Key Takeaways

- WisdomTree has decided to end its bid to launch an XRP exchange-traded fund (ETF) in the US.

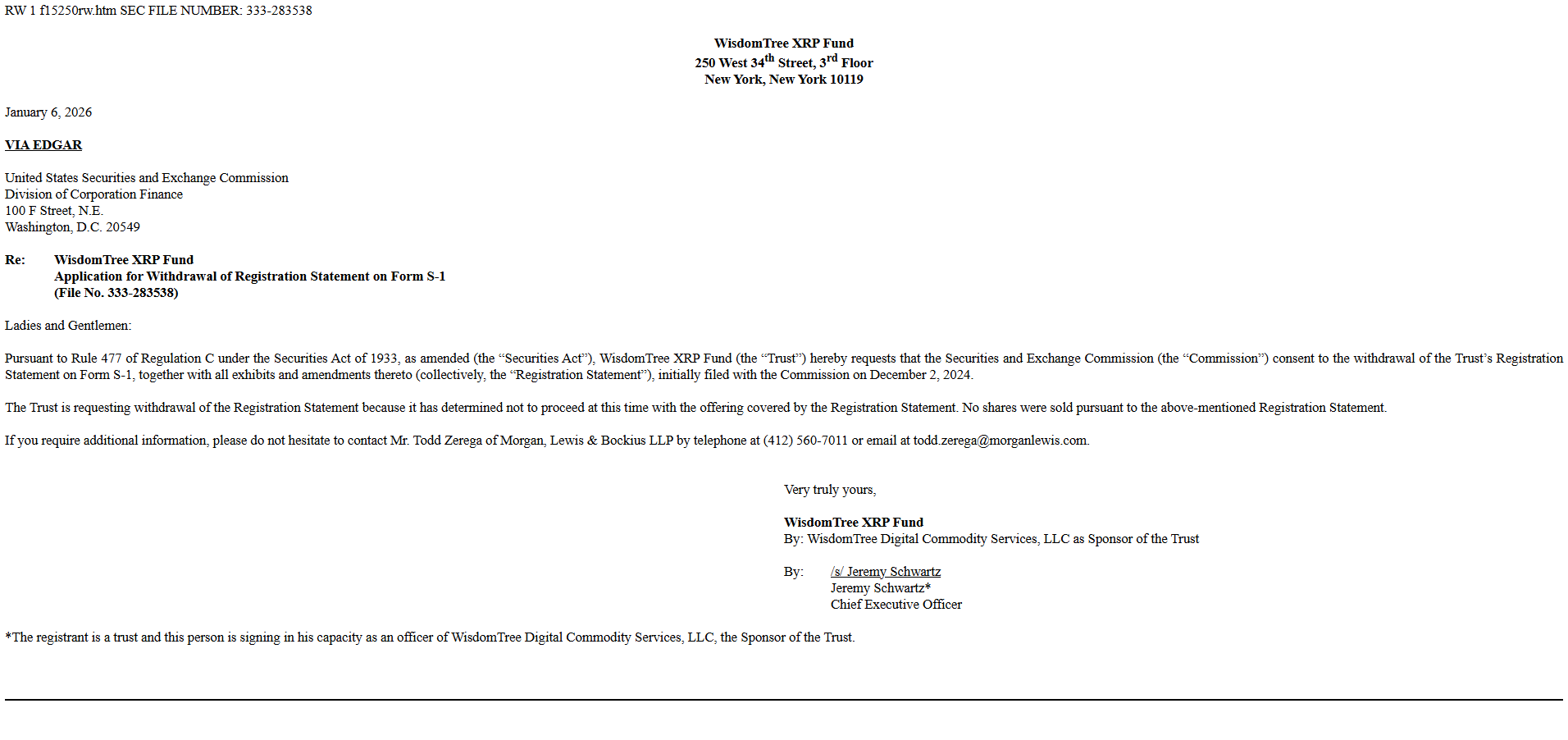

- The application withdrawal was made through a request filed to the Securities and Exchange Commission (SEC).

WisdomTree submitted a filing to the SEC this week seeking to withdraw its application to launch the WisdomTree XRP Fund, an exchange-traded fund tied to the fourth-largest digital asset.

The New York-based asset manager entered the US XRP ETF race in late 2024. Ahead of its SEC filing, the firm had already launched WisdomTree Physical XRP (XRPW) in Europe, where the product now trades on major venues including Deutsche Börse Xetra, the Swiss Exchange, and Euronext.

WisdomTree’s decision to halt its XRP ETF push follows a similar move by CoinShares, Europe’s largest digital asset investment firm, which filed to withdraw several US ETF proposals, including products tied to XRP, Solana, and Litecoin.

The decision comes as competition in the XRP ETF market, while limited in number, has already consolidated around early movers.

Since their debuts, US-listed XRP ETFs have drawn $1.2 billion in inflows and now hold nearly $1.5 billion in net assets, per SoSoValue. Canary Capital currently leads the group, with Bitwise, Franklin Templeton, and Grayscale not far behind.

XRP ETFs have continued to record steady inflows, but on a far smaller scale than Bitcoin, which remains the most liquid and institutionally demanded digital asset.

At the same time, subdued risk appetite has offered little support for the expansion of digital asset ETF products. This may prompt some sponsors to double down on established offerings rather than pursue incremental launches.

Despite challenging market conditions and soft investor demand, some big players appear willing to move ahead with crypto ETF plans. Morgan Stanley, which manages roughly $1.8 trillion in assets, recently filed with the SEC to launch ETFs linked to Bitcoin, Ether, and Solana.

cryptobriefing.com

cryptobriefing.com