Bitcoin miner MARA Holdings beat analyst expectations in its second-quarter earnings, which saw its share price slightly gain after-hours.

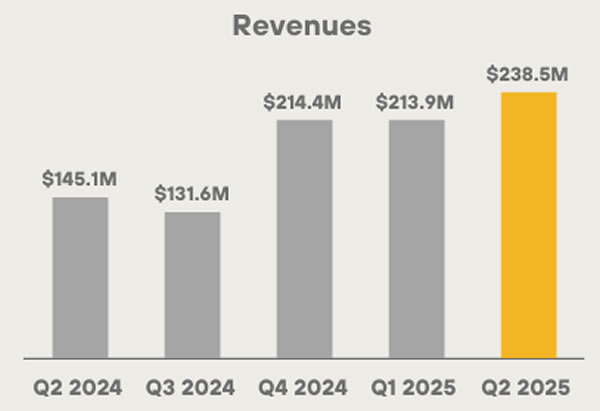

MARA Holdings’ revenues increased 64% year-on-year to $238 million, up from $145 million in Q2 2024 and also gaining from its $214 million revenues in the first quarter of 2025, the company said on Tuesday.

The firm’s revenue beat analyst expectations of $223.7 million while its net income surged 505% compared to a year ago to $808 million, up from a loss of just under $200 million in Q2 2024.

The income gain was largely driven by a $1.2 billion unrealized gain from Bitcoin ($BTC) appreciation over the period. The asset gained 31% over the three-month period ending June 30.

MARA shares gain after hours

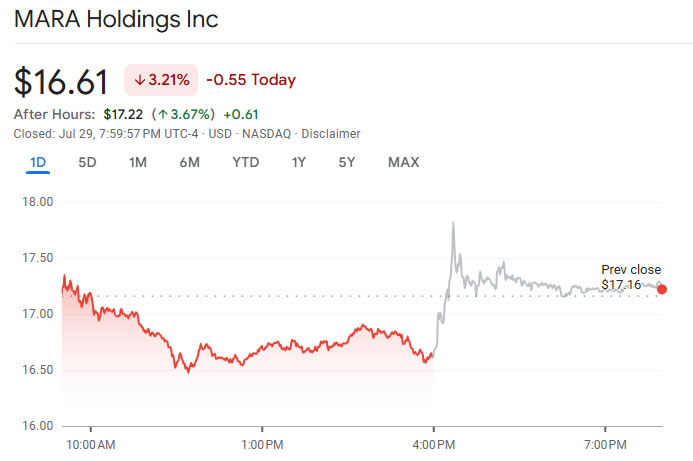

With its earnings release, shares in MARA Holdings (MARA) spiked to a high of 7.5% in after-hours trading on Tuesday to $17.82 before cooling to $17.22.

MARA closed Tuesday trading down 3.2% at $16.61. Its shares have gained 58% since a slump in mid-April but have largely traded sideways for most of this year.

Second-largest Bitcoin treasury

MARA said that shortly after the end of Q2, its Bitcoin holdings surpassed 50,000 $BTC, which it touted as “solidifying our position as the second-largest corporate public holder of Bitcoin” behind MicroStrategy.

During the second quarter, MARA mined 2,358 $BTC, up 3% from the 2,286 produced in the previous quarter. Its energized hashrate of 57.4 exahashes per second (EH/s) gained 6% from 54.3 EH/s in Q1.

Related: Mara to raise up to $1B for Bitcoin and operations via debt sale

The firm’s Bitcoin holdings increased 170% to 49,951 $BTC, worth around $5.3 billion as of the end of June. It currently holds $5.87 billion worth of the asset and is second only to Strategy, which holds a whopping 607,770 $BTC worth $71 billion.

Eyes on AI growth

The firm also announced strategic partnerships with Google-backed TAE Power Solutions and LG-backed PADO AI to co-develop grid-responsive, load-balancing platforms for next-generation AI infrastructure.

MARA is targeting 75 EH/s by year-end and sees a significant opportunity in the growing AI and data center market.

“Our vertically integrated mining operations, large $BTC treasury, budding international energy partnerships, and early AI infrastructure investments each contribute distinct and measurable value,” said CEO Fred Thiel.

Magazine: Robinhood’s tokenized stocks have stirred up a legal hornet’s nest

cointelegraph.com

cointelegraph.com