Major cryptocurrencies fell during U.S. morning hours Monday, continuing a now crystal-clear pattern of relative poor performance while American stocks trade.

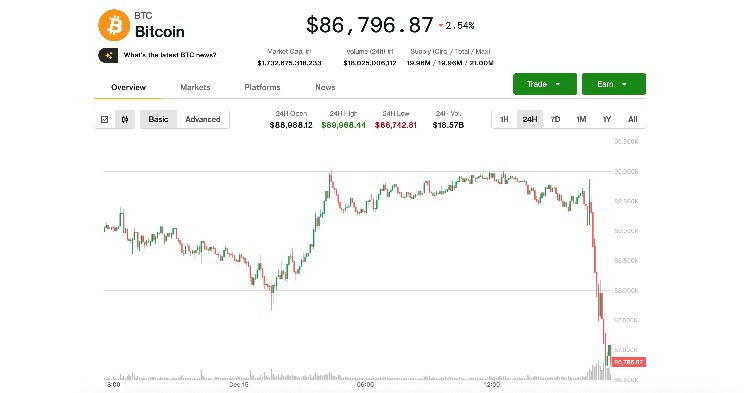

Trading fairly flat just below $90,000 overnight, bitcoin BTC$89,629.86 plunged to $86,800 in mid-morning U.S. trade.

"Since the iShares Bitcoin ETF IBIT began trading, had you only owned it after hours (buy the close, sell the next open), it's up 222%," noted Bespoke Investment. "Had you only owned intraday (buy the open, sell the close), it's down 40.5%."

Crypto stocks also started the week significantly lower with both Strategy (MSTR) and Circle (CRCL) both down about 7%. Coinbase (COIN) fell more than 5% while trading platforms Robinhood (HOOD) and eToro (ETOR) faced smaller declines of about 2%. Brokerage Gemini (GEMI), which soared late last week on approval for adding prediction markets to its offerings, pulled back 10% Monday.

Crypto miners, many closely attached to the data center infrastructure theme that took a hit last week amid artificial intelligence jitters, continued their downward trajectory. CleanSpark (CLSK), Cipher Mining (CIFR), Hut 8 (HUT) and TeraWulf (WULF) all logged over 10% declines.

Macro news on tap

As the U.S. government continues to ramp up following its long closure, the Bureau of Labor Statistics is set to release employment reports this week for both October and November. The data will be closely watched to help determine whether or not the Federal Reserve continues cutting interest rates in early 2026.

The Bank of Japan, meanwhile, is expected to hike its benchmark interest rate for the first time in nearly one year.

The Bank of England and the European Central Bank are also meeting later this week to discuss monetary policy.

coindesk.com

coindesk.com