U.S. markets closed Friday with mixed signals across major indexes, while crypto-associated stocks—particularly bitcoin miners—largely pushed higher against a backdrop of global economic fragility and shifting geopolitical currents.

Wall Street Wobbles While Publicly Traded Bitcoin Miners Outperform in a Jittery Global Market

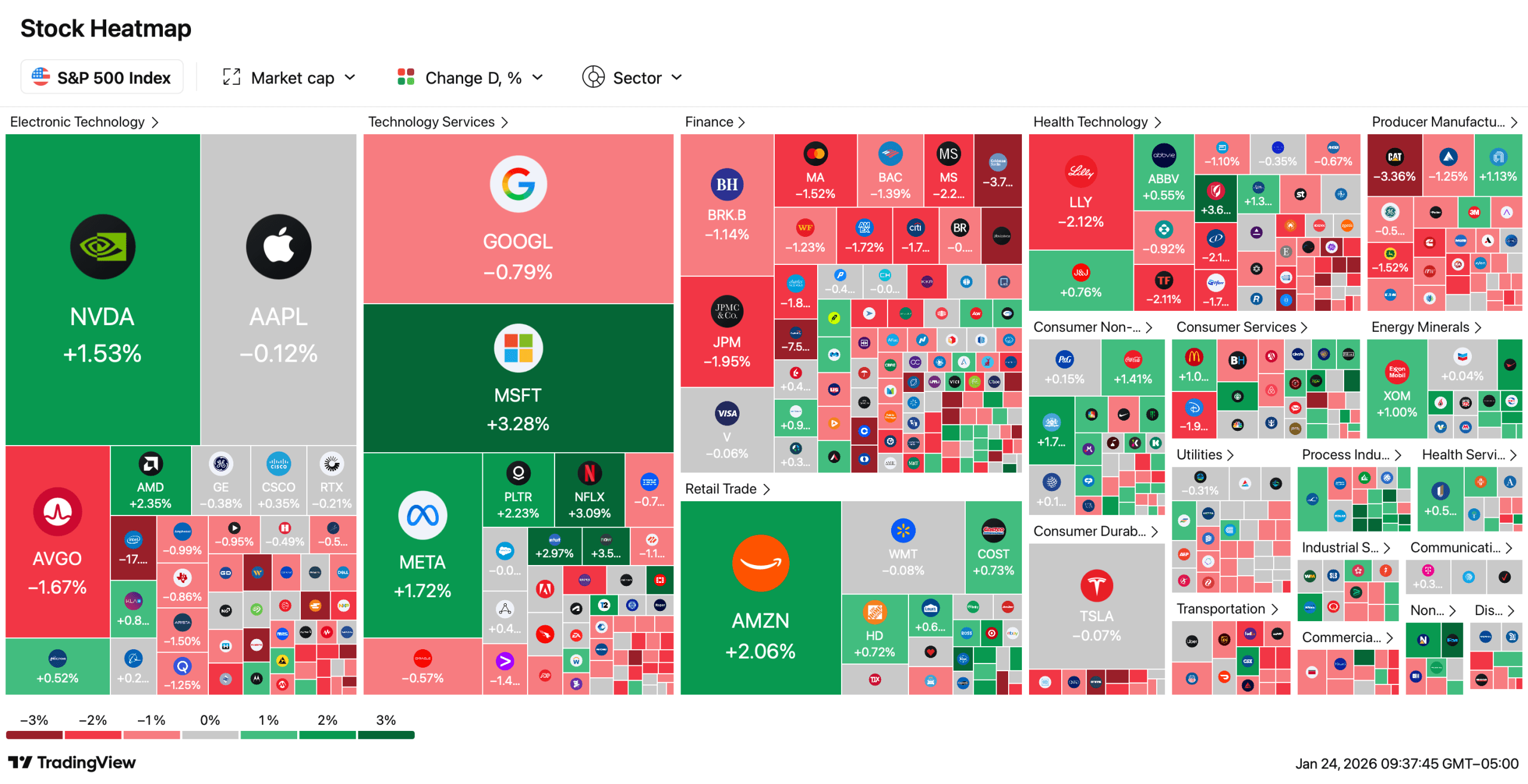

The four major U.S. stock indexes wrapped up Friday, Jan. 23, with a split personality that set the tone for crypto-linked equities.

