Regulated stablecoins, including $USDC, may create a new layer of financial settlement, announced Circle in its latest report. Stablecoins may bring Internet innovation to money, similar to the upgrades in data, media, and other industries.

$USDC serves as the sound money layer of the internet, according to Circle’s latest report on stablecoins. The company, which is one of the fast-growing fintech and crypto apps for 2025, believes stablecoins will reshape businesses and institutions.

Circle believes stablecoins will form a hybrid layer between traditional finance and on-chain infrastructure. Some regulated stablecoins may help with siloed or fragmented liquidity.

Stablecoins may be adopted even more widely by banks, payment companies, corporations, and institutions. The state of Wyoming recently distributed its FRNT stablecoin for trading, while other entities are preparing to either adopt existing tokens or launch their own brand.

$USDC grew its market share in 2025

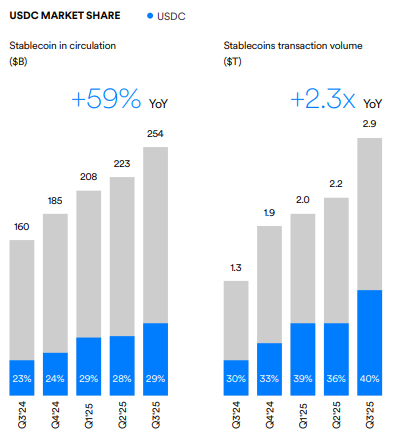

$USDC was aggressively minting new tokens in 2025, boosting its presence on multiple networks. The stablecoin expanded its market share each quarter, reaching 29% at the end of the year.

In terms of transfer volumes, $USDC carries around 40% of value, remaining the second-biggest player on the stablecoin market after USDT.

Circle also launched several stablecoins denominated in other currencies. EURC is the leading asset, growing its supply more than eight times following the launch of MiCA regulation in 2024. Circle was one of the stablecoin issuers to benefit from the new regulations, as its tokens were adopted on multiple frameworks for EU users.

Circle to launch the Arc payment infrastructure

Circle is going beyond being a plain issuer of stablecoins, instead building a new financial infrastructure.

Circle is preparing to launch Arc, a scalable blockchain and a native infrastructure for payments. Circle will compete with other chains like Polygon, which are also creating dedicated payment rails. The chain will also compete with Tether’s Plasma, a dedicated stablecoin network.

Arc may move beyond payments and into capital formation, contracts, and payroll coordination. Arc will transfer stablecoins, but also turn into an entire economic operating system. Arc will use $USDC to pay transaction fees, requiring even simple asset ownership.

The chain will also use deterministic finality instead of node coordination for increased security and compliance with financial standards. Arc has been running as a testnet since October 2025 and is already spread across the major regions for on-chain activity.

Circle enters a market with accelerating competition, where fintech apps and on-chain payment channels are consolidating. The trend includes leading apps like Revolut, as well as smaller on-chain native stablecoin hubs and wallets.

cryptopolitan.com

cryptopolitan.com