The crypto companies’ IPO boom shows no signs of slowing. After the strong debuts of Circle and Bullish, which saw shares jump 170% and 218%, eyes are now on Gemini’s listing set for September 11.

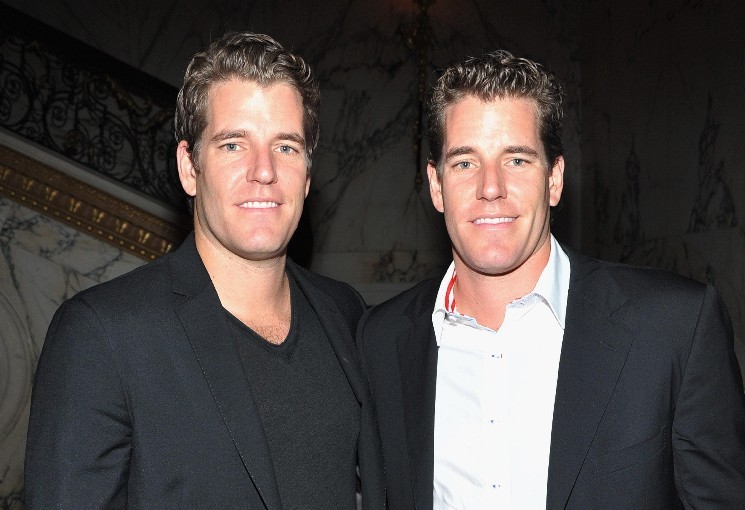

Gemini Space Station Inc. is a crypto exchange founded in 2013 by Cameron and Tyler Winklevoss. It has filed for a $316.7 million Nasdaq IPO, with 16.66 million shares to be listed under the ticker GEMI. The expected price should be between $17 and $19, implying a market value of about $2.1 billion at the midpoint.

Gemini is chasing public capital at what looks like a favorable moment, with money flowing into crypto from all kinds of funds and companies. Yet the exchange carries debt-heavy books and a history of bruising regulatory battles. Whether the deal is solid ultimately comes down to its financial resilience and regulatory footing.

How Does Gemini Rank?

By market share, the Gemini exchange is a rather small player. It ranks 35th among centralized crypto exchanges with $209 million in daily volume and a 0.3% global share, according to Messari. This is well below 1.2% for Kraken, 2.6% for Coinbase, and 21.6% for Binance.

Yet the firm punches above its weight in custody, consistently ranking third behind Coinbase and BitGo. It oversees more than $18 billion in assets, backed by SOC 1 and SOC 2 compliance, cold storage, and $125 million in insurance coverage. Its 10,000 institutional clients anchor custody and OTC services as Gemini’s strongest selling points.

Benjamin Billarant, co-founder of Balthazar Capital, a fund specializing in crypto-related assets, sees this positioning as essential. He told Forbes:

“This cycle is unmistakably institutional. From ETFs pulling in tens of billions to companies adding bitcoin and other cryptocurrencies to their balance sheets, demand for trusted custodians is set to accelerate. Gemini is well-positioned to capture a share of what could become a multi-trillion-dollar market in the years ahead.”

The broader Gemini business also includes the regulated stablecoin GUSD launched in 2018 ($51 million market cap), a crypto rewards credit card rolled out in 2022 (58,000 users), and an NFT marketplace called Nifty Gateway. The core, however, remains trading and custody, with bitcoin and ether comprising 88% of platform assets.

Gemini’s Weak Spot: Indebtedness

At first glance, 2024 looked like a turnaround year for Gemini. Assets doubled to $18.2 billion, trading volume tripled to $38.6 billion, and revenue grew 45% to $142.2 million, according to its S-1 filing.

That progress unraveled in the first half of 2025. Revenue fell to $68.6 million while net losses ballooned to $282.5 million, compared with just $41 million lost in the same period of 2024. A large part of the swing — $172.5 million — came from loans and related costs, including unrealized losses and changes in fair value.

