As part of its plan to accelerate the “construction of a financial power” and develop the digital yuan, the Central Bank of China has announced that it will allow commercial banks to pay interest on digital yuan deposits.

China To Pay Interest On Digital Yuan Deposits

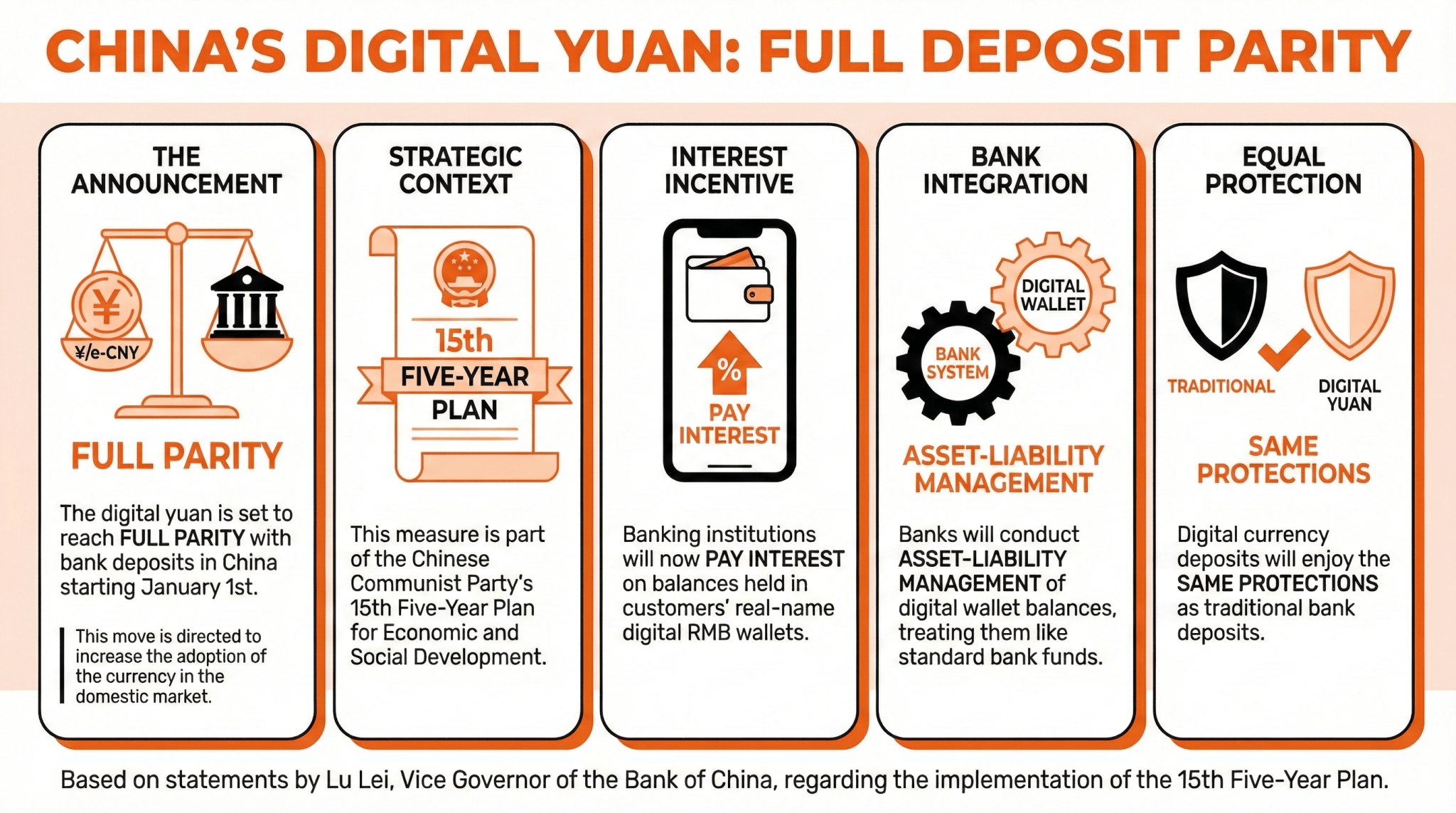

The digital yuan is about to reach parity with bank deposits in China, in a move directed to increase the adoption of the currency in the domestic market.

Lu Lei, Vice Governor of the Bank of China, revealed that this measure will be implemented on January 1st, framed as part of the Chinese Communist Party’s 15th Five-Year Plan for Economic and Social Development, which calls to “steadily develop the digital yuan.”

In an article published recently, Lei highlighted that the bank will give the digital yuan relevant incentives, pushing for its use as a payment and savings tool in bank accounts.

He stated:

Banking institutions will calculate and pay interest on the balance of customers’ real-name digital RMB wallets and comply with the self-discipline agreement on deposit interest rate pricing.

In addition, he highlighted that banks will be able to conduct asset-liability management of digital wallet balances, with digital currency deposits enjoying the same protections as traditional deposits.

While the digital yuan has enjoyed some degree of success, the Chinese market has proven difficult to dent, as there are already alternatives in the payments arena preferred by Chinese citizens. With this move, China aims to stimulate the use of the digital yuan, giving it similar incentives to bank deposits.

Even so, deposit interest in China is very low, having fallen to just 0.05% according to Bloomberg, so the measure is projected to have a limited effect.

Since November 2025, the digital yuan has processed over 3.48 billion transactions, with nearly 17 trillion yuan changing hands in these operations.

Read more: People’s Bank of China Highlights Digital Yuan and Blockchain in 2025 Strategy

FAQ

-

What major change is happening for the digital yuan on January 1st?

The digital yuan will achieve parity with bank deposits, promoting its adoption within China. -

What incentives are being introduced to encourage the use of the digital yuan?

Banking institutions will pay interest on digital RMB wallets and manage asset-liability for these balances, aligning with traditional deposit protections. -

What challenges does the digital yuan face in gaining market acceptance?

The Chinese market is competitive, with existing preferred payment alternatives, making widespread adoption challenging despite some success. -

How many transactions has the digital yuan processed since November 2025?

The digital yuan has processed over 3.48 billion transactions, totaling nearly 17 trillion yuan in value.

news.bitcoin.com

news.bitcoin.com