Digital asset investment products experienced $240 million in outflows last week, primarily driven by concerns over global economic headwinds. However, blockchain equities attracted $8 million in inflows as investors capitalized on recent price dips.

Crypto Fund Outflows Hit $240M, but Blockchain Equities Draw Fresh Inflows

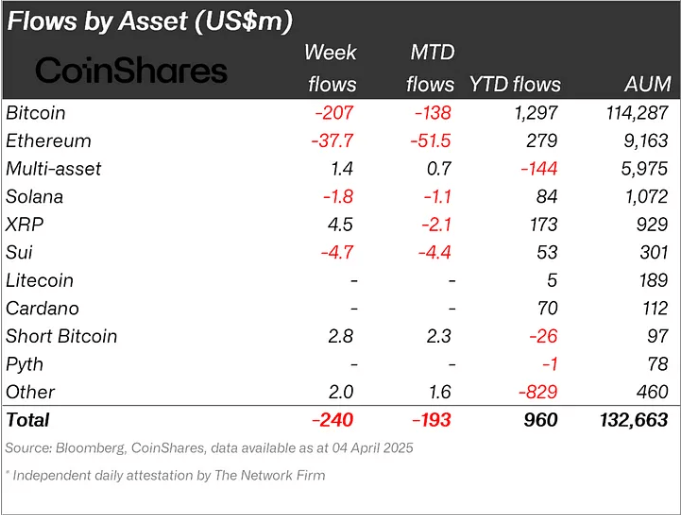

Digital asset funds faced $240 million in outflows last week, with the majority, $207 million, coming from bitcoin products. According to Coinshares’ digital assets weekly report, the downturn appears tied to concerns over new U.S. trade tariffs and their potential impact on global growth.

Despite the outflows, total assets under management (AUM) in the sector rose slightly to $132.6 billion, showcasing relative resilience compared to traditional equities, which saw steeper losses.

Ethereum also experienced notable outflows of $37.7 million, while solana and sui lost $1.8 million and $4.7 million, respectively. In contrast, Toncoin recorded a modest inflow of $1.1 million, highlighting investor interest in alternative assets.

Regionally, the U.S. and Germany led the outflows with $210 million and $17.7 million, respectively. Canadian investors bucked the trend, adding $4.8 million to digital asset holdings amid the market volatility.

One bright spot was blockchain equities, which saw inflows of $8 million for a second consecutive week. The buying suggests some investors are viewing the broader market dip as a long-term opportunity.

While economic uncertainty continues to rattle markets, digital assets appear to be holding firm, maintaining investor interest despite short-term outflows.

news.bitcoin.com

news.bitcoin.com