Sharplink Gaming Inc. announced a stock repurchase program authorizing the buyback of up to $1.5 billion of its common stock.

Sharplink Commits to $1.5 Billion Return of Capital via Buybacks

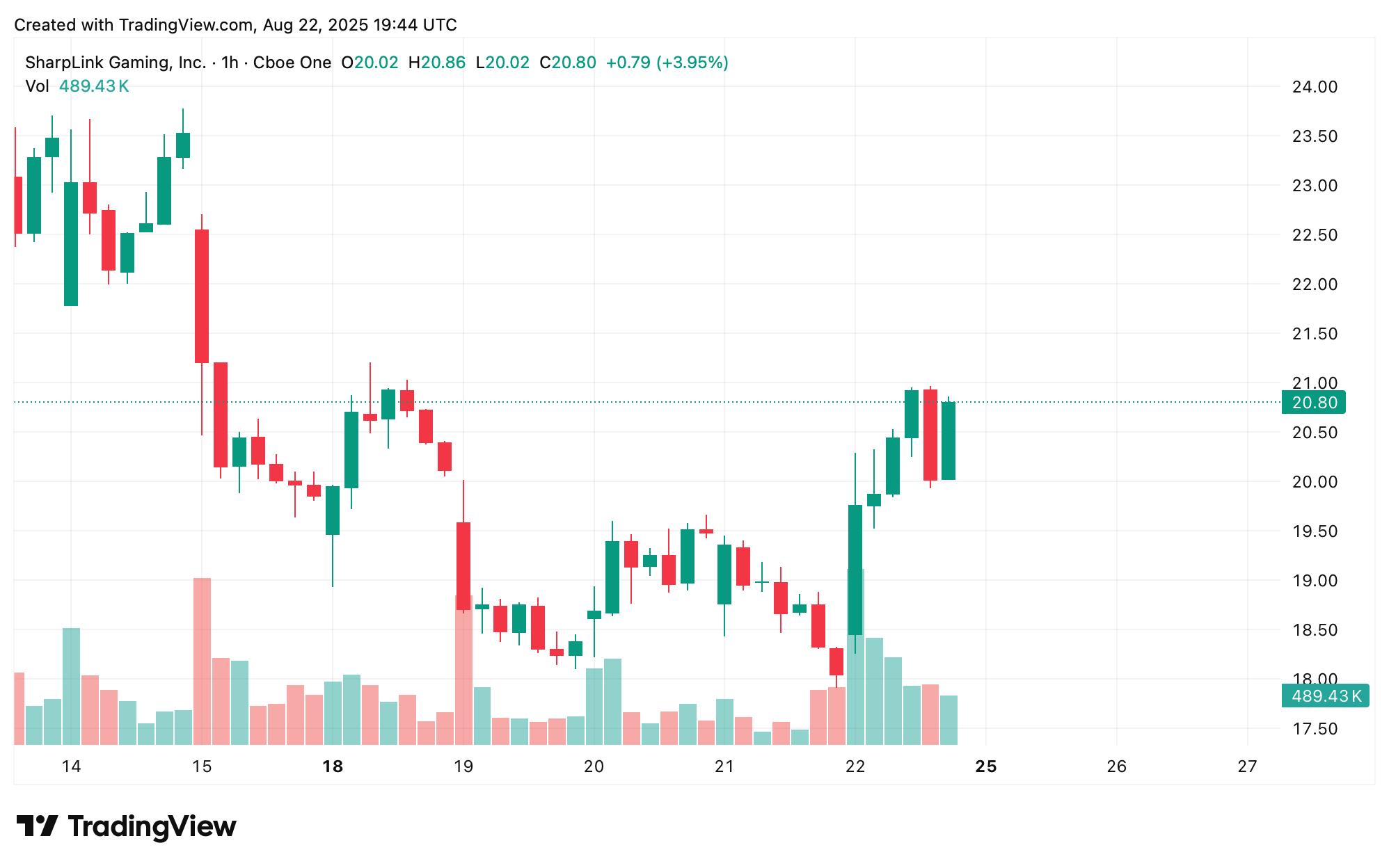

The Sharplink Gaming Inc. (Nasdaq: SBET) news propelled the company’s shares 15% higher during Friday’s trading session. The significant market reaction highlights investor approval of the capital return initiative. There’s been some volatility, and SBET is still down 21% over the last month.

Co-CEO Joseph Chalom stated on Friday that the program provides strategic flexibility. He noted it could be used to repurchase shares if they trade at or below the net asset value of the company’s ethereum (ETH) holdings, preventing dilution on a per-share basis.

Repurchases may be executed periodically through open market transactions or private deals as permitted by securities laws. The release notes that the timing and volume of buybacks will depend on share price, market conditions, and other factors.

The announcement further notes that the program is designed to optimize capital allocation and support the company’s commitment to driving long-term stockholder value. It offers a mechanism to enhance per-share metrics when management deems it accretive.

Sharplink stressed the company is not obligated to repurchase any specific number of shares and may suspend or discontinue the program at any time. At press time, near 4 p.m. Eastern time, SBET is trading for $20.90 per share. Sharplink is the second-largest ETH treasury company that’s publicly traded.

news.bitcoin.com

news.bitcoin.com