Stablecoins could process more transaction volume than the US Automated Clearing House system in 2026, as regulatory clarity and rising adoption expand their usage, according to a new forecast.

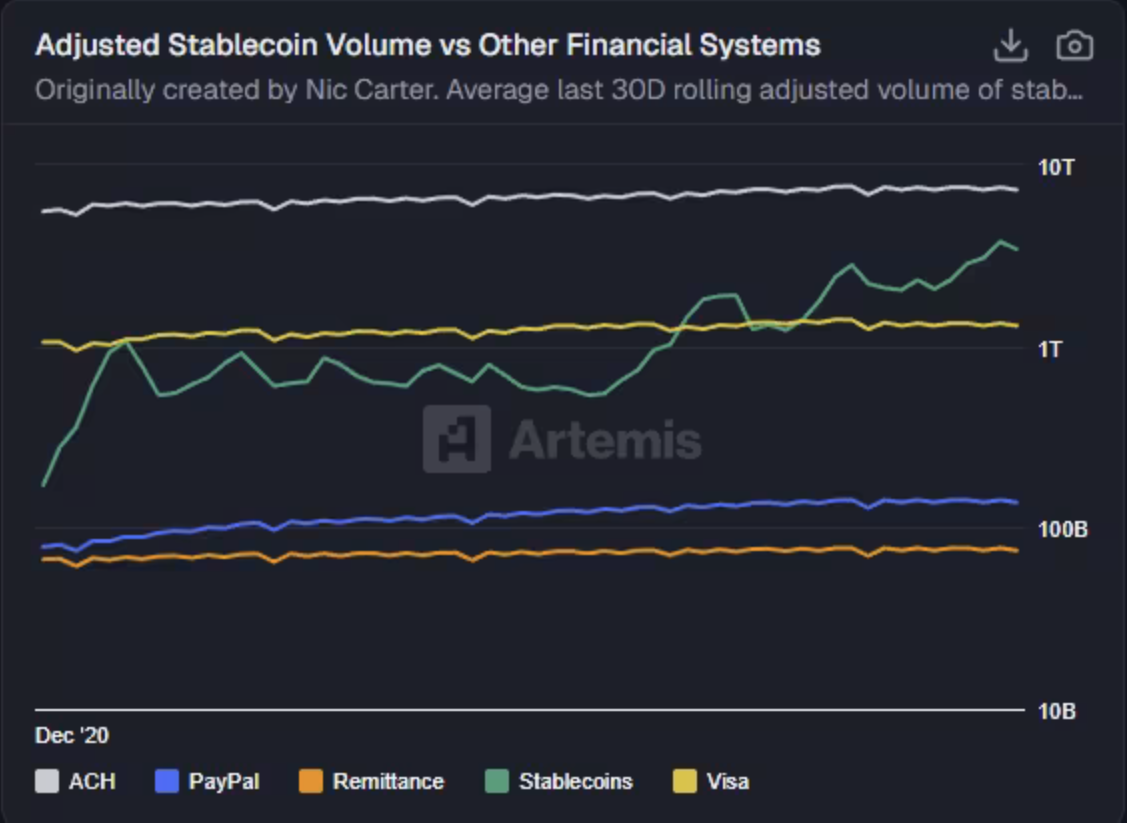

Galaxy Research, the research arm of digital asset company Galaxy Digital, pointed to existing transaction data and regulatory developments to support its prediction, noting that “stablecoin transactions already eclipse major credit card networks such as Visa and now process roughly half the transaction volume of the automated clearing house (ACH) system.”

Thad Pinakiewicz, vice president of research, said stablecoin supply has continued to grow at a 30%–40% compound annual growth rate, with transaction volumes rising alongside issuance. Galaxy also cited the expected implementation of definitions under the GENIUS Act in early 2026 as a factor supporting further growth in stablecoin usage.

The paper also brings predictions for the price of Bitcoin (BTC), writing that it could reach $250,000 by the end of 2027. According to Galaxy Research head of firmwide research Alex Thorn, 2026 is “too chaotic to predict, though Bitcoin making new all-time highs in 2026 is still possible.”

