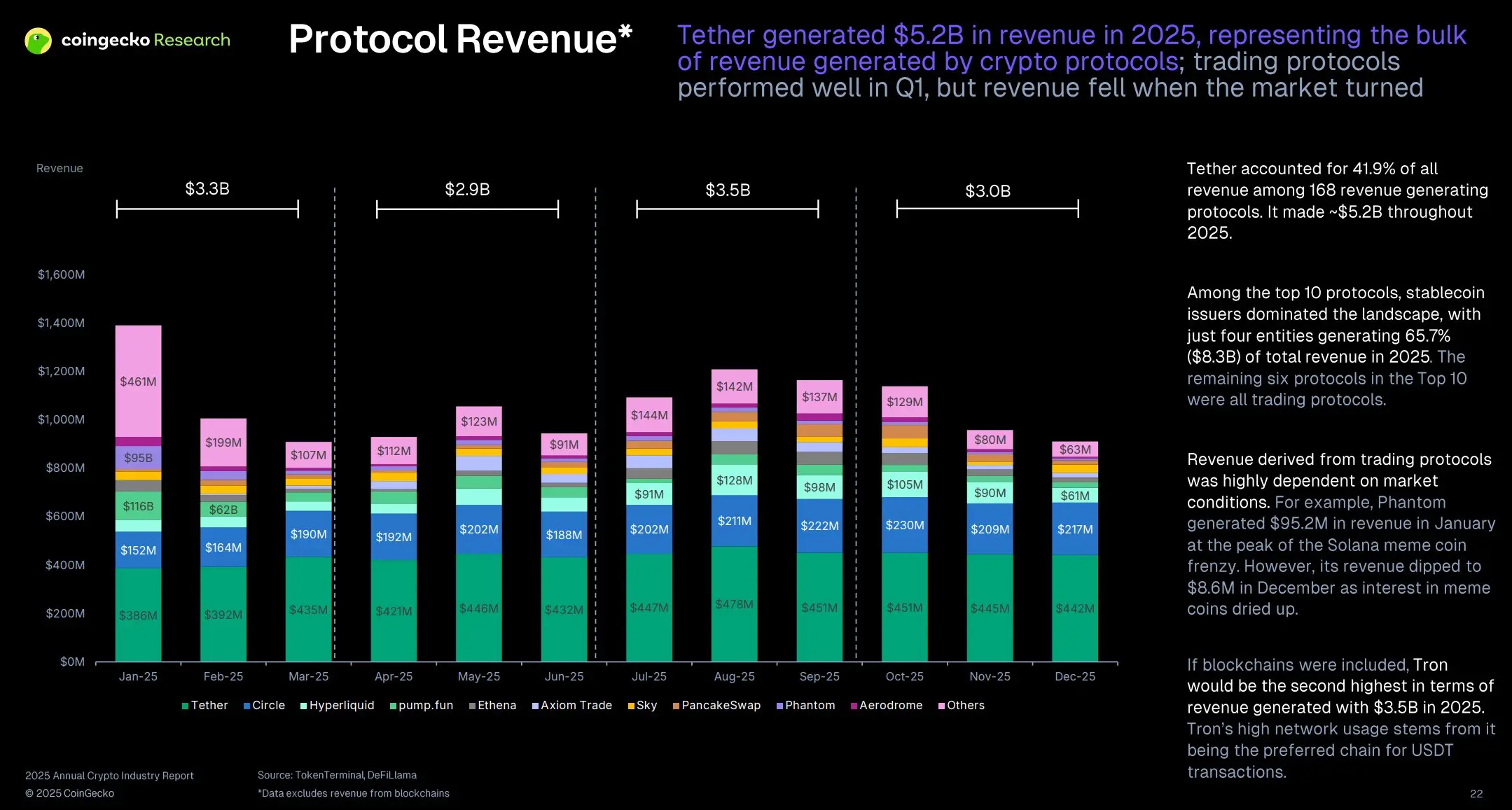

In 2025, this simple model turned Tether into the highest-earning protocol in crypto. According to CoinGecko's Annual Crypto Industry Report, the company pulled in $5.2 billion in revenue. That's 41.9% of all stablecoin-related earnings for the year.

Why Treasury Bills Are Tether's Cash Cow

The Federal Reserve kept interest rates elevated through 2025. For Tether, this was a goldmine.

With over $135 billion parked in U.S. Treasuries by year-end, even modest yields of 4-5% translate into massive returns. The math is straightforward. If you hold $135 billion earning 4.5% annually, that's roughly $6 billion in interest before you touch anything else.

