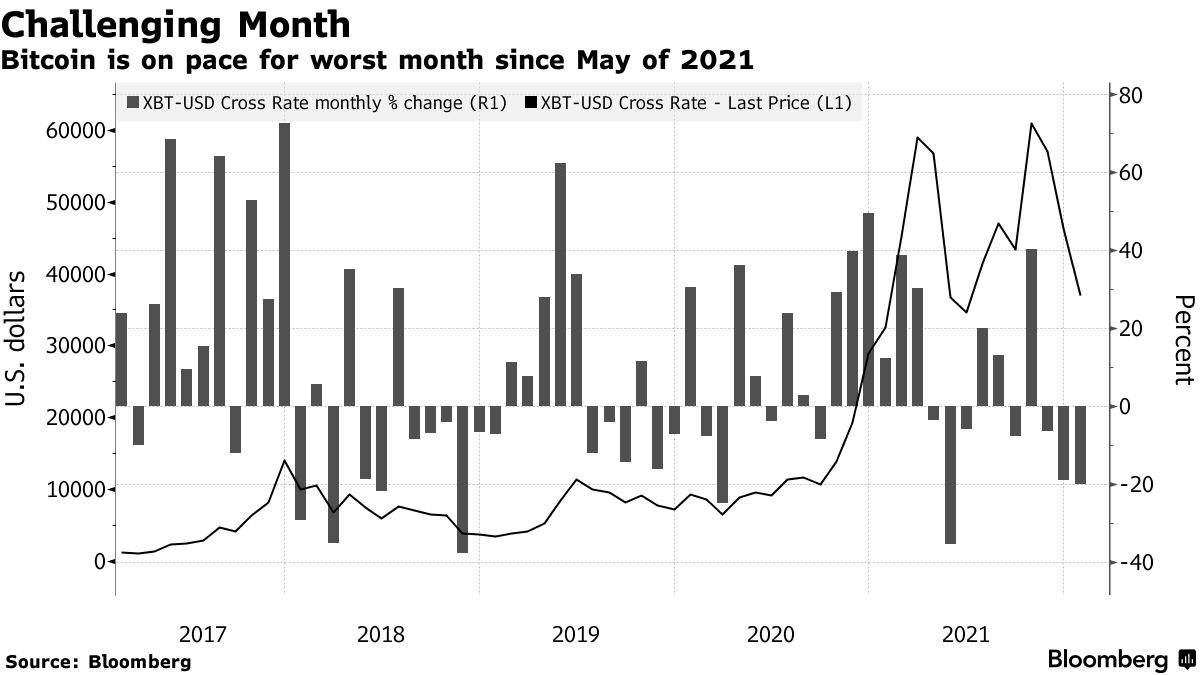

The year 2022 had one of the worst starts in the history of Bitcoin's price performance as the digital gold lost almost 30% of its value on the lowest point of the month, but the short-term recovery has softened things out, Bloomberg reports.

During trading days in January, Bitcoin dipped as low as $33,000 while trading at almost $70,000 back in November. The sell-off on the market was primarily caused by the risk of the rate hike by the Federal Reserve, which puts the whole financial system into risk-off mode.

With the majority of traders trying to avoid exposure to risky assets like Bitcoin and altcoins, their value started dropping rapidly as the majority of retail traders shift their attention from digital assets to safer options.

According to a chief market strategist at FS Investments, cryptocurrencies still remain highly volatile assets, and it remains a "much trickier" environment than it was half a year ago. Numerous experts previously noted that the digital assets market has matured compared to 2017 and 2018.

Change in macro sentiment around risk assets is also being confirmed by a report from CryptoCompare, in which analysts state that digital assets-related investment products have been facing major outflows since August. Assets under management for Bitcoin or crypto-related products have also decreased by 23%.

But as veteran traders and investors in the industry noted, there is nothing surprising in the 50% retrace on such a volatile market as Bitcoin's, and other cryptocurrencies have already gone through a similar correction period, back in 2013, 2018 and even in the summer of 2021.

At press time, Bitcoin is trading at $39,000, which is the highest point for digital gold since Jan. 21.

u.today

u.today