The Nasdaq Composite finished at 23,501.24, adding 65.22 points, while the S&P 500 edged up 2.26 points to 6,915.61. Meanwhile, the Dow Jones Industrial Average slid 285.30 points to 49,098.71, and the NYSE Composite dipped 40 points to 22,757.16, showcasing a market that appears confident in pockets and uneasy everywhere else.

That uneven footing carried straight into crypto-associated stocks, where performance varied sharply by business model. On Nasdaq, Coinbase (COIN) dropped 2.77%, signaling lingering caution around crypto trading platforms. In contrast, Strategy (MSTR) rose 1.32%, continuing to behave less like a software company and more like a leveraged bitcoin proxy in equity form.

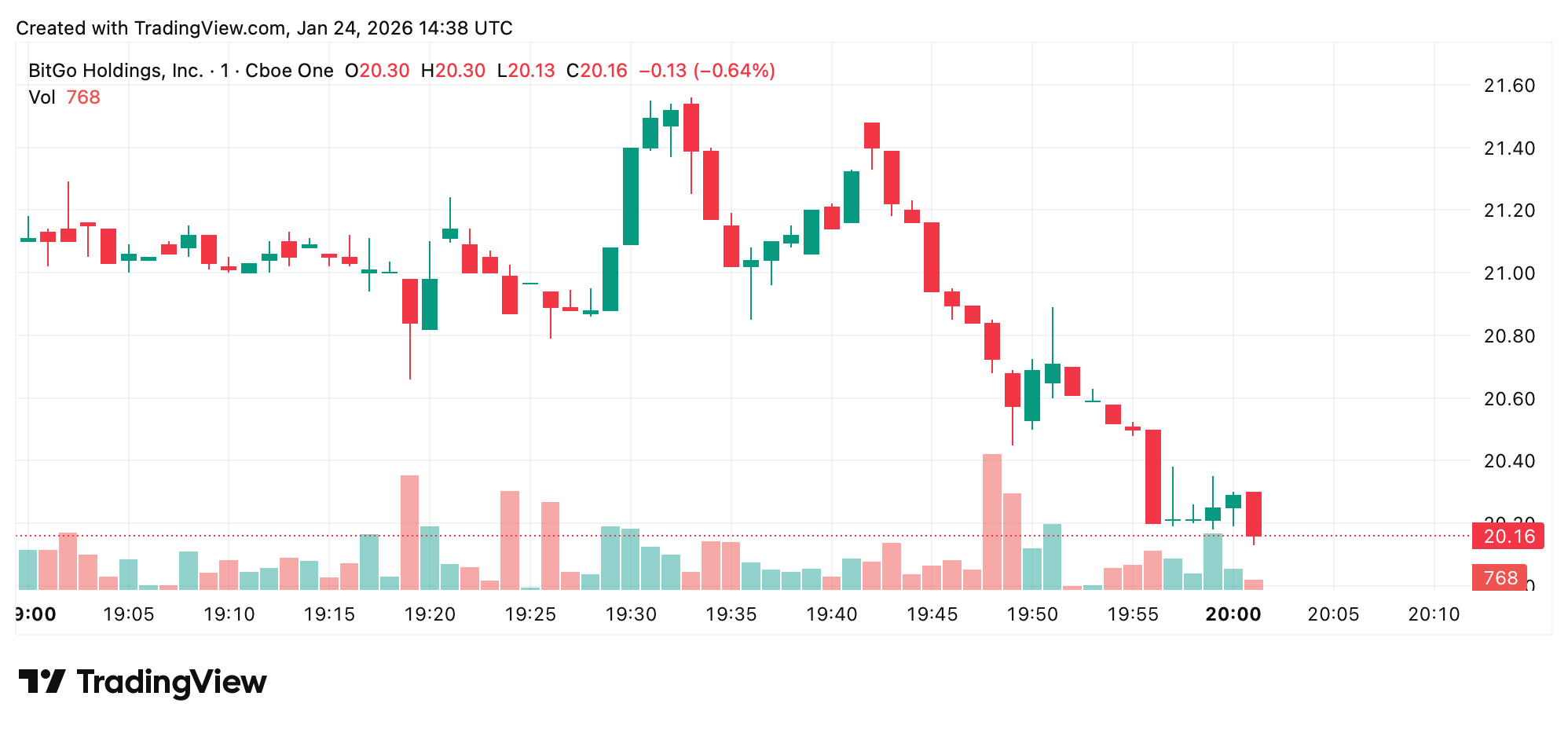

Fresh listings did not escape the turbulence. Bitgo’s NYSE debut (BTGO) was a bruising one, with shares falling 21.58% on opening day. Elsewhere on the NYSE, Circle (CRCL) slipped a marginal 0.03%, Bullish (BLSH) declined 2%, and Bitmine Immersion Technologies (BMNR) eased 0.35%—moves that reflected hesitation rather than panic, but hesitation nonetheless.