To put that in perspective: Tether now holds more U.S. government debt than South Korea or Germany. The company ranks as the 17th largest holder of Treasuries globally, sitting alongside sovereign nations.

This is why interest income accounts for an estimated 80-90% of Tether's revenue. The company essentially runs a money market fund with crypto characteristics.

By Q3 2025, Tether's reserve breakdown looked like this: $94.5 billion in U.S. Treasuries, $14.1 billion in reverse repurchase agreements, and $6.5 billion in money market funds. Total assets hit $181.2 billion.

What About Fees?

Tether does charge fees, but they're not the main revenue driver.

When large institutions mint or redeem USDT directly through Tether, they pay around 0.1% or a flat fee for high-volume transactions. This accounts for an estimated 5-10% of total revenue.

Retail users never see these fees. If you're buying USDT on Binance or Coinbase, you're trading on secondary markets. The fees you pay go to the exchange, not Tether.

Exchange partnerships add another small revenue stream. Tether earns from collaborations with platforms that use USDT as a trading pair. Some exchanges share a portion of transaction fees. But this contribution remains under 5% of total income.

Does Tether Invest in Anything Besides Treasuries?

Yes. Tether allocates excess reserves beyond the 1:1 backing requirement into alternative assets.

In Q4 2025, the company added 27 metric tons of gold to its holdings, valued at approximately $4.4 billion at current prices. This diversification play provides appreciation-based returns separate from interest income.

Tether also holds significant Bitcoin on its balance sheet. As BTC prices climbed through 2025, these holdings gained value. The company has made venture investments in AI, mining operations, and emerging markets as well.

Returns from these holdings vary. They're not the core business, but they add upside when markets cooperate.

The $5.2 Billion vs. $15 Billion Question

There's a numbers gap worth addressing.

CoinGecko reported $5.2 billion in Tether revenue for 2025. CEO Paolo Ardoino projected approximately $15 billion in net profit for the full year, with Q1-Q3 attestations already confirming over $10 billion.

The difference comes down to methodology. CoinGecko's figure represents a conservative estimate of gross revenue for industry comparison purposes. Tether's official numbers reflect net profits after (minimal) operational costs.

Earlier attestations support strong performance. Q2 2025 alone showed roughly $4.9 billion in net profit. Through the first three quarters, cumulative profits exceeded $10 billion.

For context on industry rankings, the $5.2 billion figure works. For actual company performance, Tether's official disclosures paint a more complete picture.

How Big Is Tether Now?

As of early 2026, USDT circulation sits at approximately $187 billion. That breaks down to roughly $97.6 billion on Ethereum and $83 billion on Tron, with the remainder spread across other chains.

Tether commands 60.1% of the $311 billion stablecoin market. No competitor comes close.

This dominance explains why Tether topped CoinGecko's protocol revenue rankings, beating out every DeFi platform and fellow stablecoin issuer Circle.

Why Stablecoins Dominated 2025 Earnings

Here's what makes Tether's model so powerful: it doesn't depend on crypto market conditions.

DeFi protocols rely on trading fees and volatile on-chain activity. When crypto markets dipped 10.4% in 2025, those revenue streams suffered.

Tether's income stayed steady. Treasury yields don't care whether Bitcoin is at $40,000 or $100,000. As long as people hold USDT, Tether earns interest on the backing reserves.

CoinGecko's data showed stablecoins generated 65.7% of revenue among top protocols in 2025. Tether alone represented the lion's share of that figure.

What Tether Doesn't Make Money From

A few clarifications for accuracy.

Tether earns nothing from on-chain transaction fees. When you send USDT, gas fees go to Ethereum or Tron validators, not Tether.

The company doesn't profit from USDT speculation on exchanges. Price stability is the entire point.

And despite persistent rumors, Tether doesn't mint unbacked tokens. Quarterly attestations from independent auditors (BDO Italia) confirm reserves exceed liabilities. Every USDT in circulation has backing.

The Bottom Line

Tether built a $5.2 billion revenue machine by doing something remarkably simple: collecting interest on other people's money. High rates and massive scale turned that basic model into crypto's most profitable operation.

For more information, visit the officialTether website or follow @Tether on X.

Sources

- CoinGecko 2025 Annual Crypto Industry Report — Primary source for $5.2 billion revenue figure and protocol rankings

- Tether Transparency Page — Official reserve attestations and circulation data

- Reuters — Reporting on Q4 2025 gold purchases

- Fortune — Coverage of Tether's projected $15 billion annual profit and CEO statements

bsc.news

bsc.news