By Omkar Godbole (All times ET unless indicated otherwise)

Since its introduction in 2009, bitcoin $BTC$90,709.15 fans have seen it as an anti-establishment asset and a shield against financial mismanagement and political turmoil.

Yet on Monday, the largest cryptocurrency is trailing traditional safety assets such as gold even as tensions between President Donald Trump and Fed Chair Jerome Powell escalate, raising concerns on the central bank's ability to maintain its independence.

On Sunday, Powell revealed that federal prosecutors opened a criminal investigation against him, focusing on his Congressional testimony about the central bank's $2.5 billion renovation. Powell framed the probe as political pressure on the bank's independence for refusing to cut interest rates aggressively, as the president has repeatedly demanded.

Gold rallied to a record of over $4,600 per ounce, and silver hit an all-time high of $84.60. $BTC started Monday on a positive note, rising to $92,000 during the Asian hours, bucking the weakness in Nasdaq futures and hinting at haven demand.

The rare divergence between crypto and equities was short-lived. Bitcoin fell back to $90,500 during the European hours and the broader crypto market also retreated. Privacy-focused monero pulled back from the record high of $598 to $571, still up 15% over 24 hours. CC, RENDER, and ZEC are other standout coins, gaining 4%-5% over the past 24 hours.

$BTC's pullback comes as Treasury yields maintain Friday gains, a sign the markets do not expect Powell to cave under legal pressure and cut rates aggressively. At the time of writing, the 10-year U.S. yield was poised to top the 4.2% mark, with the rate-sensitive two-year yield at 3.54%, the highest in two weeks.

Analysts at ING said that the dip in the U.S. jobless rate in December reported by the Bureau of Labor Statistics on Friday and a likely hotter-than-expected inflation data this week could keep the Fed from cutting rates at least until March.

Other observers cited ETF flows as a headwind.

"From January 5 to January 9, spot Bitcoin ETFs recorded net outflows of $681 million despite elevated trading volumes of $19.5 billion, signalling active repositioning rather than disengagement. Ethereum ETFs also posted $69 million in weekly outflows," Timothy Misir, head of research, BRN, said in an email.

"In contrast, XRP and SOL ETFs continued to attract capital, reinforcing a theme of selective rather than broad-based risk appetite," Misir added.

Derivatives, however, pointed to a lackluster market in the near term, with 30-day $BTC and $ETH implied volatility indices hovered at the lowest levels for weeks. Stay alert!

Read more: For analysis of today's activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Crypto

- Jan. 12: Dubai Financial Services Authority’s revamped Crypto Token Regulatory Framework takes effect in the Dubai International Financial Centre, retiring its recognized‑token list and making firms responsible for token‑suitability.

- Macro

- Nothing scheduled.

-

Earnings (Estimates based on FactSet data)

- Nothing scheduled.

Token Events

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Governance votes & calls

- Extra Finance DAO is voting on the distribution of lending emissions for Epochs 131 to 134. veEXTRA holders will use a weighted voting system to allocate rewards across eligible Base chain pools. Voting ends Jan. 12.

- Treehouse DAO is voting on implementing mesh bridging for its assets via Chainlink CCIP. This update will allow direct transfers between all supported chains, removing the need to route transactions through Ethereum. Voting ends Jan. 12.

- Unlocks

- No major unlocks.

- Token Launches

- Jan. 12: CharacterX (CAI) to be listed on Binance, KuCoin, and others.

Conferences

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Nothing scheduled.

Market Movements

- $BTC is unchanged from 4 p.m. ET Friday at $90,399.43 (24hrs: -0.21%)

- $ETH is up 0.15% at $3,106.83 (24hrs: +0.19%)

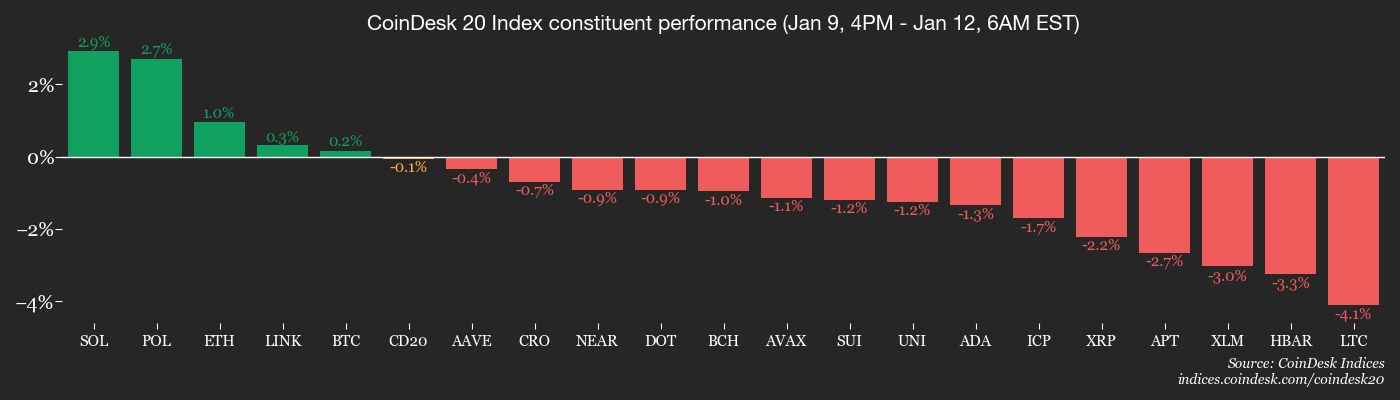

- CoinDesk 20 is down 0.24% at 2,881.65 (24hrs: -0.56%)

