Shares in Strategy have risen nearly 6% after hours as the Bitcoin treasury company reported a net income of $2.8 billion for its third quarter, down from the second quarter but still beating analyst expectations.

Strategy on Thursday reported diluted earnings per share of $8.42 for the three months ending Sept. 30, beating Wall Street expectations of $8.15.

Its $2.8 million income for the quarter was a major jump from its $340.2 million loss the same time a year ago, but a fall from its record $10 billion net income in Q2.

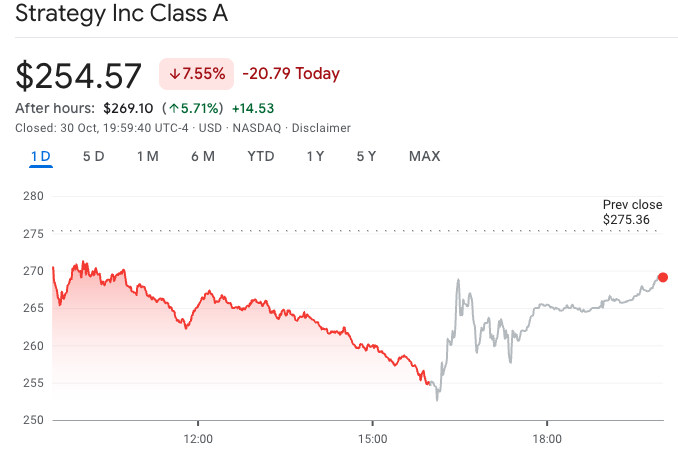

Shares in Strategy (MSTR) climbed 5.7% after-hours to over $269 after ending the trading session on Thursday down over 7.5% at an over six-month low of $254.57.

Strategy has the largest stockpile of Bitcoin ($BTC) among public companies, and the cryptocurrency’s over 6.5% rise over the quarter helped to buoy the company’s income.

Bitcoin is down 1.7% in the past 24 hours, recovering to $108,500 from an intraday low of under $106,500.

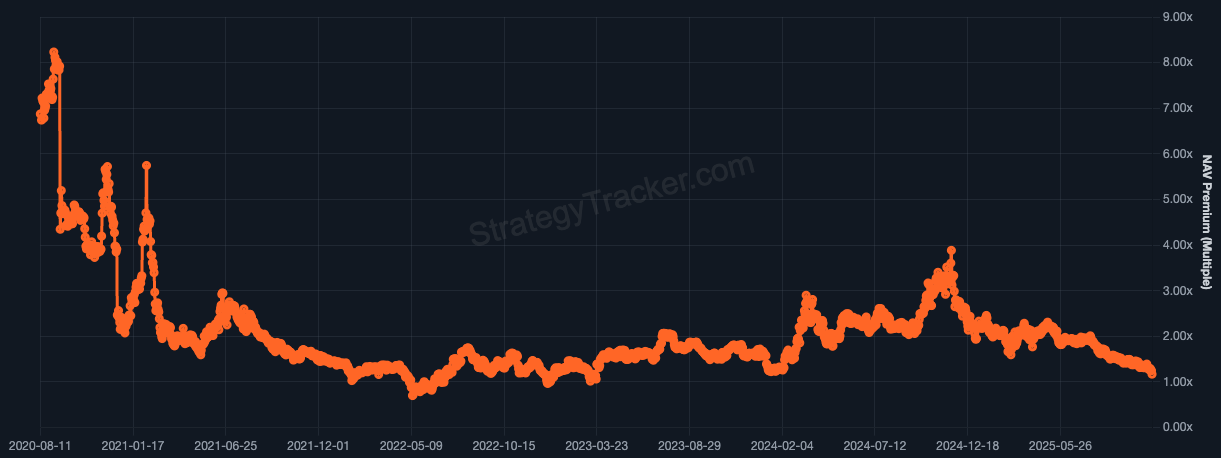

The decline in the price of Bitcoin and Strategy’s stock has squeezed its mNAV to 1.05x, falling from a peak of 3.89x in November after Bitcoin rocketed on Donald Trump’s US election win, according to StrategyTracker data.

Strategy said its Bitcoin yield had hit 26% so far this year at a $13 billion gain and reaffirmed its full-year outlook of hitting a 30% Bitcoin yield with a net income of $24 billion, based on its estimation that Bitcoin will reach $150,000.

The company added 42,706 $BTC over the third quarter to hold 640,031 $BTC by Sept. 30. It has since continued its buys to hold 640,808 as of Sunday, which Strategy said was bought at an average cost of $74,032.

cointelegraph.com

cointelegraph.com