Gold and silver started the new week at new record highs, while the leading cryptocurrency Bitcoin began with a decline. This decline is attributed to negative macroeconomic factors such as the renewed possibility of a US government shutdown.

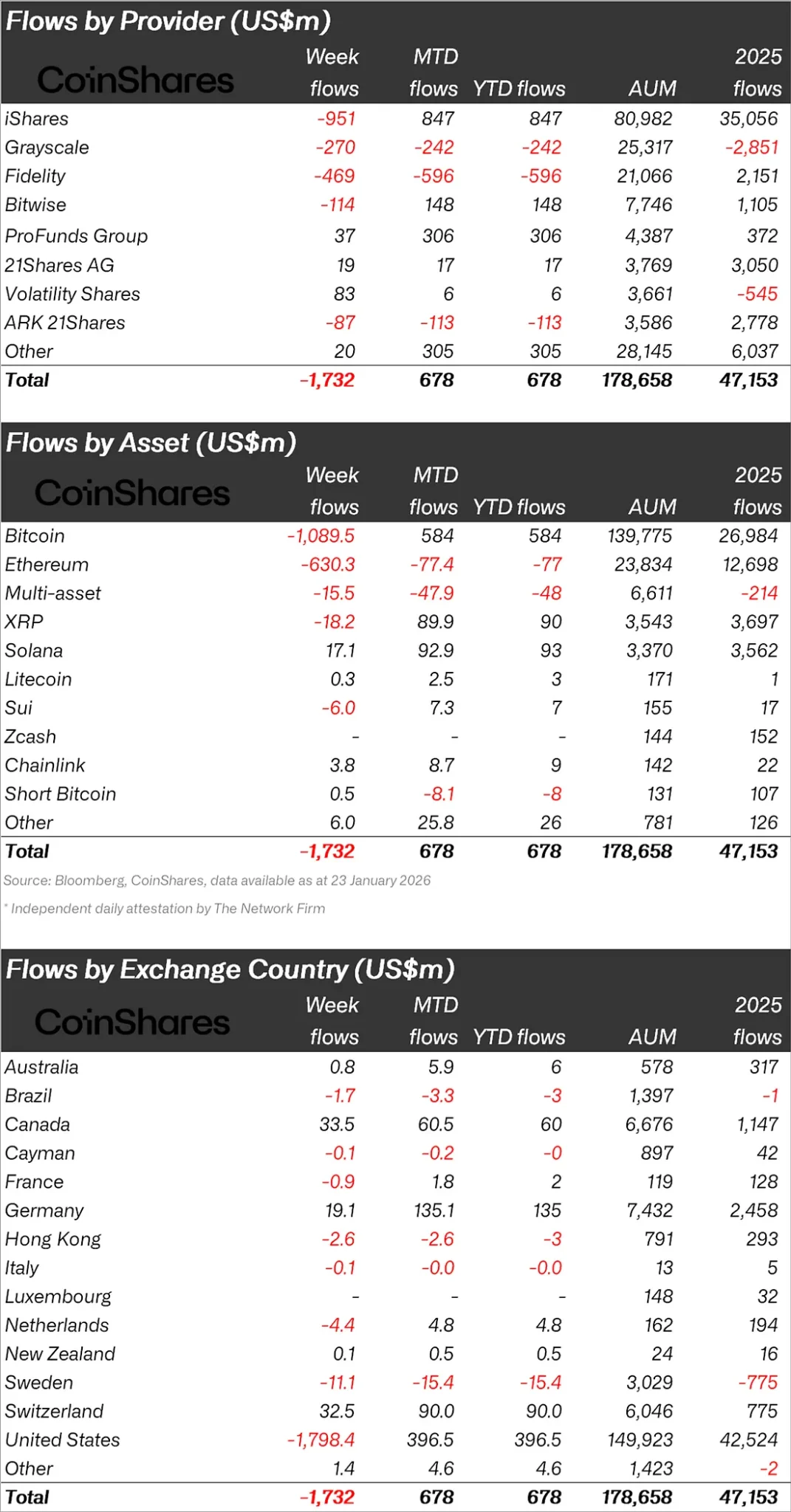

With the January 30 deadline for the government budget and the first FED interest rate decision of 2026 awaited, Coinshares released its cryptocurrency report, stating that there was a $1.73 billion outflow last week.

“Cryptocurrency investment products recorded a fund outflow of $1.73 billion, the largest since mid-November 2025.”

Exits Concentrated in Bitcoin and the US!

Looking at crypto funds individually, it was observed that the majority of outflows were in Bitcoin.

Bitcoin experienced outflows worth $1.08 billion, while Ethereum (ETH) saw outflows of $630 million.

Looking at other altcoins, we saw both inflows and outflows. Solana (SOL) experienced inflows of $17.1 million, Chainlink (LINK) $3.8 million, and Litecoin (LTC) $0.3 million; while XRP recorded outflows of $18.2 million and Sui (SUI) $6 million.

“Bitcoin experienced a $1.09 billion outflow, the largest since mid-November 2025. This indicates that market sentiment has still not recovered since the price drop on October 10, 2025.”

Ethereum and XRP saw outflows of $630 million and $18.2 million respectively, indicating a widespread negative sentiment.

Solana remained outside this trend, generating $17.1 million in revenue.

Looking at regional fund inflows and outflows, the US ranked first with an outflow of $1.79 billion.

After the US, Sweden experienced an outflow of $11.1 million, followed by the Netherlands with $4.4 million.

In response to these outflows, Switzerland experienced inflows of $32.5 million and Germany $19.1 million.

*This is not investment advice.