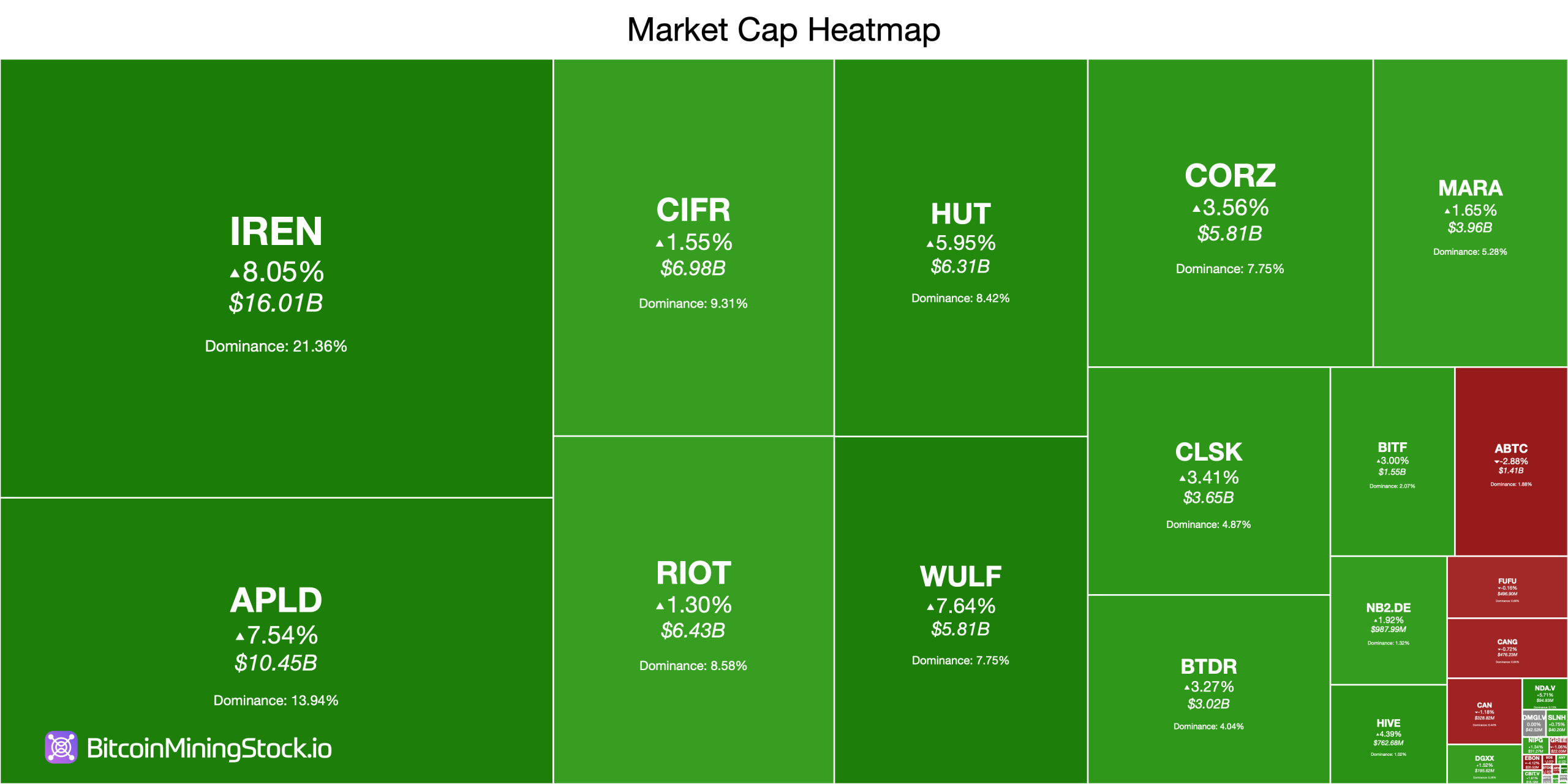

While crypto infrastructure and exchange names treaded carefully, bitcoin mining stocks delivered a notably firmer showing. IREN Limited led the group with an 8.05% gain to $56.47, followed by Applied Digital Corporation up 7.54% at $37.36. TeraWulf climbed 7.64% to $13.88, and Hut 8 Corp. advanced 5.95% to $58.40, reinforcing the sector’s recent resilience.

Mid-pack performers also leaned positive. Core Scientific rose 3.56% to $18.73, CleanSpark gained 3.41% to $13.64, and Bitdeer Technologies Group increased 3.27% to $14.50. Bitfarms added 3%, trading at $2.74, while Cipher Mining and Riot Platforms posted smaller but still positive moves of 1.55% and 1.30%, respectively.

Not every miner joined the rally. MARA Holdings rose 1.65% to $10.46, but American Bitcoin Corp. stood out as the lone decliner among the top names, sliding 2.88% to $1.52. Even so, the broader mining cohort tilted decisively green, especially when stacked against the mixed performance of traditional equities.

The divergence highlights a growing pattern: bitcoin miners increasingly trade on operational metrics, balance-sheet positioning, and long-term network expectations rather than day-to-day equity sentiment. As macro uncertainty lingers, investors appear selective, rewarding companies tied directly to bitcoin production while treating exchanges and newly listed firms with more skepticism.

Also read: Bitwise Launches Bitcoin-Linked Debasement ETF to Counter Declining Dollar Power

That selectivity makes sense in a global environment that feels increasingly brittle. Economic growth remains uneven, central bank policy is still restrictive by historical standards, and geopolitical developments continue to inject headline risk into markets already stretched by valuation and concentration concerns.

Against that backdrop, crypto-associated stocks are no longer moving as a single trade. Friday’s session showed a clear split between infrastructure, miners, and service providers—each responding differently to the same macro signals.

For now, bitcoin mining equities appear to be carving out a lane of their own, supported by firm price action and improving operational leverage. Whether that resilience holds will depend less on Wall Street’s mood and more on how the broader economic and geopolitical chessboard evolves in the weeks ahead.

FAQ ❓

-

Why did U.S. markets close mixed on Jan. 23?

Investors balanced strength in tech-heavy indexes against losses in industrial and broad-market benchmarks. -

Which crypto-linked stocks underperformed?

Coinbase and several newly listed NYSE crypto firms posted losses during the session. -

Why did bitcoin mining stocks outperform?

Miners benefited from sector-specific dynamics rather than broader equity sentiment. -

What does this signal for crypto stocks going forward?

Performance is increasingly diverging by business model, not moving as a single trade.

news.bitcoin.com

news.bitcoin.com