- Ether CESR Composite Staking Rate is down 1 bps at 2.78%

- $BTC funding rate is at 0.0034% (3.7164% annualized) on Binance

- DXY is down 0.30% at 98.84

- Gold futures are up 2.27% at $4,602.90

- Silver futures are up 6.14% at $84.21

- Nikkei 225 closed for public holiday

- Hang Seng closed up 1.44% at 26,608.48

- FTSE is down 0.08% at 10,116.28

- Euro Stoxx 50 is down 0.24% at 5,983.21

- DJIA closed on Friday up 1.08% at 49,504.07

- S&P 500 closed up 0.93% at 6,966.28

- Nasdaq Composite closed up 1.18% at 23,671.35

- S&P/TSX Composite closed up 1.22% at 32,612.93

- S&P 40 Latin America closed up 0.59% at 3.266,88

- U.S. 10-Year Treasury rate is up 2.6 bps at 4.197%

- E-mini S&P 500 futures are down 0.63% at 6,961.00

- E-mini Nasdaq-100 futures are down 0.84% at 25,719.25

- E-mini Dow Jones Industrial Average Index futures are down 0.70% at 49,376.00

Bitcoin Stats

- $BTC Dominance: 59.11% (unchanged)

- Ether-bitcoin ratio: 0.03436 (0.11%)

- Hashrate (seven-day moving average): 1,012 EH/s

- Hashprice (spot): $39.01

- Total fees: 1.92 $BTC / $174,132

- CME Futures Open Interest: 116,810 $BTC

- $BTC priced in gold: 21.4 oz.

- $BTC vs gold market cap: 6.04%

Technical Analysis

- The chart shows daily price swings of crypto oracle Chainlink's $LINK token in candlestick format.

- Prices are currently probing resistance of the bearish trendline drawn off the August high.

- A move past this trendline would qualify as a bullish breakout, potentially driving more demand for the token.

Crypto Equities

- Coinbase Global (COIN): closed on Friday at $240.78 (-1.96%), -0.45% at $239.70 in pre-market

- Circle Internet Group (CRCL): closed at $82.90 (+1.36%), -1.39% at $81.75

- Galaxy Digital (GLXY): closed at $24.94 (-2.20%), -1.28% at $24.62

- Bullish (BLSH): closed at $38.40 (-2.29%), -0.49% at $38.21

- MARA Holdings (MARA): closed at $10.22 (-2.11%), -0.20% at $10.20

- Riot Platforms (RIOT): closed at $15.32 (+1.26%), -0.65% at $15.22

- Core Scientific (CORZ): closed at $17.14 (+2.76%), -0.76% at $17.01

- CleanSpark (CLSK): closed at $11.61 (-3.17%), +0.43% at $11.66

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $42.18 (+2.63%)

- Exodus Movement (EXOD): closed at $16.34 (+1.68%), +1.10% at $16.52

Crypto Treasury Companies

- Strategy (MSTR): closed at $157.33 (-5.77%), +0.61% at $158.29

- Semler Scientific (SMLR): closed at $19.37 (-6.29%)

- SharpLink Gaming (SBET): closed at $10.02 (-2.53%), unchanged at $10.02

- Upexi (UPXI): closed at $2.12 (-4.93%), +3.77% at $2.20

- Lite Strategy (LITS): closed at $1.47 (-1.34%)

ETF Flows

Spot $BTC ETFs

- Daily net flows: -$250 million

- Cumulative net flows: $56.38 billion

- Total $BTC holdings ~1.29 million

Spot $ETH ETFs

- Daily net flows: -$93.8 million

- Cumulative net flows: $12.45 billion

- Total $ETH holdings ~6.08 million

Source: Farside Investors

While You Were Sleeping

- Federal Prosecutors Open Investigation Into Fed Chair Powell (The New York Times): The U.S. attorney’s office in Washington approved a criminal inquiry examining Congressional testimony and records tied to a $2.5 billion Fed headquarters overhaul.

- Coinbase Ups Pressure as Crypto Bill Moves to Senate Markup (Bloomberg): The exchange argues that proposed changes would bar non-bank platforms from paying stablecoin yield, something that is not prohibited under the GENIUS Act.

- U.S. Steps Up Planning for Possible Action in Iran (The Wall Street Journal): Trump is set to review response options to Iran’s protests in a formal briefing with top advisers on Tuesday, weighing steps that range from cyber measures and sanctions to possible military strikes.

- Dubai bans privacy tokens, tightens stablecoin rules in crypto reset (CoinDesk): The rules overhaul cites global anti-money laundering standards, narrows the definition of which tokens qualify as fiat-backed stablecoins and makes licensed firms responsible for approving assets in the Dubai International Financial Centre.

- UK lawmakers push to ban crypto political donations over foreign interference fears (CoinDesk): Seven Select Committee chairs argue in an open letter that cryptocurrency's opacity and traceability issues make it a threat to democratic integrity, citing a U.S. intelligence report on Russian election interference.

coindesk.com

coindesk.com