Ark Investment Management has filed with the SEC for a broad, futures-based crypto ETF led by bitcoin, ethereum, and $XRP, aiming to offer scalable, diversified exposure to the digital asset market without direct token ownership.

Ark Designs a Broad Crypto ETF Led by BTC, ETH, and $XRP Using a Market-Linked Structure Built for Scale

Ark Investment Management LLC filed a registration statement with the U.S. Securities and Exchange Commission (SEC) on Jan. 23 for the Ark Coindesk 20 Crypto ETF, detailing plans for a futures-based exchange-traded product offering diversified exposure to major crypto assets.

The filing outlines a Delaware statutory trust structured as a continuously offered commodity pool designed to track the daily performance of the Coindesk 20 Index through regulated futures contracts. The prospectus explains:

“The Ark Coindesk 20 Crypto ETF (the ‘Trust’), a Delaware Statutory Trust, is a continuously offered commodity pool and an exchange-traded product that issues common shares of beneficial interest (the ‘Shares’) that are anticipated to be listed on the NYSE Arca, Inc.”

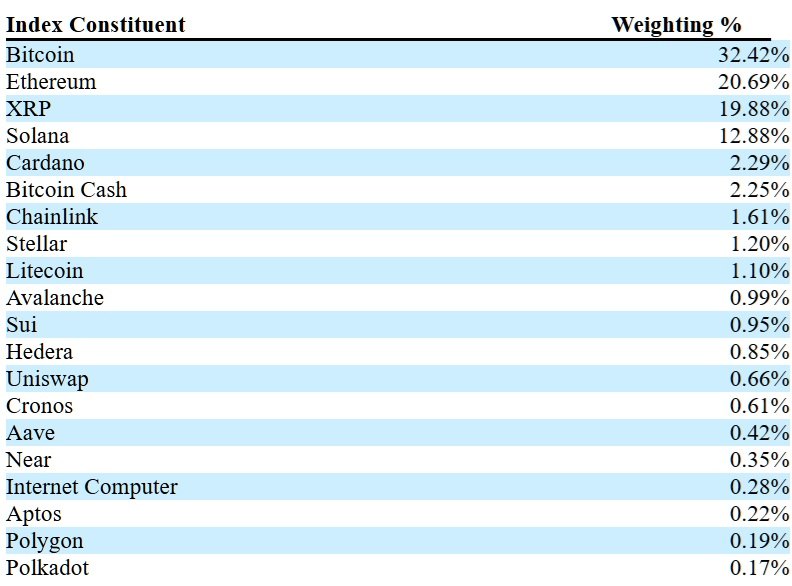

The index is described as a broad-based benchmark intended to measure the performance of the top 20 crypto assets by market capitalization, excluding stablecoins, memecoins, privacy tokens, and certain other classifications under the index provider’s methodology. It is designed to be liquid, investable, and scalable, with quarterly rebalancing that reflects the evolving structure of the digital asset market.

As of Dec. 31, 2025, bitcoin, ethereum, $XRP, solana, and cardano represented approximately 88.15% of the index’s total weight, while the remaining allocation was spread across 15 additional crypto assets, each weighted below 3% and each exceeding $1 billion in market capitalization at that date.

Further disclosures emphasize that the product does not offer direct ownership of crypto assets and instead relies on futures markets and benchmark pricing mechanisms. The filing states: “The Trust does not invest in crypto assets directly or maintain a direct exposure to ‘spot’ crypto assets. Investors seeking direct exposure to the price of crypto assets should consider an investment other than the Trust. The Trust may, however, have indirect exposure to crypto assets by virtue of its investments in Index Futures.”

Settlement pricing for the index futures relies on Coindesk Benchmark Reference Rate Settlement Calculations, which use a volume-weighted average of five-second pricing intervals between 3 p.m. and 4 p.m. London time. The filing also notes that all index constituents exceeded a $1 billion market capitalization threshold as of Dec. 31, 2025, and that the approximate notional value of the index futures contract at that date was $26,751. The structure reflects Ark’s approach to providing diversified crypto market exposure through regulated futures infrastructure rather than direct custody of digital assets.

news.bitcoin.com

news.bitcoin.com