By Omkar Godbole (All times ET unless indicated otherwise)

The word "solana" in Spanish means sunshine or sunny place, and that's a perfect description for exchange-traded funds (ETFs) based on the programmable blockchain Solana's native token, sol $SOL$156,34.

Investors have been channeling funds into U.S.-listed spot $SOL ETFs even as they withdraw capital from their bitcoin $BTC$103.539,43 and ether $ETH$3541,12 counterparts. Since their late October debuts, Bitwise and Grayscale’s spot $SOL ETFs have seen cumulative net inflows of $368.5 million while bitcoin and either ETFs suffered outflows exceeding $700 million each, SoSoValue data shows.

Traders don't seem to have noticed the difference, and have kept $SOL under pressure alongside the two largest cryptocurrencies and the broader crypto market in the past 24 hours. The solana-ether ($SOL/$ETH) ratio on Binance extended its multiweek decline today, falling to the lowest level since August, while the $SOL/$BTC ratio remains at recent lows.

Bitcoin, for its part, has struggled to gain upward momentum despite holding above the key $100,000 support level amid mixed signs of renewed spot demand.

In the past 24 hours, $BTC has remained between $101,000 and $104,000, even as smaller altcoins like FIL, UNI, NEAR and WLFI posted gains. Ether moved mostly sideways near $3,500. Meanwhile, the CoinDesk DeFi Select Index and Metaverse Select Index lost 6% and 4.2%, respectively.

In key news, the U.S. House passed legislation to end a record 41-day government shutdown, releasing back pay and restarting federal spending. Timothy Misir, head of research at BRN, said the reopening will unlock nearly $40 billion in deferred liquidity over the next month. How much will flow into risk assets like crypto remains to be seen.

In traditional markets, the yen dropped to a record low against the euro after Prime Minister Sanae Takaichi urged the central bank to "go slow" on interest-rate increases.

This dovetails with market expectations of another quarter-point Fed rate cut next month. Yet bitcoin is failing to rally in response, a stark contrast to past bullish reactions to rate cut speculations. Is stimulus fatigue setting in? Only time will tell. Stay alert.

Read more: For analysis of today's activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Crypto

- Nov. 13, market open: Canary Capital's "Canary $XRP ETF", the first pure spot $XRP ETF to register under the U.S. Securities Act of 1933, is expected to start trading on Nasdaq under the ticker XRPC.

- Nov. 13, market open: Leap Therapeutics begins trading as Cypherpunk Technologies Inc. on Nasdaq with a new ticker CYPH, following a Nov. 12 announcement of a $50 million Zcash ZEC$506,35 treasury strategy and company rebrand.

- Macro

- Nov. 13, 7 a.m.: Brazil Sept. Retail Sales YoY Est. 2%, MoM Est. 0.3%.

-

Earnings (Estimates based on FactSet data)

- Nov. 13: Hyperion Defi (HYPD), post-market, N/A.

- Nov. 13: Bitfarms Ltd (BITF), pre-market, -$0.02.

Token Events

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Governance votes & calls

- CoW DAO is voting to replace the fixed solver reward cap with a dynamic one tied to protocol fees and to introduce a 2 basis-point (0.02%), volume-based fee. Voting ends Nov. 13.

- ShapeShift DAO is voting to approve $35,330 USDC for its 2026 retreat in Hawaii, covering a $27,330 venue reimbursement and an $8,000 stipend for contributor flights. Voting ends Nov. 13.

- Arbitrum DAO is voting to grant current AGV Council members a one-time 90,000 ARB bonus, funded from AGV's existing budget, to compensate for their heavier-than-expected startup workload. Voting ends Nov. 13.

- Unlocks

- Nov. 13: AVAX$17,29 to unlock 0.33% of its circulating supply worth $27.14 million.

- Nov. 13: CHEEL$0.6529 to unlock 2.95% of its circulating supply worth $13.06 million.

