Tether CEO Paolo Ardoino fired back at S&P Global Ratings after it downgraded $USDT’s dollar-peg score, calling the agency a “propaganda machine.”

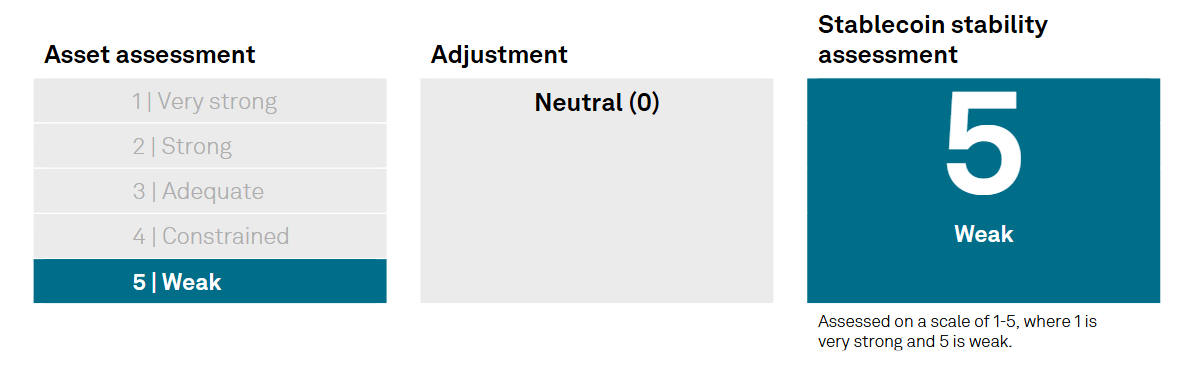

On Wednesday, Nov. 26, S&P Global Ratings lowered its stablecoin stability assessment for $USDT from 4 (constrained) to 5 (weak), its lowest mark, putting $USDT in the same bucket as Justin Sun-linked TrueUSD (TUSD) and Ethena’s USDe.

The credit rating agency explained that the downgrade reflects an “increase in higher-risk assets backing $USDT’s reserve,” stating that Tether’s exposure to “high risk assets" grew to 24% from 17% last year.

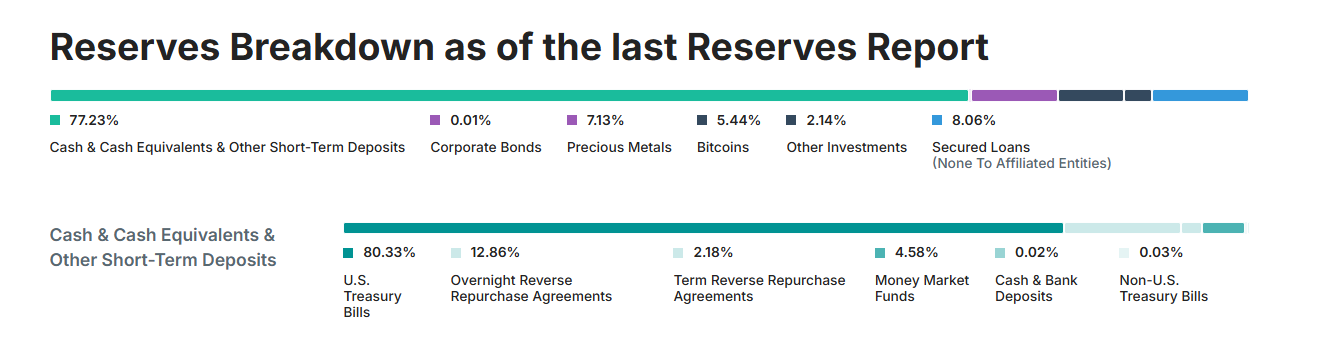

S&P Global Ratings puts assets like Bitcoin, gold and other precious metals, corporate bonds, secured loans, and other investments in its higher-risk category. Per the credit agency, they all have “limited disclosures” and face credit as well as foreign-exchange risks.

“Bitcoin now represents about 5.6% of $USDT in circulation, exceeding the 3.9% overcollateralization margin, indicating the reserve can no longer fully absorb a decline in its value,” S&P Global Ratings wrote in its report.

The credit agency also noted that Tether shares limited information about who manages its assets. Although Tether has more than $130 billion in short-term U.S. Treasuries, the firm gives very little detail on its other investments, according to the report.

Jake Kennis, a research analyst at blockchain analytics form Nansen, noted in commentary shared with The Defiant that despite the lowered rating, there have been “no meaningful outflows” from exchanges or signs of heavy redemption pressure since the reassessment was made.

“In short, market behavior suggests participants are largely dismissing the downgrade and continue to treat $USDT as reliably redeemable at 1:1 which is consistent with its historical performance through past periods of stress,” Kennis said.