Related: Coinbase ‘cautiously optimistic’ on 2026 as crypto nears institutional inflection point

Dollar-pegged stablecoin market expands

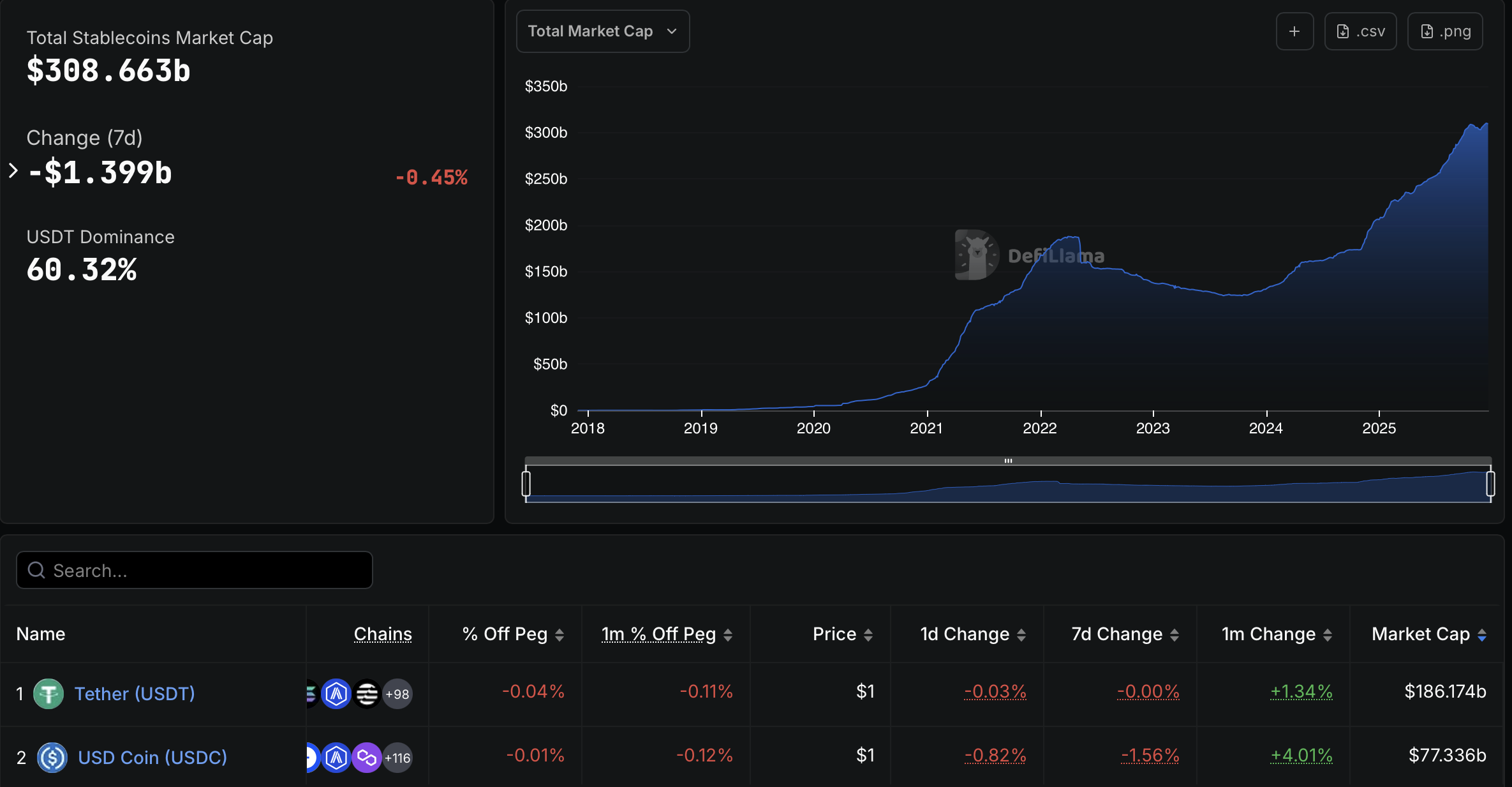

According to data from DefiLlama, the stablecoin market cap currently stands at about $309 billion. While Tether’s USDt (USDT) and Circle’s $USDC ($USDC) continue to dominate, a growing number of financial institutions and payments companies have entered the stablecoins race in recent months.

In October, Western Union announced plans to launch its own US dollar-pegged stablecoin, the US Dollar Payment Token, which will be built on the Solana blockchain and issued by Anchorage Digital Bank as part of a broader digital asset settlement network.

Sony Bank was reported to be preparing a US dollar-pegged stablecoin for use across Sony’s US ecosystem, including PlayStation games, subscriptions and anime content. The stablecoin is expected to launch in 2026.

On Thursday, SoFi Technologies launched SoFiUSD, a fully reserved US dollar stablecoin issued by its banking subsidiary, SoFi Bank. The company said the token will debut on Ethereum and is designed to support low-cost settlement for banks, fintechs and enterprise platforms.

Galaxy Research associate Jianing Wu said she expects TradFi-partnered stablecoins will consolidate in 2026, as users and merchants are unlikely to adopt a long list of digital dollars and will instead favor one or two with the “broadest acceptance.”

Magazine: Quantum attacking Bitcoin would be a waste of time: Kevin O’Leary

cointelegraph.com

cointelegraph.com