-

M0 raised $40M to issue application-specific stablecoins with built-in rules for liquidity and access.

-

Rain secured $58M to help banks issue regulated, compliant stablecoins and enable real-time payrolls.

-

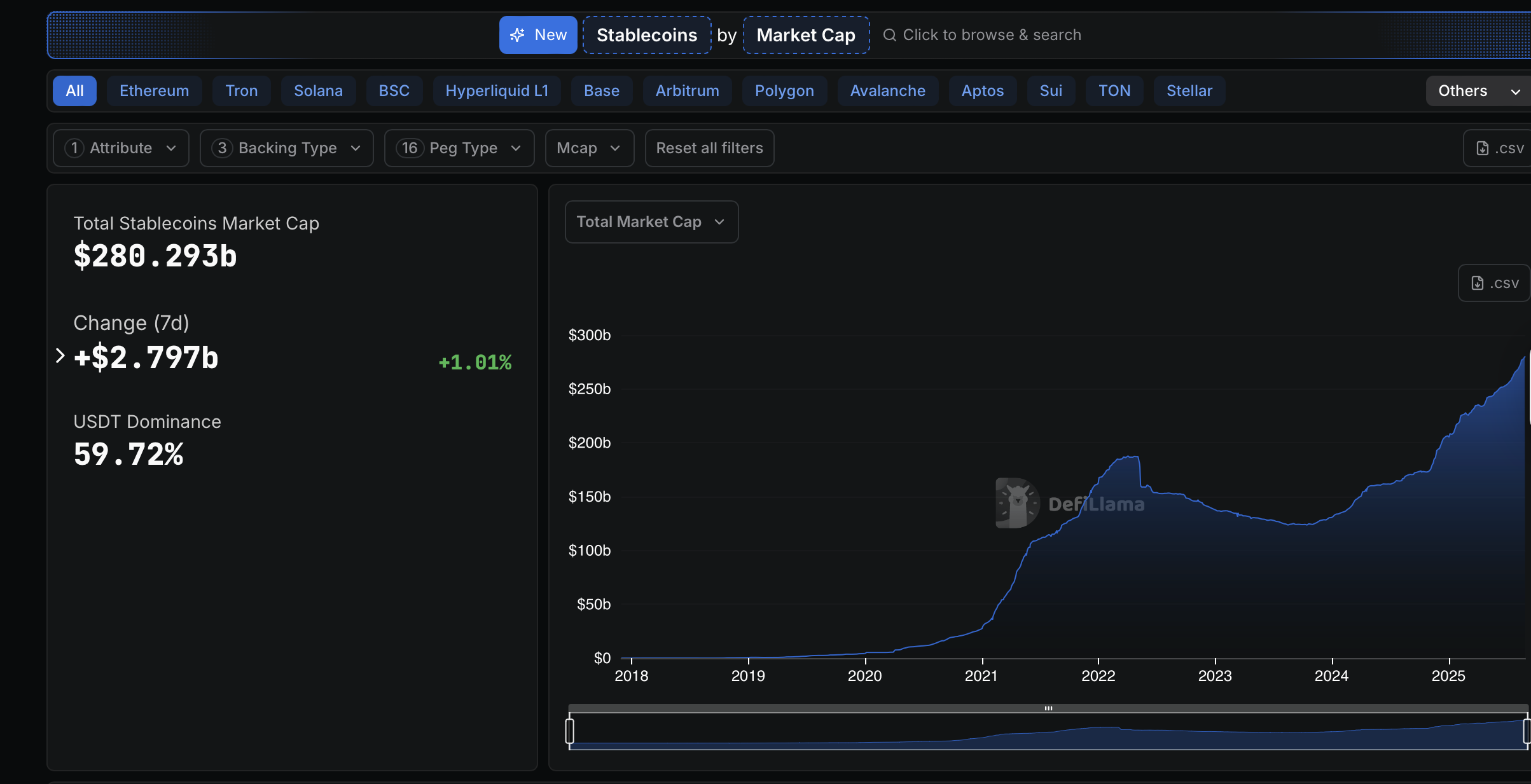

Stablecoin market capitalization reached $280 billion (DefiLlama); investors back programmable stablecoin infrastructure.

Meta description: Programmable money gains traction as stablecoin funding rises; M0 and Rain secure nearly $100M amid a $280B market cap—read key takeaways and next steps.

What is programmable money and why is funding rising?

Programmable money is digital currency with embedded rules that execute automatically via smart contracts. Investors funded nearly $100 million in stablecoin infrastructure recently, backing platforms that embed compliance, access controls and conditional payouts directly into stablecoin design.

How did M0 and Rain secure funding and what will it finance?

M0 announced a $40 million Series B led by Polychain Capital and Ribbit Capital to expand rails for issuing application-specific stablecoins. Rain closed $58 million in Series B funding led by Sapphire Ventures, with participation from Dragonfly, Galaxy Ventures and Samsung Next, bringing its total to $88.5 million.

M0, a Switzerland-based platform that lets developers issue custom stablecoins, announced a $40 million Series B on Thursday led by Polychain Capital and Ribbit Capital. Founded in 2023, M0 has partnered with projects including MetaMask and Playtron to integrate issuance rails into consumer apps.

Rain, a U.S. startup building bank-facing tools for regulated stablecoins, raised $58 million in Series B funding led by Sapphire Ventures with backing from Dragonfly, Galaxy Ventures and Samsung Next, taking its total funding to $88.5 million.

The financing announcements coincided with the stablecoin market capitalization reaching a record $280 billion on Thursday, per DefiLlama data.

Stablecoin market cap as of Thursday. Source: DefiLlama