Gold’s blistering 70% rally in a year — its strongest performance in nearly half a century — sent demand for exposure to the metal soaring. As institutional and retail investors alike sought havens during periods of rising geopolitical tensions and new tariff threats, one corner of the market stood out: tokenized gold.

Gold-backed tokens like XAUT$4,755.29 and Paxos Gold (PAXG) posted explosive growth last year, surpassing the trading volume of most traditional gold exchange-traded funds (ETFs), according to a report by crypto exchange CEX.io.

Tokenized gold trading reached $178 billion in 2025, with $126 billion of that in the last quarter of the year alone. That puts it ahead of all but one U.S.-listed ETF — the SPDR Gold Shares (GLD), which has $165 billion in assets under management — in terms of global volume.

“If tokenized gold were an ETF, it would already rank as the second-largest by trading volume,” the report said.

Still, the sector remains top-heavy. Tether's XAUT alone accounted for 75% of fourth-quarter volume, the report noted.

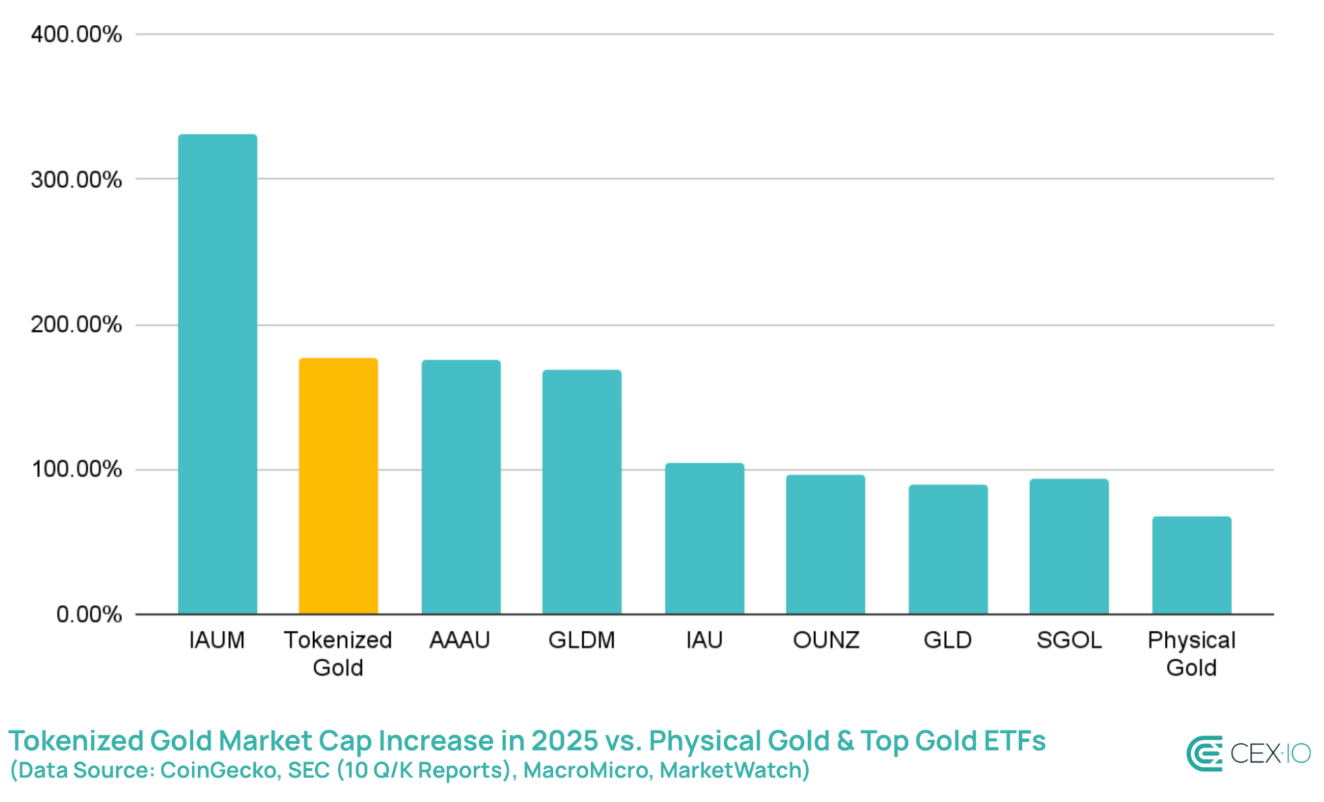

Market capitalization for tokenized gold also jumped, surging 177% to surpass $4.4 billion, the report noted. Even so, it's tiny compared with the total gold market's $32 trillion size.

Retail demand is a key driver of tokenized gold. Unlike some tokenized assets, which are restricted to accredited investors, gold tokens allow fractional ownership and no minimum investment for individual investors. That enables a broader swath of investors to participate, especially in emerging markets where gold-linked investment products might not be easily available.

As gold hit $4,750 on Tuesday, up nearly 10% since the start of the year, Gracy Chen, CEO at crypto exchange Bitget, said she sees the metal heading toward $5,000.

"With tariffs back in focus, capital is likely to rotate toward defensive assets, where gold dominates," she said. "As for the outlook, we see gold targeting the $5,000 level. If current conditions hold, it’s not far away."

coindesk.com

coindesk.com