BlackRock’s (NYSE: BLK) iShares Expanded Tech Sector ETF (IGM) has been the exemplar of the technology sector’s ability to outperform the U.S. stock market for more than two decades.

Specifically, the exchange-traded fund (ETF) has been among the most successful index-tracking products on the market and has managed to beat its peers every single year since 2001.

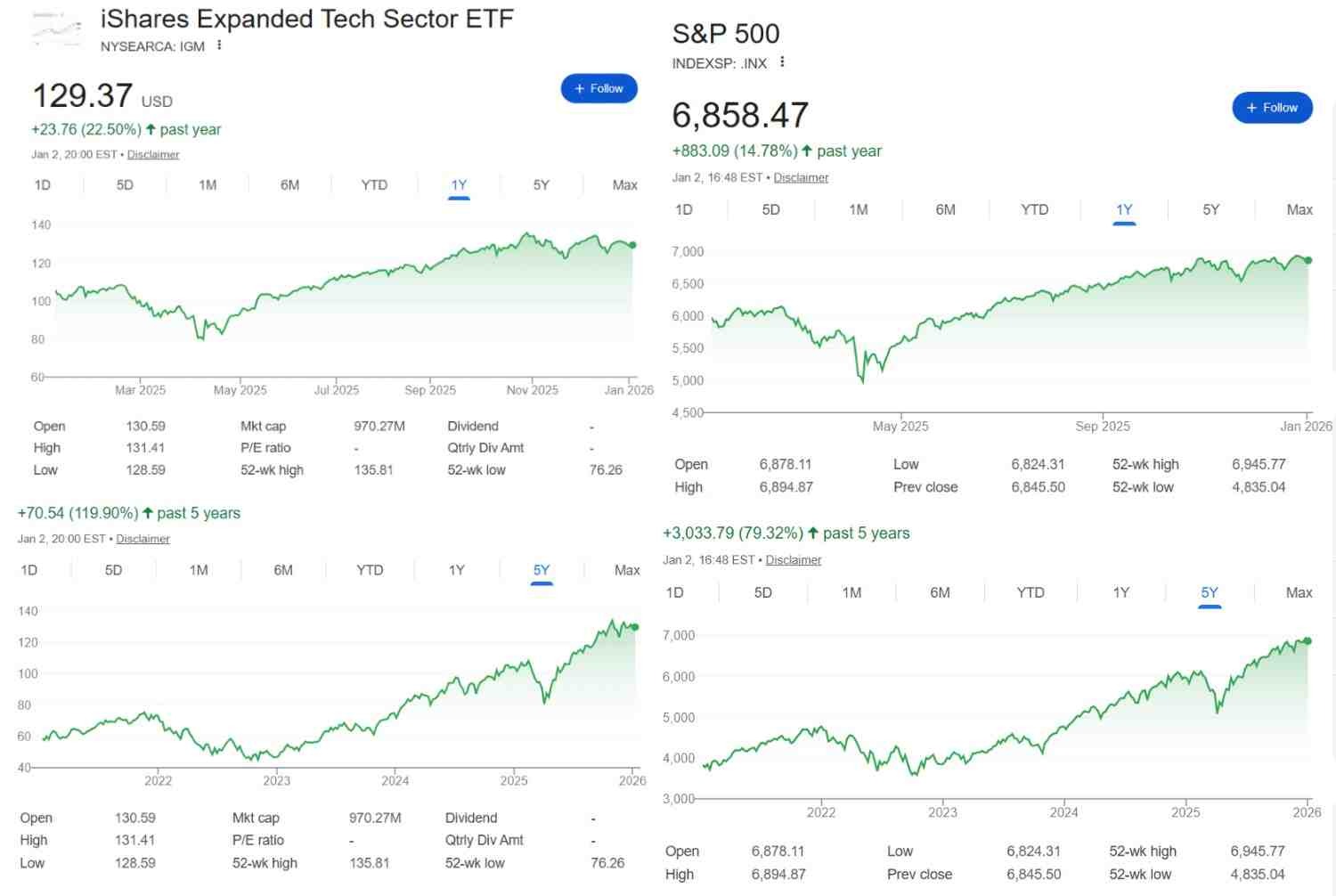

For example, IGM rose 22.50% in the last 12 months and 119.90% in the last five years. Within the same timeframes, the benchmark index rallied 14.78% and 79.32%, with the undeniable strength of the U.S. market only serving to highlight the success of BlackRock’s exchange-traded product (ETP).

IGM’s top tech stocks

Examining IGM’s composition, the reasons for such success become clear. Nvidia (NASDAQ: NVDA) is the single biggest holding in the ETF at 9.05%, meaning its 1,060% rally since the start of the artificial intelligence (AI) revolution substantially helped the fund’s holders.

Though not as bombastic as NVDA, IGM’s other major components, like Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), and Broadcom (NASDAQ: AVGO) – representing 8.70%, 8.56%, and 7.41% of the portfolio – have also contributed significantly over the years.

Apple has, in particular, been a historically important element. Despite its relative underperformance in recent years due to the company’s failure to fully participate in the AI boom, it has driven NVDA-like growth in previous decades, during the smartphone boom.

Elsewhere, Palantir (NASDAQ: PLTR) has become an increasingly important IGM holding as its own involvement with artificial intelligence and joining the S&P 500 index have led to triple-digit growth in 2025.

Should you invest in BlackRock’s technology ETF

Despite the historic success, several factors make the iShares Expanded Tech Sector ETF a slightly unattractive investment. The most in-your-face of these is the relatively high expense ratio of 0.39%, but the very index it tracks poses a systemic risk.

Specifically, with the explosive growth of the tech sector being tied to the AI boom, any hurdles in further development or adoption of the technology could trigger a massive and persistent selloff.

On the flip side, should the forecasts of big tech CEOs and enthusiasts about artificial general intelligence (AGI) or ‘superintelligence’ come true, IGM’s advantage over the rest of the market could grow exponentially.

Featured image via Shutterstock

finbold.com

finbold.com