Since 2022, it has borrowed from Winklevoss Capital Fund (WCF), with nearly 40,000 ETH and 4,700 BTC still outstanding as of mid-2025. It also owes $116.5 million to Galaxy Digital from a March 2023 loan. In July 2025, it added a $75 million credit facility with Ripple. That same month, it entered into a repo line with NYDIG, but the filing does not reveal the size of those obligations. On top of that are $200 million in convertible notes and over $400 million in WCF term loans, all set to convert into equity at a 20% discount to the IPO price.

Taken together, this paints a picture where Gemini’s liquidity relies heavily on related-party loans and external credit. What's more, planned conversion risks diluting existing shareholders.

Still, investors' opinions on loan-related fair-value losses and other unrealized losses will depend on their view of the crypto market's potential. After all, mark-to-market charges don’t become cash losses unless positions are closed. Likewise, WCF financing can read as deep sponsor support rather than a governance red flag. What remains clear is that investors may question Gemini’s path to sustainable profitability without adjustments to its cost structure, a firmer competitive footing in trading, or meaningful diversification.

Gemini’s dependence on trading fees is a concern. Roughly 70% of 2024 revenue came from transaction fees, a notoriously cyclical stream that dries up in down markets. Diversification efforts are underway in custody, credit cards, and the GUSD stablecoin. Yet, these remain secondary lines, not large enough to offset the swings in core trading income.

As Michael Ashley Schulman, partner at the multifamily office Running Point Capital, commented to Reuters:

"The question for investors regarding Gemini revolves around the business mix and moat of trading versus custody, how they differentiate on trust and growth, and what they do that Coinbase can’t copy by Tuesday."

Regulation Scars, Compliance Gains

As the founders say, they have operated under the “ask for permission, not forgiveness” motto from the start. That philosophy gave the exchange an early reputation for compliance, yet it did not shield the company from costly clashes with regulators.

Its most damaging episode came through the Earn program, run in partnership with Genesis Global Capital. When Genesis collapsed in late 2022 after exposure to FTX and other bankrupt lenders, over $1.1 billion in Gemini customer assets were frozen. The fallout happened quickly. Between 2023 and 2024, Gemini faced SEC charges, a $3B fraud claim from New York’s Attorney General, and $1.1B restitution plus a $37M fine from NYDFS. Earn users were eventually made whole, often in crypto that had appreciated in value. Gemini also settled its obligations with New York regulators. In February 2025, the SEC closed its investigation into Gemini without enforcement, removing a lingering cloud.

Today, Gemini can point to a fuller compliance footprint. It holds licenses in all U.S. states that require them, as well as in the EU, the UK, and Singapore. Still, its S-1 underscores that the regulatory landscape remains risky. Gemini's core businesses carry exposure to consumer protection, AML, sanctions, and cybersecurity rules that are expensive to maintain and unforgiving of mistakes. Gemini also warns that being labeled an “investment company” under the 1940 Act could upend its corporate structure. These risks are hardly unique, as Coinbase, Kraken, and Binance all carry similar warnings. However, Gemini’s case is complicated by its reliance on related-party financing with the Winklevosses, a governance wrinkle its peers avoid.

The environment is improving, though. A pro-crypto administration in Washington has softened regulatory rhetoric. The GENIUS Act passed in July 2025 set a clear framework for stablecoins, the lifeblood of the crypto market. Even more consequential is the CLARITY Act, now awaiting Senate approval, which could open the floodgates for large-scale tokenization. If trillions in traditional assets migrate on-chain, exchanges like Gemini stand to be among the biggest winners.

Politics play into this dynamic as well. The Winklevoss twins donated $1 million in bitcoin each to Donald Trump’s 2024 campaign and committed $21 million to a super PAC backing pro-crypto candidates ahead of the 2026 midterms.

Overall, despite its debt and regulatory scars, Gemini has a few strong cards to play. It is rooted in custody, where institutions value compliance and insurance. Its lean, U.S.-focused business model may attract regulators more than global competitors. And if global tokenization takes off as expected, Gemini’s positioning as a regulated exchange and custodian could turn into a growth engine far larger than its current scale suggests.

forbes.com

forbes.com