-

As President Trump’s “Liberation Day” approaches, its potential impact on the cryptocurrency markets cannot be overlooked amid rising tariffs and inflation concerns.

-

Recent analysis indicates that, while short-term turmoil may affect digital assets, the long-term potential for Bitcoin and other cryptocurrencies as alternative investments might increase.

-

“Tariffs raise the cost of trade, which can lead to inflationary pressures that impact risk assets like cryptocurrencies,” notes financial analyst Arthur Hayes.

President Trump’s upcoming “Liberation Day” tariffs on April 2 may drive crypto market volatility, sparking short-term pain but offering long-term potential for digital assets.

The Significance of Trump’s “Liberation Day” for Crypto Markets

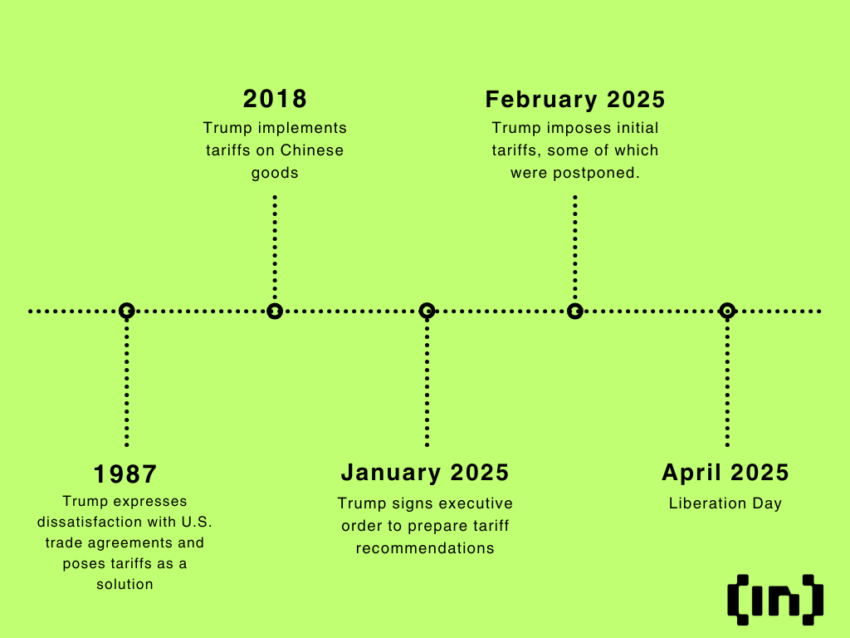

On April 2, 2025, President Donald Trump plans to enact significant import tariffs, referred to as “Liberation Day.” This move is emblematic of his ongoing trade policies aimed at renegotiating global trade agreements. The proposed tariffs could heighten tension in international markets, leading to immediate effects on the cryptocurrency landscape as investors seek to mitigate risk.

Market Response and Historical Context

The initial announcement of tariffs has historically led to bearish sentiment in crypto and equity markets. Following the announcement of “Liberation Day,” asset values for prominent cryptocurrencies like Ethereum (ETH) and Bitcoin (BTC) experienced notable declines, as did major tech stocks. This downturn illustrates the current market’s sensitivity to potential increased costs of trade.

The Implications of Tariffs on Economic Activity

Trump’s tariffs are not just a straightforward economic maneuver; they represent a broader strategy aimed at recalibrating U.S. trade relationships. While proponents argue that such tariffs protect domestic industries, skeptics warn they could lead to higher costs for consumers and diminished international trade. Current projections from the Federal Reserve highlight a revised inflation forecast, indicating that rising prices could become a persistent challenge.