- Token Launches

- Nov. 13: Planck (PLANCK) to be listed on Binance, HTX, Gate, and others.

Conferences

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Day 3 of 3: Mining Disrupt Conference (Dallas)

- Day 2 of 2: Cardano Summit 2025 (Berlin)

- Day 2 of 3: Blockchain Summit Latam 2025 (Medellin, Colombia)

- Nov. 13: Canadian Bitcoin Consortium's 5th Annual Summit (Toronto)

- Nov. 13: Digital Asset Investment Event (Amsterdam)

- Day 1 of 2: Bitcoin Amsterdam

Market Movements

- $BTC is up 0.85% from 4 p.m. ET Wednesday at $102,785.04 (24hrs: -1.83%)

- $ETH is up 1.75% at $3,482.55 (24hrs: -1.08%)

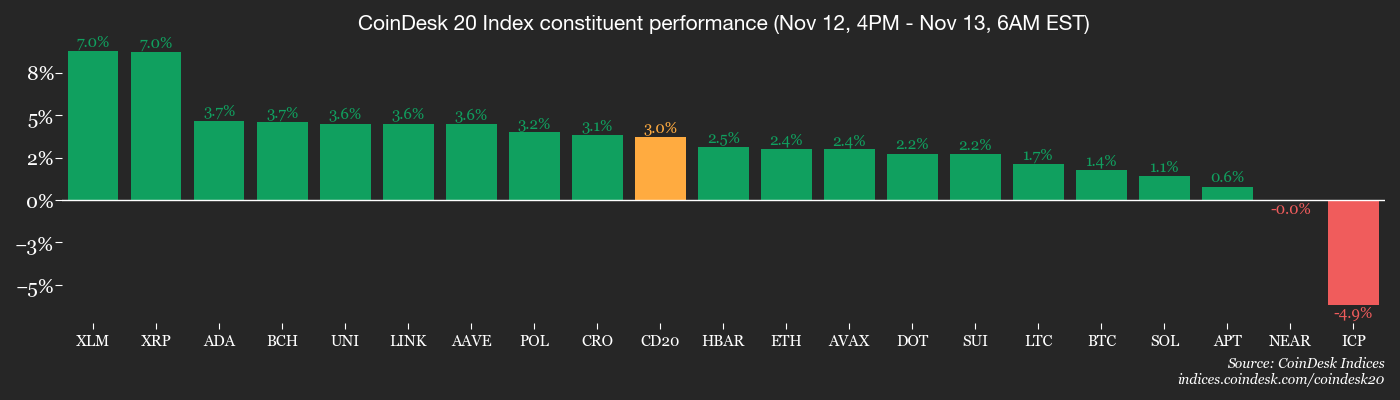

- CoinDesk 20 is up 2.04% at 3,368.95 (24hrs: -0.81%)

- Ether CESR Composite Staking Rate is down 7 bps at 2.86%

- $BTC funding rate is at 0.0059% (6.459% annualized) on OKX

- DXY is down 0.19% at 99.31

- Gold futures are up 0.49% at $4,234.10

- Silver futures are up 0.67% at $53.81

- Nikkei 225 closed up 0.43% at 51,281.83

- Hang Seng closed up 0.56% at 27,073.03

- FTSE is down 0.42% at 9,870.02

- Euro Stoxx 50 is up 0.19% at 5,798.45

- DJIA closed on Wednesday up 0.68% at 48,254.82

- S&P 500 closed unchanged at 6,850.92

- Nasdaq Composite closed down 0.26% at 23,406.46

- S&P/TSX Composite closed up 1.38% at 30,827.58

- S&P 40 Latin America closed down 0.97% at 3,145.09

- U.S. 10-Year Treasury rate is up 0.9 bps at 4.088%

- E-mini S&P 500 futures are unchanged at 6,871.00

- E-mini Nasdaq-100 futures are unchanged at 25,600.00

- E-mini Dow Jones Industrial Average Index are up 0.04% at 48,389.00

Bitcoin Stats

- $BTC Dominance: 59.77% (-0.22%)

- Ether-bitcoin ratio: 0.03391 (0.94%)

- Hashrate (seven-day moving average): 1,081 EH/s

- Hashprice (spot): $42.75

- Total fees: 2.61 $BTC / $268,962

- CME Futures Open Interest: 138,410 $BTC

- $BTC priced in gold: 24.4 oz.