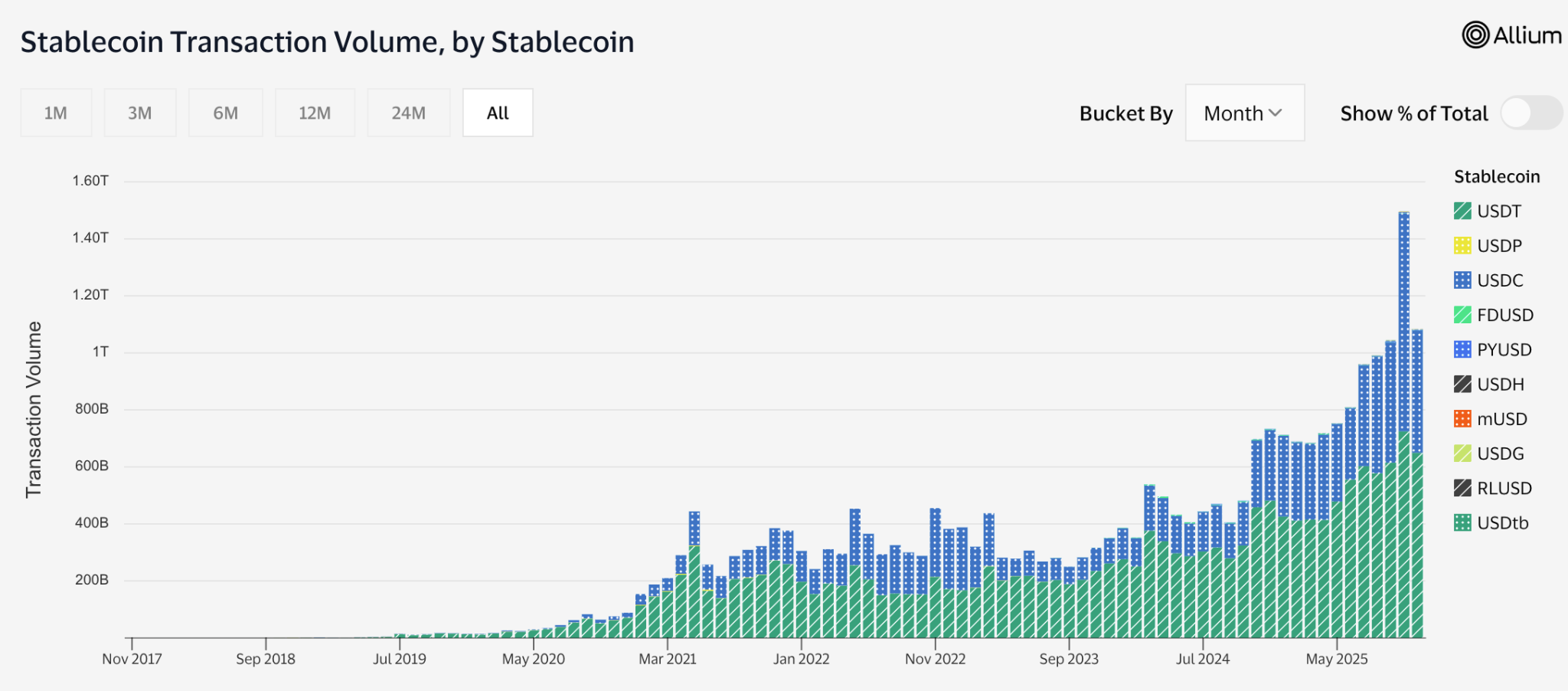

Tether’s $USDT is by far the largest stablecoin globally, making up over 60% of total market cap across all USD-pegged stablecoins, which reached over $300 billion for the first time last month.

$USDT also leads stablecoins in terms of monthly transaction volumes, with Circle’s $USDC taking second place. $USDT historically sees double $USDC’s volumes, or more, per month. However, just last month, $USDC overtook $USDT for the first time, with $764.6 billion in transactions, while $USDT saw $724.8 billion.

'Broken Financial System’

Tether’s Ardoino quickly pushed back after the new rating was published, writing in an X post on Nov. 26 that Tether “wears your loathing with pride” and arguing that traditional ratings models have led investors into failures in legacy finance.

“The traditional finance propaganda machine is growing worried when any company tries to defy the force of gravity of the broken financial system. No company should dare to decouple itself from it,” Ardoino wrote.

Tether, based in El Salvador as of this year, and backed by quarterly attestations from audit firm BDO Italia, reported $181.2 billion in assets to back $174.4 billion in circulating $USDT as of Sept. 30, making $USDT overcollateralized at that time.

In terms of what assets Tether holds as reserves, the latest breakdown on Tether’s website shows 77.23% are in cash, cash equivalents, and other short-term deposits, with the rest spread across corporate bonds, precious metals, Bitcoin, secured loans, and other investments. Just over 80% of the cash and cash equivalent portion is in U.S. Treasury bills.