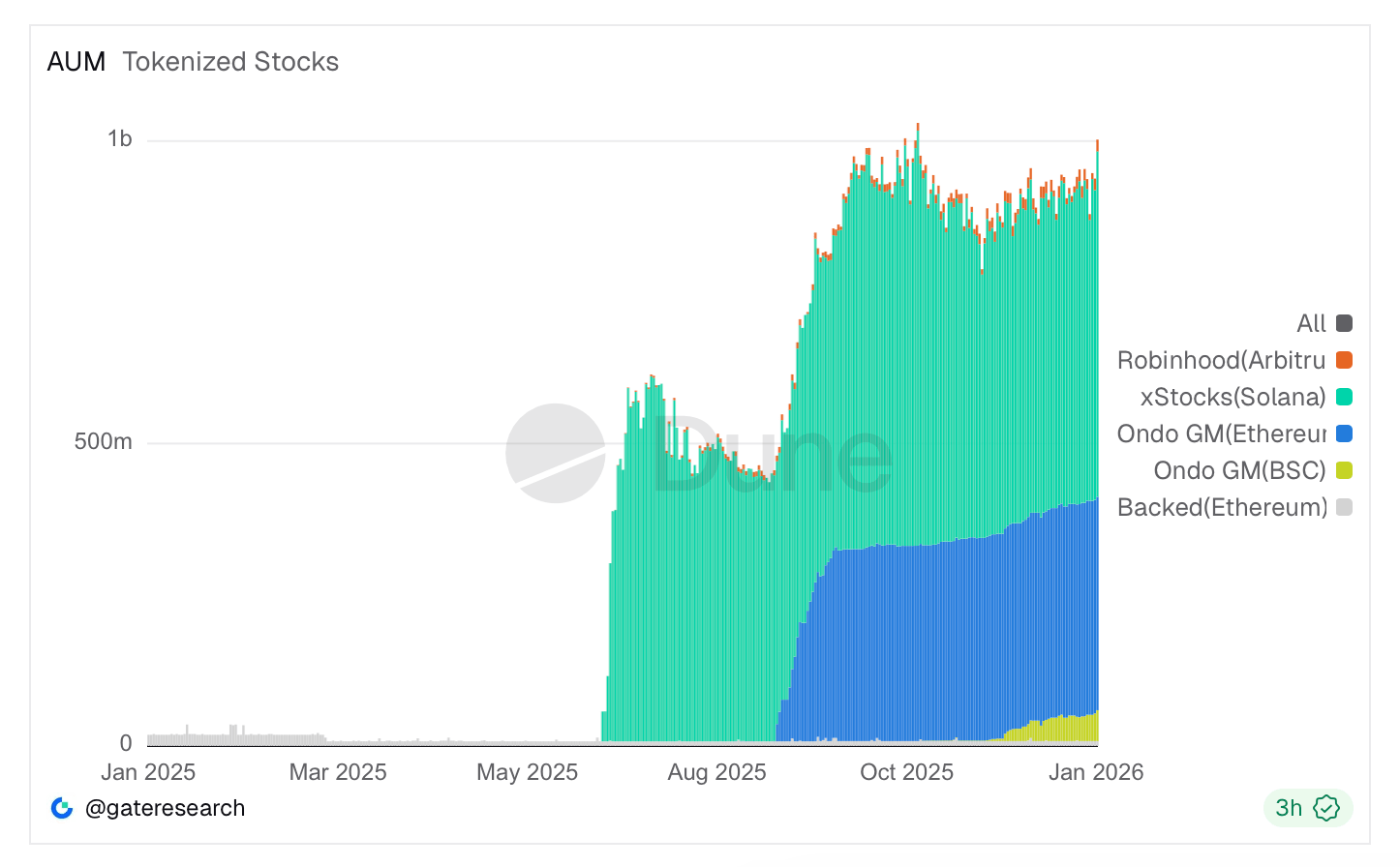

The Solana blockchain is the dominant force behind the exponential rise of tokenized stocks, onchain data shows.

Solana and xStocks Drive the Fastest-Growing Corner of Tokenized Finance

According to blockchain analytics platform Dune, the total assets under management (AUM) of all tokenized stocks is currently sitting just over the $1 billion mark, with Solana’s xStocks accounting for over 57% of it.

xStocks, which have exploded from zero to $571 million in AUM since June 2025, represent the first major successful effort of bringing US equities directly onchain as tradable tokens that can be accessed 24/7.

Dune’s data shows that the most popular stocks being traded on Solana are Tesla (TSLA), Circle (CRCL), and Nvidia (NVDA).

Behind Solana’s xStocks is Ondo’s Global Markets (GM) platform, which operates on Ethereum, boasting $352 million in AUM, and on the Binance Smart Chain (BSC) with an AUM of $52 million.

While the decentralized ecosystem of tokenized stocks booms, Bitget, the sixth-largest cryptocurrency exchange in the world, reports the success of its own tokenized stocks platform.

In an announcement last week, Bitget reported $1 billion in cumulative spot trading volume for its tokenized stocks platform, which uses an integration of xStocks and Ondo Finance’s GM.

Interestingly, the company noted that roughly 95% of that total volume was generated in December alone, “underscoring a sharp acceleration in user participation and liquidity as tokenized stocks moved from early adoption to mainstream trading.”

Bitget CEO Gracy Chen said:

“What we are seeing is not just demand for equities on-chain, but a broader appetite for assets like gold and commodities to trade with the same speed, transparency, and global reach as crypto… As tokenized stocks, ETFs, and traditional assets converge on a single platform, capital is increasingly moving toward markets that operate continuously and without geographic barriers. This milestone signals that on-chain access to real-world assets is becoming a core part of modern market participation.”

FAQ ❓

-

What are tokenized stocks?

Tokenized stocks are blockchain-based versions of real-world equities that can be traded on-chain 24/7 without traditional market hours. -

What are Solana xStocks and why are they important?

Solana’s xStocks are tokenized U.S. equities that now control over 57% of the $1B tokenized stocks market, marking the first major success of equities going fully on-chain. -

Which tokenized stocks are most popular on Solana?

According to Dune, Tesla (TSLA), Circle (CRCL), and Nvidia (NVDA) are the most actively traded tokenized stocks on Solana. -

How is Bitget involved in tokenized stocks?

Bitget integrates xStocks and Ondo Finance’s Global Markets to offer tokenized stocks, reaching $1B in cumulative trading volume with most activity occurring in December.

news.bitcoin.com

news.bitcoin.com