- $BTC vs gold market cap: 11.46%

Technical Analysis

- $SOL has established a series of lower highs and lower lows since mid-September in a sign of strengthening bearish trend.

- Prices are now holding on to the 61.8% Fibonacci retracement line, the so-called golden ratio widely tracked by traders.

- An acceptance below this level could embolden bears, potentially yielding a deeper slide to $129.

Crypto Equities

- Coinbase Global (COIN): closed unchanged on Wednesday at $304, +0.58% at $305.76 in pre-market

- Circle Internet (CRCL): closed at $86.3 (-12.21%), +2.67% at $88.60

- Galaxy Digital (GLXY): closed at $31.27 (+1.72%), +0.64% at $31.47

- Bullish (BLSH): closed at $45.5 (+0.24%), -0.88% at $45.10

- MARA Holdings (MARA): closed at $14.41 (-1.5%), -0.35% at $14.36

- Riot Platforms (RIOT): closed at $15.46 (-4.21%)

- Core Scientific (CORZ): closed at $16.44 (-5.08%)

- CleanSpark (CLSK): closed at $13.33 (-5.09%), +0.23% at $13.36

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $47.73 (-4.64%)

- Exodus Movement (EXOD): closed at $19.91 (-6.48%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $224.61 (-2.91%), +0.45% at $225.62

- Semler Scientific (SMLR): closed at $25.73 (-5.92%), -3.23% at $24.90

- SharpLink Gaming (SBET): closed at $11.57 (+0.09%), +3.89% at $12.02

- Upexi (UPXI): closed at $3.38 (+5.3%), +1.48% at $3.43

- Lite Strategy (LITS): closed at $2.01 (-3.37%)

ETF Flows

Spot $BTC ETFs

- Daily net flows: -$278.1 million

- Cumulative net flows: $60.19 billion

- Total $BTC holdings ~1.34 million

Spot $ETH ETFs

- Daily net flows: -$183.7 million

- Cumulative net flows: $13.59 billion

- Total $ETH holdings ~6.53 million

Source: Farside Investors

While You Were Sleeping

- Japan Exchange Looks at Ways to Curb Crypto Hoarding Firms (Bloomberg): The market operator is weighing tougher reverse-takeover rules and new audits after losses in bitcoin-treasury shares. Three listed companies have paused planned crypto purchases since September amid heightened scrutiny.

- How Bitcoin and $XRP Traders Are Positioning Themselves in a Choppy Market Environment (CoinDesk): Deribit data shows large $BTC traders are employing non-directional options strategies like strangles and straddles to benefit from volatility, while $XRP block flow points to bias for volatility compression.

- Yen Sinks to Record Low vs Euro as Japan PM Touts Slow Rate Hikes (Reuters): After the newly elected leader urged a cautious approach to tightening and closer central bank coordination, markets put 22% odds on a December quarter-point move, rising to 43% by January.

- UK Economy Unexpectedly Contracted by 0.1% in September (Financial Times): A cyber attack on Jaguar Land Rover cut auto output 28.6%, dragging activity lower, while swaps imply 83% odds of a December Bank of England cut after weak jobs data.

- Firm Behind First U.S. Spot $XRP ETF Files for MOG Fund (CoinDesk): On Wednesday, Canary Capital proposed an exchange-traded product tracking a TikTok-born cat meme token on Ethereum, a $170 million asset ranked 339 that has fallen 78% over the past year.

coindesk.com

coindesk.com