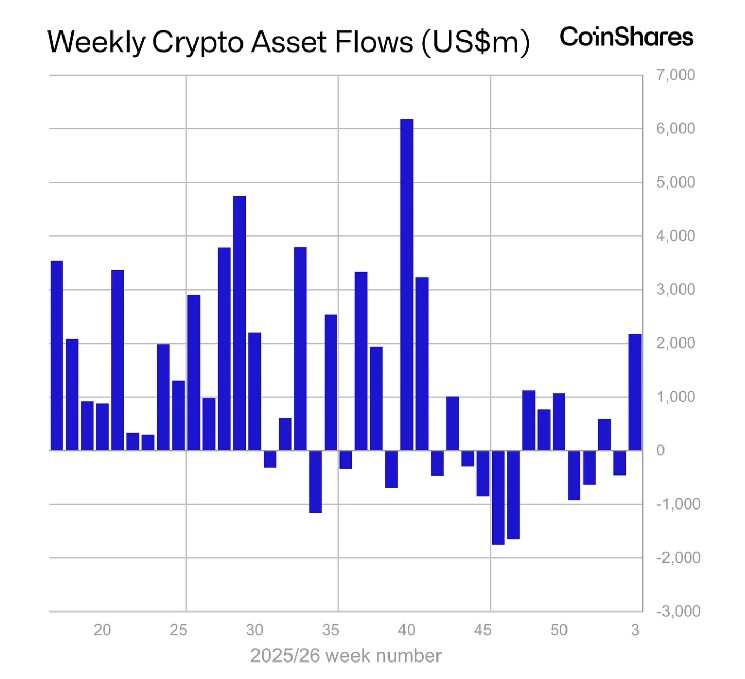

Digital asset investment products recorded $2.17 billion of net inflows last week, the strongest weekly haul since October 2025, as fresh allocations flowed into bitcoin and a broad set of major tokens before a late-week wobble in sentiment.

Bitcoin led the week’s intake with $1.55 billion of inflows, according to a CoinShares report Monday. Ether added $496 million and solana drew $45.5 million, signalling that appetite extended beyond bitcoin even as policy chatter around stablecoins and yield remained in focus.

The week wasn’t one-way. Flows turned sharply on Friday, when products saw $378 million of outflows after geopolitical tensions and tariff threats resurfaced, including renewed friction tied to Greenland. CoinShares head of research James Butterfill also pointed to policy uncertainty after reports suggested Kevin Hassett, seen by some as a contender for the next U.S. Federal Reserve chair, was likely to remain in his current role.

Regionally, the U.S. dominated, accounting for $2.05 billion of inflows. Germany, Switzerland, Canada and the Netherlands also logged positive flows of $63.9 million, $41.6 million, $12.3 million and $6 million, respectively.

Altcoins posted smaller but notable gains, led by XRP with $69.5 million. Sui, lido and hedera also saw modest inflows.

Outside token funds, blockchain equities attracted $72.6 million, adding to signs that investors are still willing to express crypto exposure through public-market proxies even as headline risk returns.

coindesk.com

coindesk.com