Tether’s growing footprint in the global gold market has entered the chat in a big way, thanks to a new analysis from Jefferies that frames the stablecoin giant as something akin to a private-sector central bank.

Why Jefferies Thinks Tether Is the Most Important Gold Buyer You’re Not Watching

Tether, already known for steering the world’s largest stablecoin, now appears to be steering something else: the flow of bullion. A report from Jefferies equity analysts Fahad Tariq and Andrew Moss — amplified by coverage from Reuters’ Mike Dolan and Kitco News’ Neils Christensen — argues that Tether has quietly evolved into one of the most influential buyers in the gold market, rivaling mid-tier central banks and subtly shaping global prices.

Jefferies, for readers outside the investment-banking bubble, is a New York-based financial powerhouse specializing in capital markets, research, advisory services, and all things high-finance. Its analysts are known for tracking structural trends, not just headlines, which is why their latest deep dive on Tether’s bullion binge is landing with weight.

According to the report, written by the Jefferies analysts, Tether held 116 metric tons of gold by the end of Q3 2025 — split between reserves backing its gold token XAUT and a far larger chunk reinforcing $USDT’s balance sheet. That stash puts the stablecoin issuer shoulder-to-shoulder with sovereign holders like South Korea and Greece, and far beyond many institutional players.

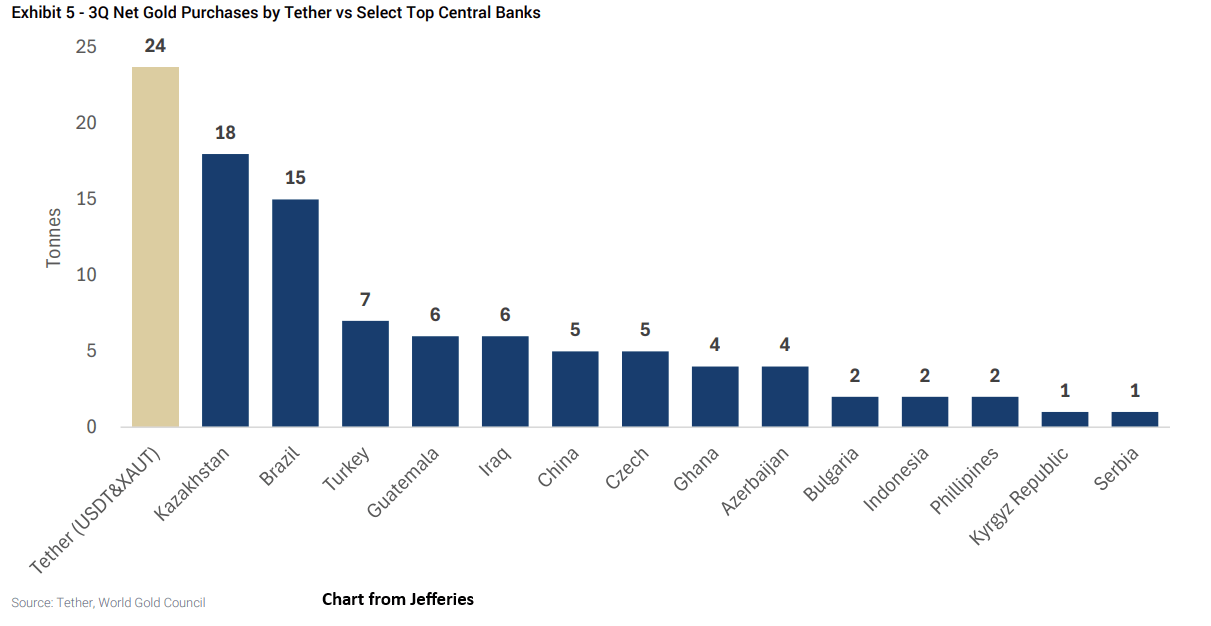

The market strategists note that Tether’s holdings aren’t decorative; they’re strategic and expanding at a pace that has meaningfully tightened supply. Jefferies estimates that Tether added 26 tons of gold in Q3 alone, accounting for roughly 2% of global demand and more than 12% of all central bank purchases during that period.

Read more: Tether Moves Into Bitcoin-Backed Lending With Strategic Ledn Stake

Coincidentally, gold prices crossed $4,000 per ounce this year, climbing more than 50% as investor anxiety, geopolitical tensions, and central bank accumulation converged. Tether’s buying, the report suggests, didn’t just ride that wave; it helped lift it. The analysts project that Tether could add as much as 60 tons of gold annually if it channels half of its expected 2025 profits into bullion.

With $USDT issuance still expanding globally, Jefferies argues that gold demand from the stablecoin ecosystem could become a structural force, not a seasonal quirk. In other words: this trend may just be getting warmed up. Beyond stockpiling gold, Tether has reportedly funneled more than $300 million into mining royalty and streaming companies and hired former HSBC metals traders, signaling ambitions that go deeper than passive reserve management.

The report describes these moves as early steps toward a vertically integrated metals strategy — a sentence that might sound dramatic until you remember that Tether already commands a balance sheet larger than some national treasuries. Still, Jefferies tempers the bull case with caveats.

Tether’s upcoming GENIUS Act-compliant stablecoin, USAT, does not require gold backing, potentially reducing long-term bullion demand. Regulatory shifts could disrupt reserve strategies. And Tether’s history of scrutiny means any misstep could reverberate far beyond crypto-native circles.

Even so, Jefferies’ takeaway is clear: Tether now matters in the gold market — perhaps far more than global traders realize. And if $USDT keeps growing, so too could Tether’s golden appetite.

FAQ ❓

- What did Jefferies highlight about Tether’s gold strategy?Analysts said Tether’s rapid gold accumulation now influences global supply and supports high prices.

- How much gold does Tether hold?Tether controls roughly 116 metric tons of bullion across $USDT and XAUT reserves.

- Why does this matter for global markets?Jefferies argues Tether’s demand could shape long-term pricing as stablecoin adoption grows.

- What is Jefferies’ role in this analysis?Jefferies provides institutional research explaining how Tether’s buying affects global commodities markets.

news.bitcoin.com

news.bitcoin.com