Odds of a December quarter-point rate cut have marched sharply higher this Thanksgiving, with prediction markets and rate-tracking tools showing traders are almost fully convinced the Federal Reserve will trim its benchmark.

December 25bps Cut Now Dominant Market Bet Ahead of Fed Meeting

Prediction platforms are now lighting up with overwhelming confidence in a 25-basis-point cut, turning what was once a cautious lean into something close to a holiday certainty.

Polymarket’s primary contract shows an 84% chance of a 25-bps cut, up from 66% just five days ago. The platform’s alternate market—tracking policy decisions paired with Fed dissents—places a 25-bps cut with more than two dissenting votes at 63%, while a cut with two or fewer dissenters sits near 60%. The “no-change” camp has slipped decisively into long-shot territory, tagged between 12% and 16% across markets.

Kalshi mirrors the same conviction, also pegging the quarter-point cut at 84% as of Thursday. The platform assigns only an 18% probability to a rate hold, with anything beyond a standard 25-bps move sitting at statistical footnote levels. U.S. traders may be busy carving turkey, but the pricing says they’re just as confident carving out the path of monetary policy.

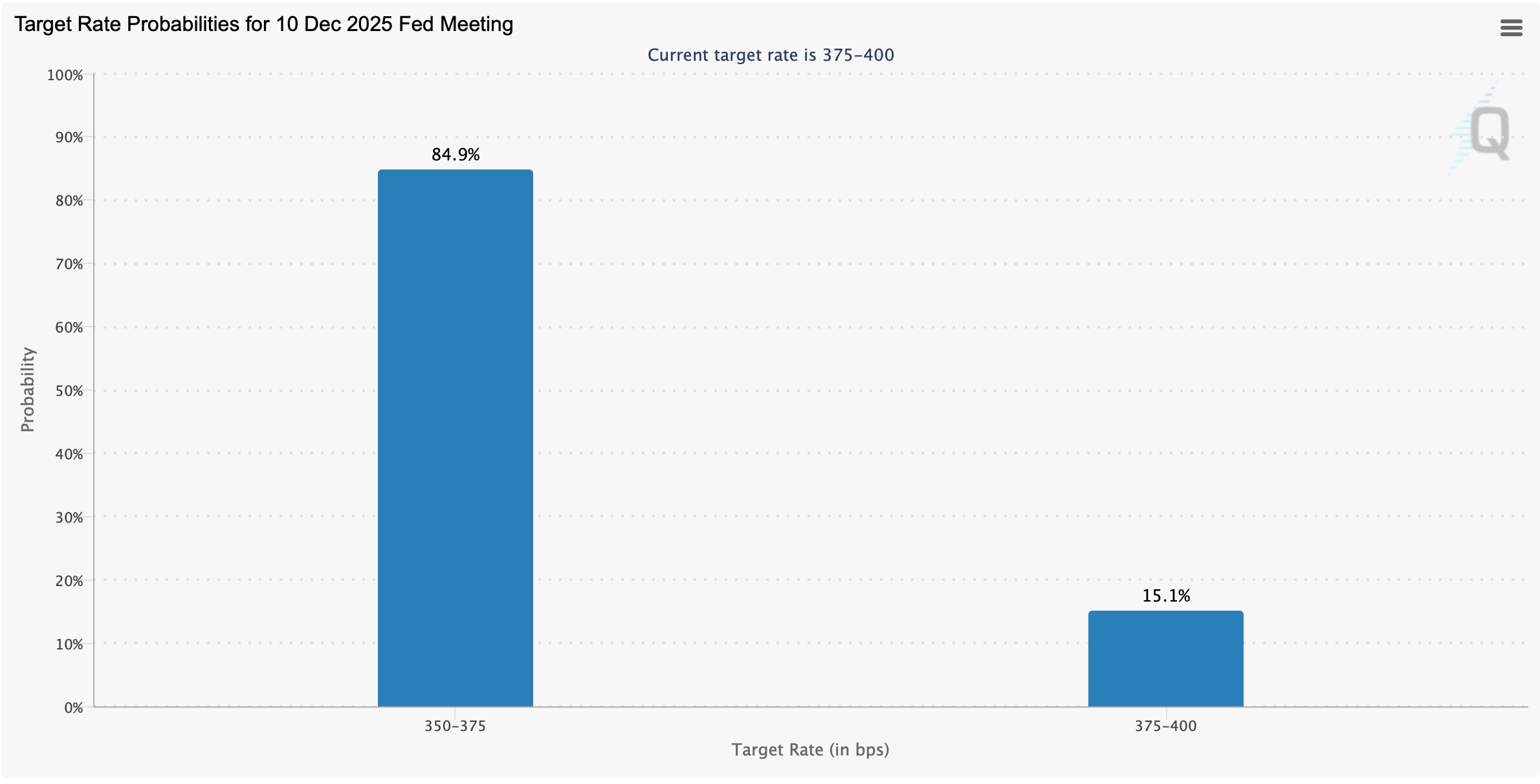

Meanwhile, CME’s Fedwatch Tool pushes the narrative even further. For the Dec. 10 policy meeting, Fedwatch shows an 84.9% probability of the target range shifting down to 350–375 basis points from today’s 375–400. Only 15.1% of the tool’s weighting supports a rate hold. The shift marks a significant jump from the 71% probability Fedwatch displayed last week.

Also read: Fed Governor Stephen Miran Calls for ‘Large’ Rate Cuts Amid Rising Jobless Data

The consistent alignment across platforms highlights a clear market message: despite months of mixed signals and policy caution, traders now expect the central bank to move forward with a modest trim. With liquidity, holiday trading, and macro uncertainty all simmering together, even a standard quarter-point cut has become the main course.

Whether the Fed obliges remains to be seen, but the markets—at least for today—seem convinced enough to place their bets early, with stuffing and confidence on the side.

FAQ ❓

-

What are traders expecting for the December Fed meeting? Most prediction markets show an 84% chance of a 25-basis-point cut.

-

How does CME FedWatch compare? FedWatch places the December cut probability near 85%.

-

Are rate-hold odds still significant? Market odds for no change have slipped into the low-teens.

- Which platforms are driving today’s expectations? Polymarket, Kalshi, and CME FedWatch all signal strong support for a December cut.

news.bitcoin.com

news.bitcoin.com